COVID-19 created a demand for advances from technology and software companies that investors may want to use to pursue profits.

The Delta variant of COVID-19 may be spurring demand for services that require the latest software. So, perhaps it’s time to look at an exchange-traded fund (ETF) that offers broad exposure to large- and mid-cap technology and software stocks: iShares Expanded Tech-Software Sector ETF (BATS:IGV).

The ETF offers diverse exposure to the North American software industry and focuses solely on U.S.-based companies. The fund caps individual security weights at 8.5%, which allows for broader coverage in a concentrated industry.

IGV invests primarily in mid-cap software firms, allowing investors access to a decent amount of lesser-known, potentially high-growth firms. However, though the ETF invests in primarily mid-caps, it holds an array of well-known firms, as well. The ETF’s management reviews the fund’s holdings semiannually in June and December, and the weight caps are applied quarterly, starting in March.

On December 24, 2018, IGV changed indexes, but the new index is functionally identical. The main difference is that the new one includes specific companies by name, including Activision Blizzard (NASDAQ: ATVI), Electronic Arts, Inc. (NASDAQ: EA) and Snap Inc. (NYSE: SNAP). The index change seems to be a savvy move, since these companies, and others, were reclassified into the new Communications Services Sector near the end of 2018. Those stocks would have been removed from the fund, but the index change allowed them to remain in the Technology and Software sector.

IGV has an expense ratio of 0.43% and a 0.02% distribution yield, with an upcoming ex-dividend date set for Sept. 24. The ETF has $5.63 billion in assets under management and $4.92 billion in net assets.

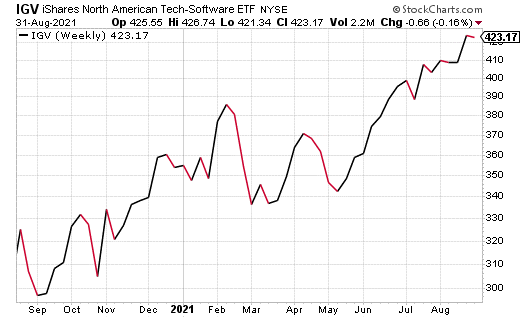

The fund, which was created in 2001, is currently going strong. In late 2020, the ETF saw a considerable dip but then spiked in mid-March 2021. After two smaller dips, it began recovering in mid-May. Since then, the fund has climbed steadily and is currently at the high end of its 52-week range that has reached as high as $426.74.

Altogether, this open-ended fund seems to be seeing solid upward movement and an increased level of buyer interest.

Chart courtesy of www.stockcharts.com

The ETF’s top five holdings include Adobe Inc. (NASDAQ:ADBE), 9.11%; Microsoft Corp. (NASDAQ:MSFT), 8.70%; Salesforce.com Inc. (NYSE:CRM), 8.25%; Oracle Corp. (NYSE:ORCL), 6.25%; and Intuit Inc. (NASDAQ:INTU), 5.72%.

Not only is IGV a good segue into the software industry, but its mid-cap and large-cap holdings provide diverse exposure to lesser-known companies. As it concentrates on North American stocks, it may hold extra appeal for those, like me, who consider themselves patriotic.

For investors looking for a sensible approach to software exposure, iShares Expanded Tech-Software Sector ETF (BATS:IGV) may be worth looking into. However, it is important that all investors conduct their own due diligence prior to investing.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)