Five supply chain stocks to buy for finding shelter from risks feature recommendations focused on strong-performing industrial stocks favored by BoA Global Research.

The five supply chain stocks to buy amid delays for many industries to obtain the parts needed to manufacture goods to meet demand include two stocks that are executing their business plans particularly well, two others that that the investment firm described as “quality” companies and a fifth that should escape much damage. For investors interested in owning shares in each of the five supply chain stocks to buy, keep in mind the companies are not immune from such problems but they seem more likely than most to sidestep the biggest blows.

Equity markets worldwide have retreated sharply in what has already been a steady slide during September, said Bryan Perry, who leads the high-yield-focused Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader services. This retreat stems from concerns about persistent global supply chain disruptions, the potential default by China’s second-largest property developer, Evergrande, Fed policy uncertainty and problems in containing the Delta variant of COVID-19 that combine to fuel inflationary pressures, he added.

These collective fears come as investors seem to expect a correction after 11 straight months without a pullback of more than 3%, Perry advised his Premium Income subscribers on Sept. 21. Even though the market has been rising, the NYSE advance and decline lines have weakened since June and key large-cap stocks have done most of the heavy lifting to sustain the rally since then, he cautioned.

Paul Dykewicz interviews Bryan Perry.

Watch out Not Only for Supply Chain Woes but Inflation, Warns Jim Woods

“Higher inflation means rising input costs, and rising input costs can cause pernicious margin compression,” said Jim Woods, editor of the Successful Investing and Intelligence Report newsletters, as well as the leader of the Bullseye Stock Trader advisory service. “As investors, we need to look at companies that can weather rising costs the most.”

Woods addressed the growing supply chain problems in his most recent Intelligence Report. Woods, a Wall Street veteran, also shared some of his favorite strategies for avoiding the worst of the supply chain fallout and the risk of increased inflation.

Paul Dykewicz discusses investments with Jim Woods, editor of Intelligence Report.

Five Supply Chain Stocks to Buy Include Industrial Manufacturer Dover

One of the stocks BoA touted for the execution of its successful business operations is Dover Corp. (NYSE: DOV), a Downers Grove, Illinois-based manufacturer of industrial products. The company received a buy recommendation and a $190 price objective from BoA on the strength of a 17x enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA) multiple of the investment firm’s 2022 estimates.

BoA’s target multiple actually is at a discount to multi-industrial peers trading at 21x 2021 estimates, but the investment firm wrote the comparatively modest valuation is fair due to Dover’s lower EBITDA margins. Risks that could prevent Dover from attaining the price objective of $190 that BoA forecast include slowing U.S. industrial production; not achieving expected returns from organic investments or acquisitions; and slower-than-expected margin improvement.

Dover not only is performing well with its organic growth but through acquisitions, too. On Sept. 15, Dover announced completion of its previously disclosed acquisition of the Espy Corporation, which will become part of the Microwave Products Group (MPG) within Dover’s Engineered Products segment. Espy designs and manufactures advanced electronic radio frequency sensor systems used to detect, record, analyze and geolocate signals.

Just outside of Austin, Texas, Espy offers complete signal intelligence systems with integrated software that is sold globally. Espy’s proprietary machine learning and real-time geolocation technology, together with its software interface, greatly reduce the time needed to identify and process signals of interest while providing high accuracy on a signal’s origin.

One of the Five Supply Chain Stocks to Buy Boosts Its Dividend

Dover’s board of directors on Aug. 5 increased the company’s quarterly cash dividend to $0.50 per share, up from $0.495 per share, to mark the 66th straight year in which the company has boosted its payout. The increase shows Dover’s longstanding policy of returning capital to shareholders.

For the second quarter ended June 30, Dover generated revenue of $2.0 billion, an increase of 36%, compared to the second quarter of the prior year. Organic growth accounted for 83.33% of the overall gain.

Dover reported Generally Accepted Accounting Principles (GAAP) net earnings for second-quarter 2021 of $265 million, up 112% from the comparable quarter a year ago. The company’s diluted earnings per share (EPS) of $1.82 on a GAAP basis also rose 112%. On an adjusted basis, net earnings of $299 million in Q2 2021 increased 82% and adjusted diluted EPS of $2.06 was also up 82% versus the comparable quarter of the prior year.

Chart courtesy of www.StockCharts.com

CEO of One of the Five Supply Chain Stocks to Buy Boasts of Backlog

“We performed well again this quarter as new order activity remained strong and margin improvement continued its solid trajectory across all segments,” said Richard J. Tobin, Dover’s president and chief executive officer. “Our portfolio is performing above pre-pandemic levels in terms of revenue and margin, and our record-high backlog provides visibility into the second half of the year and in some of our businesses into 2022.

“During the quarter, we saw top-line growth across all of our segments, with the largest contributions to the year-over-year increase from pumps and process solutions, fueling solutions, food retail, marking & coding and the automotive aftermarket businesses. We are encouraged by the demand growth in compressor components, foodservice, and textile printing, and we expect continued recovery in these markets over the balance of the year.

“Our teams have done a commendable job in the first half navigating logistics bottlenecks, component and labor shortages, and cost inflation to meet end market demand and drive solid margin conversion. Our forecast for the balance of the year reflects the expectation that logistics constraints and input cost inflation will neither deteriorate nor improve materially. Despite this dynamic, we believe that our localized manufacturing and sourcing strategy and diverse business mix give us distinct advantages to win in the current demand environment.”

In the second half of 2021, Dover management expressed optimism about the second half of the year, including “robust backlog levels.” The company’s leaders also remain confident about executing operationally to drive portfolio profitability sufficiently to warrant heightened full-year revenue and earnings per share (EPS) guidance.

Five Supply Chain Stocks to Buy Gain Attention from Pension Chairman

“The supply chain problems are going to continue for some time,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “In this environment it’s important to invest in companies with high-quality management and long histories of surviving different environments.”

A good example is Dover, said Carlson, who leads the Retirement Watch investment newsletter. Carlson praised Dover for its rising dividend policy and long track record of returning cash to its shareholders.

“Supply chain management is critical to companies these days,” Carlson said. “The economy is booming, yet in the latest earnings season many companies are forecasting lower revenues and earnings. The lower forecasts are due mostly to lost sales and higher costs caused by supply problems.”

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

Power Management Company Ranks Among Five Supply Chain Stocks to Buy

Eaton Corp. PLC (NYSE: ETN), a Dublin, Ireland-based diversified power management company, gained a buy recommendation from BoA. The company has been in operation for more than 100 years and its business units include electrical products, electrical systems and services, aerospace, vehicles and, most recently, e-mobility.

Eaton’s mission is to improve the quality of life and the environment by using power management technologies and services. The company provides sustainable solutions to help its customers effectively manage electrical, hydraulic and mechanical power safely, efficiently and reliably. Eaton sells products to customers in more than 175 countries.

Sales in the second quarter of 2021 reached $5.2 billion, up 35% from the second quarter of 2020. The increase consisted of 27% growth in organic sales, 5% growth from acquisitions and 3% from positive currency translation, the company reported.

Five Supply Chain Stocks to Buy Include Eaton

Craig Arnold, Eaton’s chairman and chief executive officer, said when reporting the results that the company built on the momentum from its first quarter.

“We delivered record second-quarter adjusted earnings per share and segment margins, and organic sales were slightly above the midpoint of our guidance range, despite supply chain constraints impacting many of our businesses, Arnold said. “We are pleased with how well our businesses are executing in this environment.”

Eaton’s “sustainable priorities” span five pillars: transparency, shareholder value, workforce, environment and community. Supply chain practices are an integral part of each of these pillars, according to the company.

The company’s supply chain management undertakes “rigorous annual examination” to identify and mitigate a broad spectrum of supply chain risks, Eaton added.

Eaton, One of Five Supply Chain Stocks to Buy, Now Is Seeing Parts Arrive Late

Nonetheless, Arnold recently acknowledged revenue for the third quarter will be reduced because parts it needs aren’t arriving on time. He specifically mentioned its MasterCraft business is having supply-chain problems.

“Those problems seem to be reflected in ETN’s stock price,” Carlson said.

Even so, Eaton is seeing strong demand for its renewable power generation and vehicle electrification equipment, Carlson continued. Sales growth should be strong for at least the next few years, he added.

“The supply chain problems are going to continue for some time,” Carlson said. “In this environment it’s important to invest in companies with high-quality management and long histories of surviving different environments.”

BoA gave Eaton a $195 price objective on a 20x enterprise value EV/ EBITDA multiple based on the investment firm’s 2022 estimates. The target multiple is at a premium to the 18x peer average on 2021 estimates but the valuation is warranted due to expected upside from cyclical operating leverage, strong margin performance and Eaton’s less cyclical portfolio mix, BoA added.

Downside risks to BoA’s price target for Eaton are: a worse-than-expected global industrial recession, particularly in commercial construction; mergers and acquisitions is inherently risky due to the need for availability of accretive synergistic targets and a company’s ability to integrate; and the trajectory of the recovery in automotive and aerospace end markets.

Chart courtesy of www.StockCharts.com

Electronic Instruments Maker Joins Five Supply Chain Stocks to Buy

AMETEK Inc. (NYSE: AME), a Berwyn, Pennsylvania-based manufacturer of electronic instruments and electromechanical devices, gained a recommendation from BoA, too. Its Electronic Instruments consist of advanced analytical, test and measurement products for the energy, aerospace, power, research, medical and industrial markets, while its Electromechanical devices feature automation and precision motion control solutions, highly engineered electrical interconnects, specialty metals and thermal management systems.

For the second quarter ended June 30, AMETEK’s sales reached a record $1.39 billion, a 37% increase from the second quarter of 2020, with organic sales growth of 25%. Operating income increased 39% to a record $316.6 million and operating margins hit 22.8%, up 40 basis points over the prior-year period.

On a GAAP basis, second-quarter earnings per diluted share were $1.00. Adjusted earnings were a record $1.15 per diluted share, up 37% versus the prior year’s adjusted results. Adjusted earnings add back non-cash, after-tax, acquisition-related intangible amortization of $0.15 per diluted share.

“Sales growth and operating performance were exceptionally strong while earnings exceeded our expectations,” said David A. Zapico, AMETEK Chairman and Chief Executive Officer. “Order growth remains robust and broad-based resulting in a record $2.5 billion in backlog. Additionally, our businesses generated outstanding levels of cash flow with free cash flow conversion a strong 114% of net income.”

AMETEK’s Growth Shows Why It Is Among Five Supply Chain Stocks to Buy

Following AMETEK’s second quarter results, it increased its guidance for the year. Overall sales are expected to rise approximately 20% with organic sales up approximately 10%. Adjusted earnings per diluted share are expected to be in the range of $4.62 to $4.68, up 17% to 18% over 2020, rising from AMETEK’s previous guidance range of $4.48 to $4.56 per diluted share.

“We expect overall sales in the third quarter to be up in the mid-20% range compared to the third quarter of 2020. Adjusted earnings per diluted share are anticipated to be in the range of $1.16 to $1.18, up 15% to 17% over the same period in 2020,” concluded Zapico.

BoA based its $165 price objective on a 23x EV/EBITDA multiple of its 2022 estimates for AMETEK. The target of 23x multiple is at a premium to the peer average trading on 2021E of 22x, which BoA views as fair given the company’s higher margins, strong cost control and cyclical operating leverage. Risks to meeting that price objective are: weaker industrial production trends; a slowing pace of acquisitions; and any disruption in the ongoing relocation of labor to low-cost countries.

Chart courtesy of www.StockCharts.com

Fortive Forges Way onto List of Five Supply Chain Stocks to Buy

Everett, Washington-based Fortive Corporation (NYSE: FTV), a diversified industrial technology conglomerate that was spun off from Danaher in July 2016, won a recommendation from BoA as a provider of technologies for connected workflow solutions across a range of markets. Fortive’s strategic segments of Intelligent Operating Solutions, Precision Technologies and Advanced Healthcare Solutions includes brands with leading positions in their markets.

The company’s businesses design, develop, service, manufacture and market professional and engineered products, software and services. Fortive employs more than 17,000 research and development, manufacturing, sales, distribution, service and administrative team members in 50-plus countries.

Plus, Fortive reported on Sept. 1 that it completed its previously announced acquisition of ServiceChannel Holdings Inc. to become an operating company within its own Intelligent Operating Solutions (IOS) segment. ServiceChannel, with more than 500 enterprise customers in over 70 countries, is a global provider of SaaS-based multi-site facilities maintenance service solutions with an integrated service-provider network of 70,000-plus facilities maintenance service providers.

“The transaction adds another differentiated, high-growth SaaS asset with an attractive runway to drive increasing profitability and free cash flow, and generate strong returns over the next five years, said James Lico, Fortive’s president and chief executive officer. “As we look ahead, we have significant capacity and opportunity for additional capital allocation which will continue to strengthen the portfolio and drive double-digit earnings and free cash flow growth over the long-term.”

Fortive’s second-quarter results, ended July 2, produced a 26.7% jump in revenues from continuing operations to reach $1.3 billion, compared to the same quarter a year ago. For Q2 2021, adjusted net earnings from continuing operations were $238.8 million. Diluted net earnings per share from continuing operations for the second quarter, ended July 2, were $0.48. For the same period, adjusted diluted net earnings per share from continuing operations were $0.66.

Chart courtesy of www.StockCharts.com

BoA gave Fortive a $85 price objective, based on a 23x EV/EBITDA multiple of 2022 EBITDA estimates. The investment firm wrote its target multiple is in line with the peer average of 23x on 2021 estimate. Potential risks to Fortive attaining the price target are a weaker-than-expected capex cycle; redeploying cash into accretive acquisitions; and further strengthening of the U.S. dollar.

Honeywell Gains Spot as One of Five Supply Chain Stocks to Buy

Honeywell International Inc. (NASAQ: HON), a Charlotte, North Carolina-based provider of aerospace and building technologies, performance materials and technologies and safety and productivity solutions, gained a recommendation from BoA. The investment firm’s $270 price objective is based on 20x 2022E EV/EBITDA.

The target multiple is at a premium to peers trading at 18x EV/EBITDA on 2021 estimates, BoA wrote. The investment firm opined that a premium is warranted given a more defensive portfolio yielding resilient margins and above average EPS growth.

Potential risks to the BoA price objective on Honeywell are: acquisitions, specifically if Honeywell overpays for deals in the pursuit of diversifying and expanding into new, faster-growing adjacent markets; unforeseen future sales slowdowns due to economic pressures; and execution around ongoing simplification efforts.

Chart courtesy of www.StockCharts.com

U.S. Census Bureau Warns of Supply Chain Woes

The U.S. Census Bureau conducts a weekly Small Business Pulse Survey measuring the effect of changing business conditions during COVID-19 on the nation’s small businesses and found 67% of small businesses in manufacturing are incurring domestic supplier delays, above the 42% national average. Manufacturing businesses are also experiencing greater foreign supplier delays, production delays and shipping delays versus other sectors.

The percentage of respondents reporting supply chain issues has almost doubled from the prior year, the bureau reported. It seems supply chain issues have eased a bit in August but remain challenging.

Delta Variant of COVID-19 Affect Five Back-to-School Stocks to Buy

The Delta variant of COVID-19 has proven to be highly transmissible and is raising concerns from health experts about the spread of the virus. The Centers for Disease Control and Prevention (CDC) is blaming the variant for recent spikes in case numbers and deaths.

However, the variant also is leading to a rise in the number of people vaccinated against COVID-19. As of Sept. 21, 212,255,202 people, or 63.9% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 182,012,343 people, or 54.8%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide, as of Sept. 21, total 229,513,803 and led to 4,707,676 deaths, according to Johns Hopkins University. U.S. COVID-19 cases hit 42,410,289 and caused 678,405 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five supply chain stocks to buy can help investors identify businesses that are mitigating the problem of delayed parts that is causing many other companies to suffer.

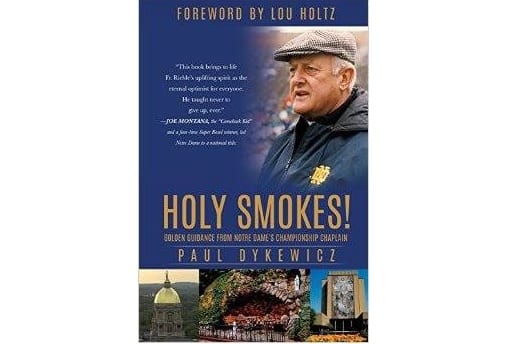

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing!