Blending data and real estate cause misnomers everywhere.

Examples of misnaming abound. Panama hats actually come from Ecuador, French horns originated in Germany, not France, and pencil lead is not made of lead, but graphite.

Similarly, while the name “real estate investment trusts” (REITs) seems to indicate that they are only focused on investing in houses, apartments and commercial properties such as offices and malls, that is not necessarily always the case. For example, the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSEARCA: SRVR) is a REIT that tracks an index of companies that derive at least 85% of their earnings from real estate properties related to data and infrastructure, including the storage, computation and transmission of data.

In comparison to many other exchange-traded funds, SRVR’s managers do not engage in any sort of complex calculations or use any fancy weighting systems to attempt to tease out winners. The only things that the mangers do is to weight the REITs by market capitalization and cap the largest names at 15%.

Currently, the fund’s top holdings include Crown Castle International Corp. (NYSE: CCI), Equinix, Inc. (NASDAQ: EQIX), American Tower Corp. (NYSE: AMT), CyrusOne Inc. (NASDAQ: CONE), Iron Mountain Inc. (NYSE: IRM), CoreSite Realty Corp. (NYSE: COR), SBA Communications Corp. (NASDAQ: SBAC) and Cellnex Telecom ADR (OTCMKTS: CLLNY).

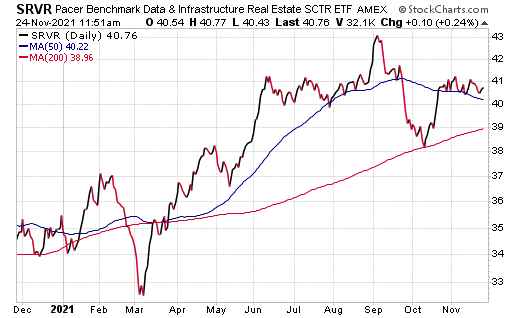

This fund’s performance has been mixed, even when including the damage done by the COVID-19 pandemic. As of Nov. 23, SRVR has been down 0.29% over the past month and 1.59% for the past three months. However, it is currently up 14.59% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $1.54 billion in assets under management and has an expense ratio of 0.60%.

In short, while SRVR does provide an investor with a way to profit from data-related REITs, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)