The top three growth investments to buy now include an augmented reality developer, a potential next Alibaba (NYSE: BABA) and the leader in enterprise management software.

Growth stocks are perfect for investors seeking triple-digit-percentage returns in a few short years. Many growth companies possess the potential to disrupt entire industries or change the world.

Some notable growth investments include Google (NASDAQ: GOOGL), Tesla (NASDAQ: TSLA) and Palantir (NYSE: PLTR). Growth investing has begun to outshine value stocks. Over the last decade, the iShares growth exchange-traded funds (ETFs) have generated 18.4% annually, compared to 12.8% for value funds.

However, growth stocks are inherently riskier than value investments since they derive their value from future cash flows and profits. If a company cannot meet its growth projections, the underlying stock price will often be subject to a harsh correction. As a result, growth investors must be comprehensive in their due diligence.

To aid your investment analysis and reduce your risk, we have sorted through hundreds of potential stocks to identify the top three growth investments to buy now.

3 Best Growth Investments to Buy Now: #3

Salesforce Inc. (NASDAQ: CRM)

Salesforce Inc. (NASDAQ: CRM), founded in 1999, specializes in providing enterprise cloud computing solutions. The company currently boasts a market capitalization (market cap) of $166.2 billion and is headquartered in San Francisco, California.

Marc Benioff, a former mentee of Steve Jobs and Larry Ellison, founded Salesforce on the idea that web-based enterprise software was more attractive than programs requiring downloads. Benioff’s unique idea was to inject software-as-a-service (SaaS) into his business model. Benioff’s adoption of SaaS was revolutionary during its time. Saas has since grown into one of the most popular business models in the technology industry and is employed by Microsoft (NASDAQ: MSFT), Adobe (NASDAQ: ADBE) and Slack, among other companies, to generate sales.

By leveraging its SaaS model, Salesforce has transformed from a scrappy upstart rival to Oracle (NYSE: ORCL) to the dominant force in the customer relationship management (CRM) industry with a 19.5% market share.

Salesforce has four primary offerings: Service Cloud for customer service support, Marketing Cloud to manage and facilitate digital marketing campaigns, Commerce Cloud, an e-commerce engine and Salesforce Platform, which allows businesses to build online applications.

The rise of hybrid and work-from-home models has spurred an increase in enterprise cloud software demand. According to a February 2022 Pew Research Poll, 61% of Americans voluntarily chose to work from home rather than the office. Although online video and messaging tools such as Zoom (NASDAQ: ZM) and Microsoft Teams have garnered the most attention, CRM has seen a 15.0% average annual growth over the last five years.

Salesforce has averaged a 24.5% increase in revenue over the last five years and generated a 90.9% return for its investors. CRM is forecast to continue the strong growth. The company is projected to see a 21.1% increase in sales in its current fiscal year, 2023, and an 18.1% growth in fiscal year 2024.

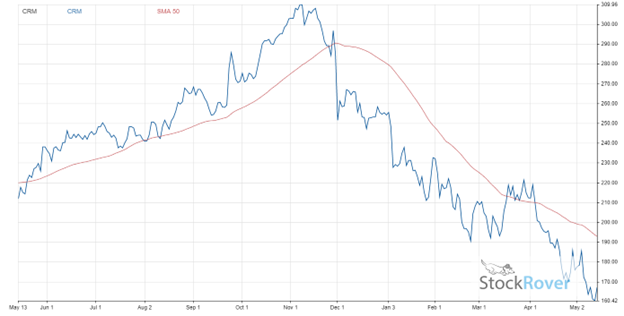

Like many technology stocks, Salesforce has seen its share price decline over the past few months. CRM’s price fell by 22.3% over 12 months. CRM’s performance over the past year is shown below alongside a 50-day moving average to illustrate change better.

Chart provided by Stock Rover.

Salesforce’s drop in share price may concern some investors. However, CRM’s decline is an overreaction by investors to a potential correction in the technology industry. CRM still maintains a 98/100 Stock Rover growth rating. The company’s forward price-to-earnings (P/E) ratio is projected to drop from 100+ to 28.0, a sign of CRM’s continued expansion.

Salesforce may not be as significant of a household name as Microsoft, but the company is just as prominent in the business software market. As businesses across the globe increasingly integrate technology in their operations, the ease of SaaS combined with the power of Salesforce makes CRM a must-buy stock.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $307.93, 84.2% higher than its latest closing price of $167.15, earning CRM a “STRONG BUY” recommendation from Stock Rover and a place among our three best growth investments to buy now.

3 Best Growth Investments to Buy Now: #2

MercadoLibre Inc. (NASDAQ: MELI)

MercadoLibre Inc. (NASDAQ: MELI) is an e-commerce company headquartered in Buenos Aires, Argentina. Founded in 1999, the company has since grown into the most extensive digital marketplace in Latin America, with a market cap of $39.0 billion. MercadoLibre also possesses major business segments in shipping services (Mercado Envios), financial services (Mercado Pago) and advertisements (Mercado Clicks).

Although MercadoLibre is not a household name for most families in the United States, the company is one of the world’s largest online service and retail platforms. The company operates two primary business segments: e-commerce and online financial services, both leaders in their respective industries in Latin America. MercadoLibre sold $28.4 billion in gross merchandise volume and processed $77 billion worth of payments in 2021. Both figures are all-time highs for the company. Gross merchandise sales grew by 35.7%, while payment processing jumped by 55% year-over-year. MercadoLibre also set a new record for internet traffic to its site, garnering over 139.5 million unique monthly visitors in 2021.

MercadoLibre has consistently outperformed the rest of the internet retail industry. MELI has seen an average revenue growth rate of 52.5% and a return rate of 175.1% over the past five years. Meanwhile, the industry average sits at 32.0% and 43.8%, respectively. MELI, however, has likely only discovered the tip of the iceberg and has a long runway to grow.

Despite Latin American retail e-commerce reaching $85 billion in sales in 2021, it only accounted for 6.2% of total retail sales in the region. The retail e-commerce industry is expected to reach $160 billion by 2025.

Mercado Pago was launched as a payment processing platform in 2003 but has since grown to include financial services such as credit cards and mobile point-of-sale machines. Currently, only 54% of individuals in Latin America possess a bank account, and less than 20.0% have a credit card. There is a gap between the supply of traditional banking and the demand of Latin American consumers for bank accounts. That gap is one that Mercado Pago has perfectly positioned itself to fill.

All signs point to MercadoLibre developing into Latin America’s Alibaba. The company is forecast to see a 41.6% rise in revenue in 2022 and a 31.7% increase in 2023.

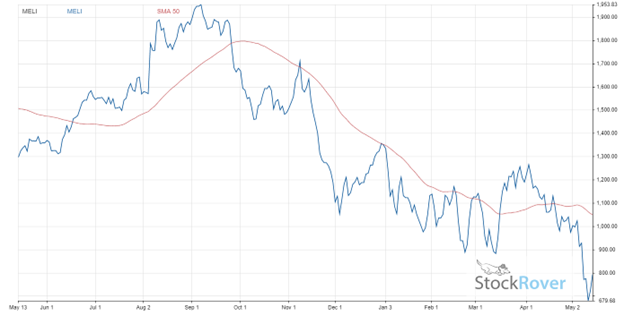

MELI has experienced a rough year, with the company seeing a 47.8% drop in share price over the past 12 months. The decrease in share price was due to an overall decline in the online retail market. A combination of global supply chain disruptions and shortages and industry growth slowing has put a damper on the online retail stock. MELI’s change over the past year is displayed below, with a 50-day moving average.

Chart provided by Stock Rover.

However, MELI’s decline is not in sync with the company’s underlying intrinsic value. Jeff Bezos famously wrote to Amazon (NASDAQ: AMZN) shareholders in 2000 following the dot-com crash that “the company is in a stronger position now than at any time in its past,” despite AMZN shares plummeting by 80% from the previous year. Bezos’ analysis was that Amazon’s internal metrics were improving year-over-year despite the change in share price.

MercadoLibre is in the same situation. The company’s stock price has fallen due to an overall decline in the technology industry. The NASDAQ has declined by 25.28% over the past six months. However, MecardoLibre’s internal figures: sales, users and profits have all reached record highs. MELI posted its first profitable year since 2017, with a net income of $83 million in 2021. Despite MecardoLibre’s share price reduction, the company has improved its standing as one of the most attractive growth investments available.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $1,695.00, 118.9% higher than its latest closing price of $774.44, earning MELI a “BUY” recommendation from Stock Rover and a place among our three best growth investments to buy now.

3 Best Growth Investments to Buy Now: #1

Meta Platforms Inc. (NASDAQ: FB)

Meta Platforms Inc. (NASDAQ:FB), formerly known as Facebook Inc., is the world’s largest online social network. Founded in 2004 and headquartered in Menlo Park, California, Meta has come a long way since Mark Zuckerberg’s Harvard dorm room, rising to a market cap of $534.6 billion. The company owns numerous subsidiaries, including WhatsApp, Instagram and Oculus.

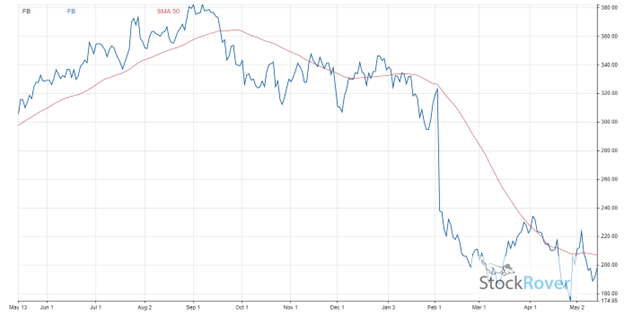

FB has seen its share price plummet since it announced its transition from Facebook to Meta in late October 2021. FB has fallen by 41.1% over the past six months. The fall in Meta’s share price was driven by a February 2022 announcement revealing that the company had lost users for the first time in its history. Meta followed the February declaration with a disclosure that the company has lost nearly $20 billion in virtual reality (VR) and augmented reality (AR) development since 2020. FB’s movement is graphed below alongside a 50-day moving average.

Chart provided by Stock Rover.

Meta’s decline in users, heavy cash burn rate and dismal stock price performance have repelled many individuals. However, the company is perfect for growth investors. Growth investing relies on a company’s future cash flows and profits to generate returns, not its current operation.

Meta’s VR and Metaverse departments are not meant to be currently profitable. An in-depth analysis infers that augmented reality can be the next big thing in the coming decades. Zuckerberg predicted in 2021 that the Metaverse “will be mainstream in 5-10 years.” Even Elon Musk and Neil Degrasse Tyson have concluded that we are more likely than not in a simulation, marking the idea of an expansive augmented reality as entirely plausible.

Meta is far ahead of other companies in regards to Metaverse development. Microsoft (NASDAQ: MSFT), the only other major company that has pursued significant Metaverse development, has reportedly lost dozens of members of its augmented reality team to Meta. Meta’s cash burn issue is also not as severe as it seems on the surface. The company currently possesses $43.9 billion in cash on its balance sheet – plenty to fund its Metaverse development for years to come.

The Metaverse may consist mainly of pixelated “real estate” and non-fungible tokens. However, Meta has proven that there is no company better at understanding social interactions throughout its history. According to the Federal Trade Commission, the company has dominated the social networking space, controlling over 60% of the market. Bloomberg Intelligence analysts Matthew Kanterman and Nathan Naidu projected that the Metaverse may explode into an $800 billion market by 2024.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $425.00, 50.8% higher than its latest closing price of $297.97, earning FB a “BUY” recommendation from Stock Rover and a place among our three best growth investments to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)