What happens if bond yields have peaked? What kind of investments would tend to do well in that environment?

That’s the question many are asking, especially now that bond yields have come well off their mid-June highs. One segment of the market that stands to benefit from this trend is dividend-paying equities.

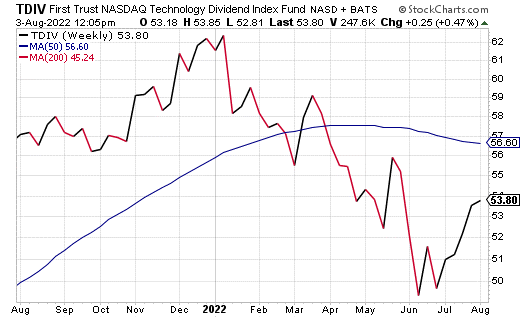

The First Trust NASDAQ Technology Dividend Index Fund (NASDAQ: TDIV) tracks a modified dividend-weighted index of U.S.-listed technology companies that pay regular dividends.

TDIV holds a dividend-weighted portfolio of up to 100 companies considered as technology or telecommunications businesses under the Industry Classification Benchmark. The fund limits its portfolio to U.S.-listed stocks that pay dividends.

These criteria significantly narrow the global technology universe, causing it to exclude certain segment giants. Its international exposure comes mostly from American depository receipts (ADRs).

The companies included are first weighted according to their dividend yield relative to other securities within the index, then they are adjusted accordingly so that tech companies occupy up to 80% of the index, while the telecom companies occupy only 20%. Rebalancing occurs quarterly while reconstitution occurs semi-annually.

Source: StockCharts.com

TDIV has $1.7 billion in assets under management and a 0.05% average spread. It currently has 92 out of 100 possible holdings and a nice 2.22% dividend yield. Its expense ratio is 0.50%.

The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the index. The fund is non-diversified.

While TDIV provides investors with great exposure to the dividend-paying stocks, this kind of ETF may not be appropriate for all portfolios. Interested investors always should conduct their own due diligence in deciding whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)