As you know, I am a fervent supporter of effective communication and the power that such a skill can bring to bear in almost every aspect of our daily lives.

Indeed, I strongly believe that effective communication skills are a potent antidote to the political polarization that is currently endemic in America. If you want to know more about this problem, as well as how you can make effective communication one of your New Year’s declarations, my friend and colleague Heather Wagenhals recently wrote a column in my The Deep Woods newsletter about this very topic.

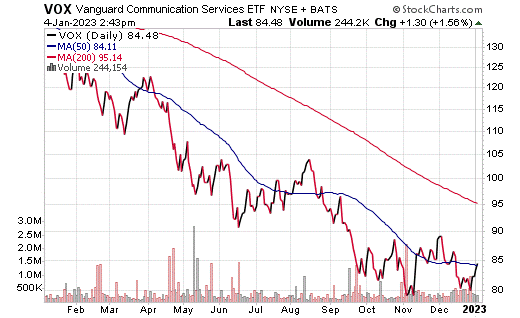

The telecommunications sector, however, did not do well in 2022. According to MarketWatch.com, telecommunications was the worst-performing sector of the S&P 500 last year.

Indeed, some companies in the sector, including Meta (NASDAQ: META) and WarnerBros Discovery (NASDAQ:WBD) had the “worst year on record.” For instance, according to MarketWatch, the SPDR Communication Services Select Sector Exchange-Traded Fund (NYSEARCA: XLC), which tracks the communications sector of the S&P 500, dropped by 39% in 2022, while the S&P 500 itself fell by 20.2% over the same time.

However, that does not mean that we should flee telecommunications and never look back. After all, our need, as humans, to communicate is still as prevalent as ever, and the sector continues to grow. One way to generate returns from telecommunication stocks is through the exchange-traded fund (ETF) Vanguard Communication Services Index Fund ETF (NYSEARCA: VOX).

VOX is an ETF that tracks the performance of the NASDAQ OMX U.S. Telecommunication Services Index, which consists of companies in the telecommunications sector. This includes both traditional telecommunications companies, as well as certain types of media and internet services companies.

Some of the firms in VOX’s portfolio include Alphabet Inc. Class A (NASDAQ: GOOGL), Alphabet Inc. Class C (NASDAQ: GOOG), Facebook Inc. Class A (NASDAQ: META), Walt Disney Co. (NYSE: DIS), Verizon (NYSE: VZ), AT&T (NYSE: T) and T-Mobile (NASDAQ: TMUS).

As of Jan. 3, VOX has been down 6.66% over the past month and 1.62% for the past three months. It is currently up 1.13% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $2.34 billion in assets under management and has an expense ratio of 0.10%.

Overall, the VOX ETF may be a good choice for investors looking for exposure to the telecommunications sector, but it is important to carefully consider the risks and potential returns before making any investment decisions.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.