Having been led by the “Magnificent Seven” mega-cap tech stocks, the stock market is starting to exhibit some healthier signs of broadening out. The S&P posted a 6.5% gain for the month of June boosted by a number of bullish economic reports. The third revision of first-quarter GDP came in at 2.0% versus 1.3%, coupled with consumer confidence for June registering 109.7 versus an upwardly revised 102.5 for May and the lowest weekly jobless claims report in a month.

So much for the Fed’s wish for widespread layoffs. Working Americans are spending with confidence. The S&P is now ahead by 16% at the midpoint of 2023. Wall Street’s most vocal bears, Mike Wilson of Morgan Stanley and Michael Hartnett of Bank of America, are still calling for a big sell off sometime over the next few months. Their thesis of a major collapse in S&P earnings just doesn’t seem to be materializing in many of the key sectors that are getting their footing.

In yet another catalyst for the bulls, the Federal Reserve provided more good news, saying 23 of the country’s largest banks passed the regulator’s annual stress tests of lender strength in the face of a hypothetical economic recession.

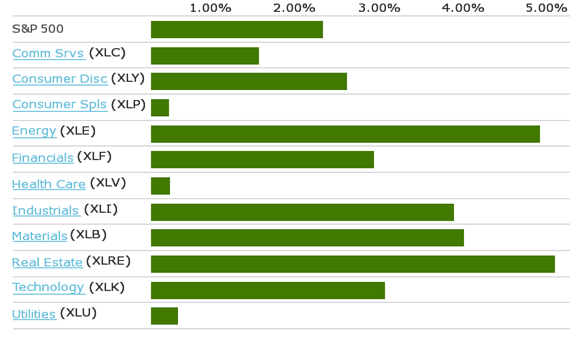

For the first time that I can remember for 2023, all the S&P 500’s sectors rose last week. Even the real estate and utility sectors gained in the face of Powell and the bond market pretty convinced another quarter-point rate hike at the July 26 Federal Open Market Committee meeting is in the offing. Real estate stocks actually led all market sectors, up 5% on the week.

Source: www.sectorspdr.com

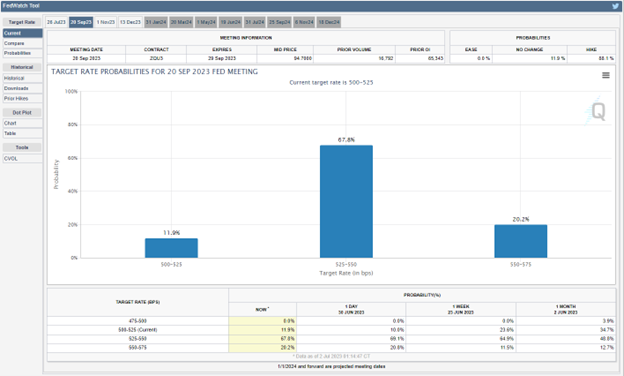

This week, investors will receive some key economic data, with readings on June manufacturing followed by June private-sector employment reported by ADP, weekly jobless claims and the June employment report. Given the robust data of late, the bond futures market is pricing in a quarter-point rate hike in Fed funds of 5.25-5.50%. The Atlanta FedWatch Tool shows an 86.8% chance of this taking place as of June 30 and only a 20.2% chance of another rate hike in September, that will surely swing higher if this week’s manufacturing and employment data come in hot.

Source: www.cmegroup.com

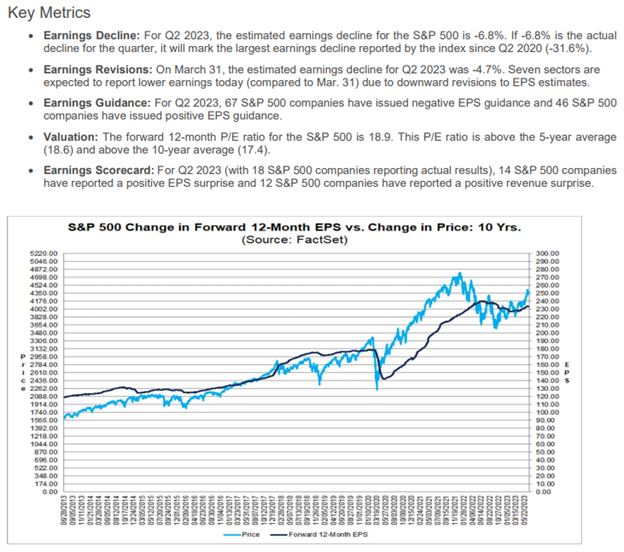

Come the week of July 10, second-quarter earnings season gets into full swing, with estimates wide-ranging. Below is the June 30 table of key metrics from FactSet Earnings Insight, that shows the current consensus 2023 estimate for S&P 500 earnings to be around $221, which is a far cry from the $185 level Mike Wilson is predicting. It would take an earnings apocalypse in the second and third quarters for this kind of an aggregate miss on the bottom line. To put it simply, there is a lot riding on this earnings season for the bears to prove their case.

Source: insight.factset.com

Where the bears can run into trouble is if FOMO psychology starts to take hold of the notion that a recession isn’t in the cards. There is a mountain of cash in money markets and short-term treasuries that could start to find its way into equities if 5% just doesn’t satisfy. As of last week, total money market fund assets decreased by $2.89 billion to $5.43 trillion for the week ended Wednesday, June 28, the Investment Company Institute reported. Among taxable money market funds, government funds decreased by $2.77 billion and prime funds decreased by $1.16 billion. Tax-exempt money market funds increased by $1.04 billion.

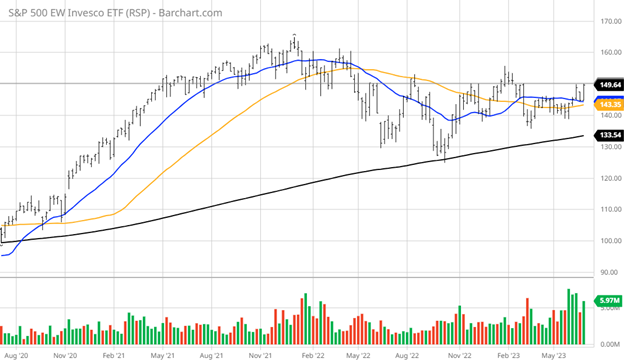

The Invesco S&P 500 Equal Weight ETF (RSP) outperformed the SPDR S&P 500 ETF (SPY) last week as the advance/decline line improved with more sectors getting a bullish lift. A break above $150 might well usher in a dash from cash. Hard to say, but this rally has caught millions of nervous investors flat-footed thanks to the most telegraphed recession that has yet to materialize. Sure, there are big pockets of weakness like corporate office properties, but heading into earnings season, there just hasn’t been some huge swath of companies issuing dramatically lower guidance that would materially alter the $221 estimate being put out by FactSet.

For one of the most hated rallies that comes to mind over the past serval years, the pressure to get in can sometimes exceed that to stay out. I would think the phones at Morgan Stanley’s and Bank of America’s bearish equity desks were burning up on Friday as the quarter ended on a powerfully bullish close. The thing about bearish predictions is that they always come true at some point, but the timing of forecasting a meltdown can be many weeks, months or even years down the road.

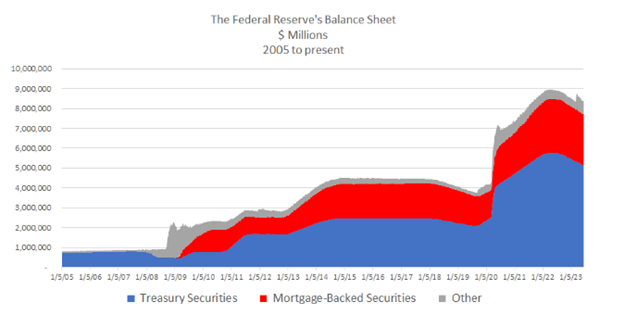

There is still so much money sloshing around the globe. As of June 14, the Fed’s assets stand at $8.4 trillion. And then there are the rest of the G-8 central banks and their bloated balance sheets. Money goes where it is best served, and with so little action in the IPO space to soak up excess liquidity, there looks to be room for the market to continue its advance and lift most boats of well-managed companies.

Source: www.americanactionforum.org

P.S. Join me at FreedomFest, “the world’s largest gathering of free minds,” just a week away! I, along with my fellow Eagle Financial gurus, Mark Skousen, George Gilder and Jim Woods, will be speaking. The full agenda — speakers, panels, debates and breakout sessions — is now posted online. Go to www.freedomfest.com/agenda to check it out. You will be amazed! You can also click on the name of each presenter to see when and on what topic they will be speaking. Click here to find out more. When registering, use code EAGLE50 to receive a discount. I hope to see you at FreedomFest in “Music City,” Memphis, Tennessee, July 12-15.

P.P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.