The old saying of “having your cake and eating it too” comes to mind when certain stock market related assets are not just in the sweet spot of what’s working best but also are structured to deliver phenomenal income streams to investors seeking outsized yields. I am not talking about junk bonds or highly levered securities either.

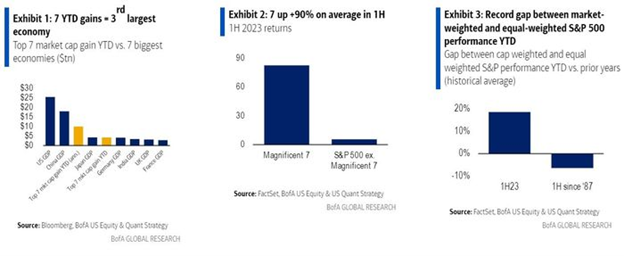

Year to date, the stock market has been dominated by the so-called “Magnificent Seven” that include the FAANG names, with the exception that Nvidia Inc. (NVDA) has replaced Netflix Inc. (NFLX) while also including Microsoft Corp. (MSFT) and Tesla Inc. (TSLA). The seven companies have a combined market value in excess of $11 trillion, with each of them surpassing the performance of the S&P 500 for the year. It’s been a massive and concentrated move higher for the group driven by the euphoria over all things AI.

To address this narrow and top-heavy phenomenon, it was announced recently there will be a Nasdaq 100 special rebalancing taking place before the market open on Monday, July 24, to “address overconcentration in the index by redistributing the weights.” The Nasdaq has only conducted a special rebalance twice in its history: in December 1998 and May 2011. Prior to the rebalance, the top five companies had a weighting of 46.7%, whereas after the rebalance, the weighting will be reduced to 38.5%. It’s a meaningful change, and will likely only slow the pace of advance.

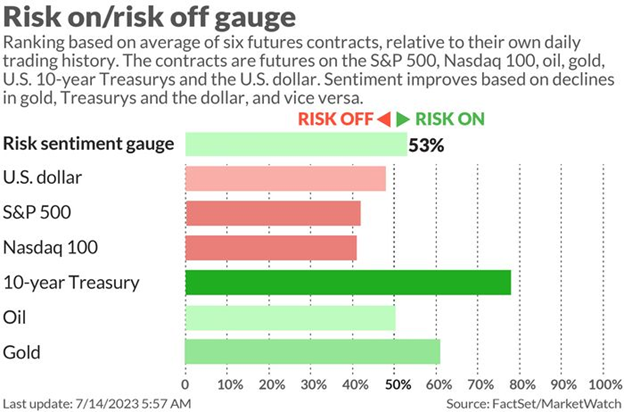

What’s important to note is that, being on the cusp of second-quarter earnings season with so much price appreciation built into the Nasdaq 100 holdings, it begs the question of how much these companies need to beat estimates and raise guidance to add to what have been heady gains already. Will this be a quantum “sell the news” phase of this rally that has begun to widen out as recession fears are pushed out? If one looks at how risk is traded in the futures market, there is definitely some near-term caution heading into the reporting period.

For investors that wonder if the torrid advance of these stocks can continue, the next two to three weeks will help define an answer to that question when the numbers and forward guidance are released. As to those in the market with income as their main objective and yet want to be in these behemoth tech darlings, there is some good news and how to have cake (income) and eat it too (capital gains from mighty Nasdaq).

There are a handful of ETFs that own these top names and deploy an active covered-call strategy where the annual yields are in excess of 10% and the ETFs make monthly payments. It has been about the best source of income generation available during a time when the Fed has been raising rates with bonds and other fixed income assets have been losing value over the course of the past 18 months after the Fed starting hiking rates.

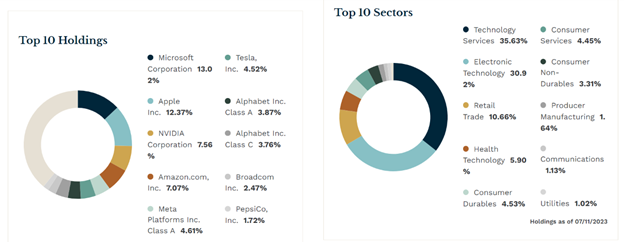

One such ETF is the Global X NASDAQ 100 Covered-Call ETF (QYLD), a fund that owns all the leading names within the top 10 holdings while selling calls on the Invesco QQQ Trust (QQQ) shares. The current distribution yield is mouth-watering 11.56%. With monthly distributions included, QYLD has returned about 20.6% year to date.

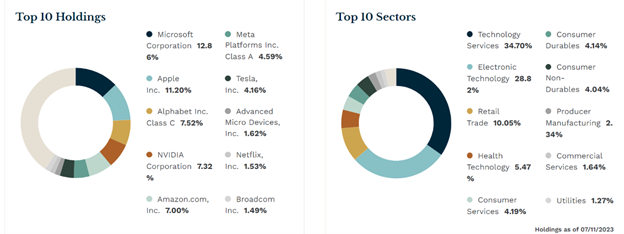

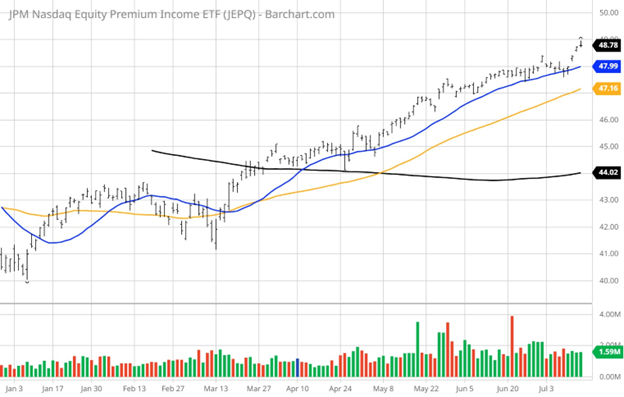

A second ETF of similar make up but with a better track record is the JPMorgan Nasdaq Equity Premium Income ETF (JEPI). The fund owns many of the same stocks, but also has equity-linked notes within its portfolio and sells one-month, out-of-the-money calls on its individual holdings. The current distribution yield is 10.75% and its monthly payout varies. Although the current yield is a tad lower than QYLD, the fund has put up a better total return of about 26% year to date, including distributions.

Not knowing if the market has seen its best gains for 2023, and with the Fed still making noise about further tightening, income investors have a clear choice of how to be in the way of further potential market gains while deriving an income stream that, in my view, has all the right ingredients to beat inflation, most dividend paying stocks and just about everything in the bond and bond equivalent markets. As with most of the big Nasdaq leaders, shares of JEPQ are a bit overbought, per the chart below, showing where the shares trade relative to their 20-day moving average (blue line).

What’s also nice about these covered-call funds is that they not only take advantage of market volatility by selling it in the form of option income received, these strategies also lower share price volatility as well, as option income tends to cushion price fluctuations. Grant it, the performance of both QYLD and JEPQ have not put up the same heady returns of the underlying stocks themselves, but they serve a different audience, where if cash flow is the number one objective, then many income investors, it’s plenty good.

Both QYLD and JEPQ are core holdings of the Cash Machine model portfolio, where the blended portfolio yield is 10.5%. For more information how to subscribe to the service, click here.

P.S. My colleague, George Gilder, will be hosting a teleconference on July 26 at 2 p.m. EST — and you’re invited! The title of the conference is “How to Profit from the Next S&P500 Companies” and it is free. However, you have to register here to be able to attend. Don’t miss out!

P.P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture, and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)