Bullish investors were rewarded last week with a winning streak of economic data points coupled with a move higher for the majority of equities and bond prices. One could sense a huge sense of relief in how the data crossed the tape one good news report after another that fed the narrative of a definite pause in Fed tightening at the Sept. 20 Federal Open Market Committee (FOMC) meeting.

For several months inflation has been stubbornly high due to a tight labor market, sticky rental prices, and the high costs for professional services. The market finally got some bullish developments on all three of these key components where there was hard evidence of softening that underpins some fresh talk of a Fed pivot maybe sooner than most economists are willing to accept at this point in time.

Rental prices for shelter continued slowing down this month, with both annual and monthly rent growth turning negative. Apartments on a national average are now about 1-2% cheaper than where they were a year ago. “The vacancy index has increased for 22 consecutive months and now sits at 6.4 percent, slightly above the pre-pandemic average. Additionally, with a record number of apartments under construction, we expect vacancies to remain strong in the coming months.”

Source: https://www.apartmentlist.com/research/national-rent-data

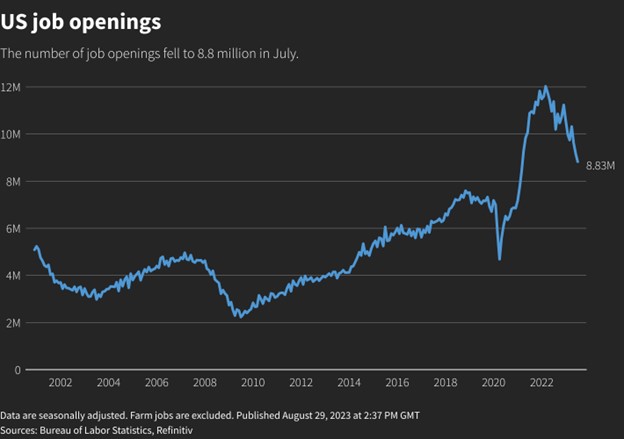

On the employment front, the Job Openings and Labor Turnover Survey (JOLTS), showed that around 8.83 million positions went unfilled over the month of July, down from the 9.582 million recorded in June and extending a run of monthly declines that began in March. The July figure was the lowest since March of 2021 and down from the all-time high of 12.027 million recorded in March of last year.

“While most Americans who want a job have one, it is not as easy to find new work as a year ago. Hires and quits are back to their pre-pandemic levels, and job openings are falling rapidly,” said Bill Adams, chief economist for Comerica Bank in Dallas. “The Fed is concerned that rapid wage growth might stoke inflationary pressures in 2024, but wage growth is likely to slow in coming months with workers seeing fewer opportunities to raise wages by switching jobs,” he added. “As wage growth cools, the Fed is likely to become more confident that inflation will keep moving towards their 2% target.”

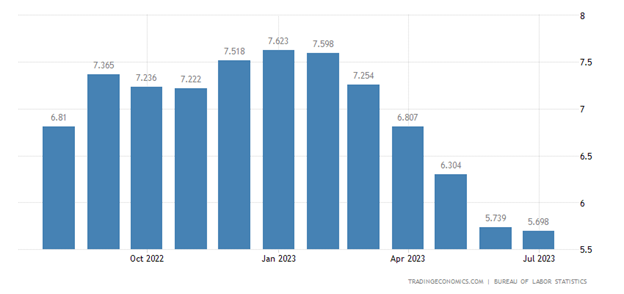

Services inflation in the United States eased for the sixth month to 5.70% year-on-year in July 2023, the lowest in over a year, from 5.74% in the prior month. This a very big news for consumers, considering food and energy prices ticked higher in August, but do not factor as much in the Fed’s inflation policy being they are more volatile. And yet, they do matter greatly to the average consumer.

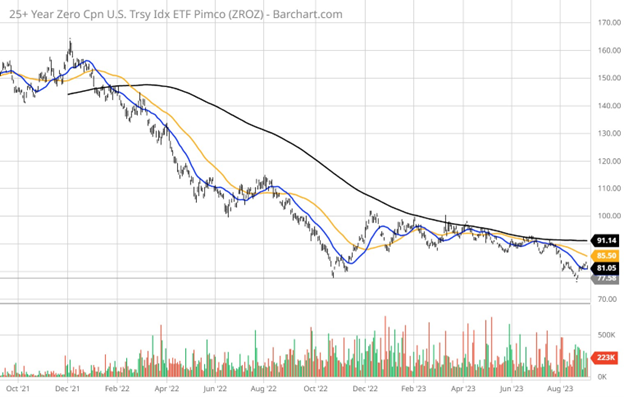

Looking at the 20-year chart of the 20-year Treasury bond, this maturing and the 10-year hit a pressure point at the 4.35%-4.45% level recently. The selling pressure in the Treasury market witnessed twice during the month of August was largely responsible for the 5% correction in the major averages. With the latest set of data pointing to further decline in the overall rate of inflation, at some point, assuming inflation is on a glide path to the Fed’s 2% target rate, bonds become a buy for investors and traders.

Fed Funds last traded at the Fed’s 2% target rate back in June-July 2022. The largest liquid investment grade corporate bond ETF is the iShares Investment Grade Corporate Bond ETF (LQD), paying 4.00% and trading at about $105 per share. When long-term rates were at 2% back in April 2022, shares of LQD were trading at $115. It’s a pretty significant discount where a move back to the 2% level over the course of the next year could potentially return roughly 20%, a juicy return for a bond investor.

For those seeking pure potential price appreciation, the PIMCO 25+ year Zero Coupon U.S. Treasury Index ETF (ZROZ) is trading at $81 per share, nearly 40% below where they were trading in April 2022. Sometimes investors and fund manager rack their brains hunting for the next big winning stock trade, when there are certain times within the cycle of interest rates that the returns in specific investment grade bonds, rival that of just about any stock on the board. Given how inflation is trending, the time for betting on long-term bonds might be more a case of much sooner than later.

P.S. Come join me and many of my Eagle colleagues on an incredible cruise! If you book before Sept. 29, you’ll receive a spend-as-you-wish $250 ship board credit! In addition, this is all-inclusive — meals, drinks and even the excursions are included in your one-time price! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)