Three technology investments to buy offer long-term potential for potent upside despite the Biden administration’s newly announced policy aimed at regulating use of artificial intelligence.

Even though the three technology investments to buy rebounded in the first part of 2023 after the sector slid more than 30% in 2022, they have pulled back along with the market in recent months but do not appear to be in danger of a meltdown. If investors can withstand headwinds of higher-for-longer interest rates, runaway federal deficits and rising political risk with Russia’s unrelenting war in Ukraine amid escalating attacks in the Middle East following the murderous Oct. 7 rampage by Hamas inside Israel.

I cautioned in a column earlier this year that governments may start to regulate artificial intelligence and affect the independence of companies to pursue the plans of their choice. President Biden did not wait long before announcing on Oct. 30 that he would begin federal oversight of the technology advances.

“To realize the promise of AI and avoid the risks, we need to govern this technology,” President Biden said during his Oct. 30 press briefing.

Three Technology Investments to Buy: Reasoning for Executive Order

The president described the executive order he signed on Oct. 30 as the “most significant action” any government anywhere in the world has ever taken on AI safety, security and trust. The order builds on previous steps to ensure the “AI Bill of Rights” by bringing together AI companies that agreed to voluntarily make sure the technology is safe and secure, he added.

“I am invoking what’s called the Defense Production Act that federal government uses in the most urgent of moments, like mobilizing the nation during… a time of war or developing COVID vaccines during the pandemic,” President Biden said. “This executive order will use the same authority to make companies prove that their most powerful systems are safe before allowing them to be used.”

That means companies must tell the government about the large-scale AI systems they’re developing and share rigorous independent test results to prove they pose no national security or safety risk to the American people, President Biden said. At the same time, President Biden said he would direct the Department of Energy to ensure AI systems don’t pose chemical, biological, or nuclear risks.

In the wrong hands, AI can make it easier for hackers to “exploit vulnerabilities” in the software that makes society run, President Biden said.

For that reason, President Biden said he was directing the Department of Defense and the Department of Homeland Security to develop “game-changing cyber protections” that will make computers and critical infrastructure more secure than it is today. As part of that response, President Biden said his administration would take “decisive steps” to prevent the use of cutting-edge AI chips to undermine U.S. national security, he added.

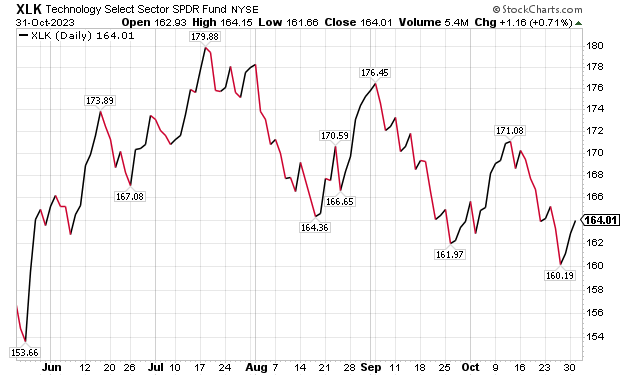

Three Technology Investments to Buy: XLK

The first of the three income-technology investments to buy that will use artificial intelligence is Technology Select Sector SPDR Fund (NYSE: XLK), featured in the Forecasts & Strategies investment newsletter led by Mark Skousen, PhD. That fund had jumped 33.04% in 2023 through June 8, but it has dipped a bit since then. The fund still is up 32.65% on a total return basis through Oct. 30.

Source: Stockcharts.com

Investors who can stomach volatility may want to tap these technology equities in pursuit of potent performance.

“Bear in mind that governments may start to regulate artificial intelligence and affect the independence of companies to do what their management teams want,” I wrote in my June 20 dividend column.

Technology entrepreneur Elon Musk, the owner and CEO of Twitter, Inc. (NYSE: TWTR), CEO of Tesla Inc. (NASDAQ: TSLA) and founder and CEO of privately held SpaceX, said on a recent podcast with presidential candidate Robert F. Kennedy Jr. that China is planning to initiate the regulation of artificial intelligence.

Skousen, a strong advocate of XLK, serves as a Presidential Fellow at Chapman University, as well as the head the Forecasts & Strategies investment newsletter. Skousen, who is a descendant of founding father, diplomat and inventor Benjamin Franklin, also is a seasoned stock market forecaster.

Mark Skousen, head of Five Star Trader and scion of Ben Franklin, talks to Paul Dykewicz.

In a presentation Skousen gave last Sunday, Oct. 29, at the MoneyShow in Orlando, he spoke about “The Fed Disaster Plan.” Skousen told attendees how the Federal Reserve has aggressively raised interest rates and created an inverted yield curve. The U.S. central bank leaders have raised rates faster than any other time in the past 30 years, taking its toll on Wall Street, Skousen added.

“When you can get a 5.4% return on safe money market funds or government securities, it’s hard to stay invested in risky growth stocks,” Skousen opined.

So far, the economy has resisted recession; the federal government announced last week that real GDP in the third quarter rose 4.9%, due to strong consumer and government spending. But business continues to slump, which is the real key to the growing possibility of an all-out recession in 2024, an election year, Skousen counseled.

Three Technology Investments to Buy: Sell-off Reduces Price of Shares

Given that the stock market has suffered its worst two weeks of the year, falling into correction territory, those looking to purchase shares of good stocks now can do so at reduced prices. Last week, the S&P 500 fell 2.5%. Despite a strong start to 2023, that index now is up just 8.5% through the first 10 months of the year, seasoned stock picker Jim Woods wrote in the just-completed November edition of his monthly Intelligence Report investment newsletter.

Paul Dykewicz meets with Jim Woods, head of Intelligence Report.

Since August, investors have reduced their interest in technology, Woods wrote. The S&P 500 recently fell to fresh five-month lows as earnings lagged, with many companies falling short of projected earnings per share (EPS), revenue or margins, he added.

“The selling was disproportionately centered on the tech names, and it’s fair to say that tech weakness and earnings disappointment has been the main driver of the declines in the S&P 500 in the final weeks of October,” Woods told his Intelligence Report subscribers.

While earnings season has been somewhat disappointing, it hasn’t been outright bad, Woods wrote. He described it as an expectation problem.

“Tech companies are not producing the kinds of growth that was assumed when the AI craze hit markets in May,” Woods explained. “As such, we are seeing those AI-driven gains given back.”

AI mania is not the sole reason for the 2023 gains, since falling inflation and resilient growth have contributed, too, Woods wrote. But the AI-driven rise in stocks during May and early June was based on very aggressive growth assumptions, so disappointment in that space is now another headwind for markets to face, he added.

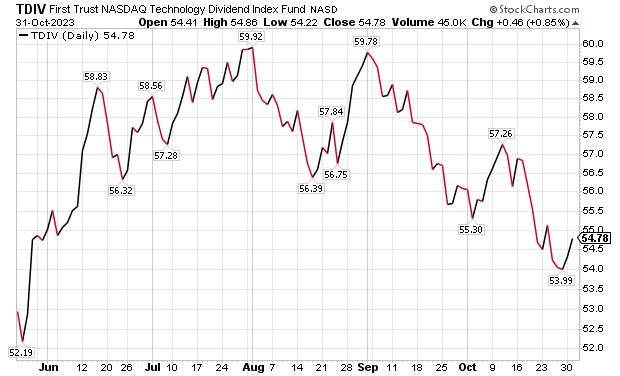

Three Technology Investments to Buy: TDIV

A broad technology fund that also offers a dividend yield and some exposure to artificial intelligence is First Trust NASDAQ Technology Dividend Index (TDIV). The ETF seeks to track the Nasdaq Technology Dividend Index, which is composed of technology and telecommunications companies, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, head of Retirement Watch, gives an interview to Paul Dykewicz.

TDIV recently had 84 holdings, and its 10 largest positions accounted for 53.7% of its assets. The biggest weightings recently were Microsoft (NASDAQ:MSFT), IBM (NYSE: IBM) and Broadcom (NASDAQ: AGVO).

Source: Stockcharts.com

The fund with $1.9 billion in assets has produced a total return of 15.1% through Oct. 31 this year. It also offers a current dividend yield of 2.1%.

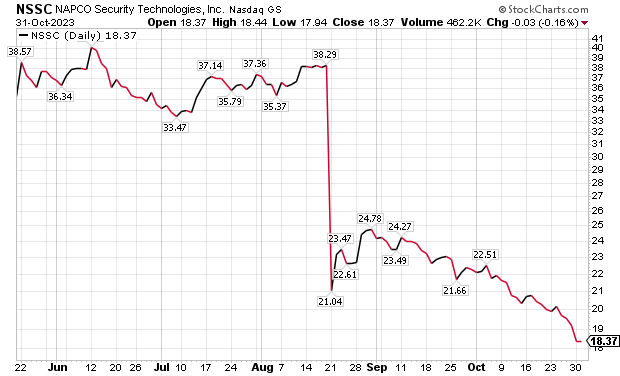

Three Technology Investments to Buy: Napco Security Technologies

Napco Security Technologies (NASDAQ: NSSC) is an Amityville, New York-based manufacturer of security products that offer advanced technologies for intrusion, fire, video, wireless, access control and door-locking systems. The company’s products are sold and installed by tens of thousands of security professionals worldwide to serve commercial, industrial, institutional, residential and government applications.

In addition, the company has a heritage of developing innovative technology and reliable security solutions for the professional security community, including StarLink Universal Wireless Intrusion & Commercial Fire Communicators and new StarLink Connect Radios with Universal Full Up/Download for major brands. Napco Security also offers Gemini Security & Fire Systems and the NAPCO Commercial Platform of 24V Addressable/Conventional/Wireless Systems and Firewolf Fire Panels & Devices.

Source: Stockcharts.com

When the Federal Reserve stops ratcheting up interest rates, expect strong growth stories to profit, said Michell Connell, who heads the Dallas-based Portia Capital Management. The company’s five-year revenue growth has been 10.45% per year and its five-year earnings growth rate has averaged 28% or more annually, Connell added.

“EPS growth rate is expected to increase exponentially more than 100% this year,” Connell commented. “That’s well ahead of the industry average expected growth rate of 22%.”

The company is a “strong cash generator” and initiated a dividend when it reported results on May 8. Connell told me. While the dividend yield for NSSC is just 0.78%, it is a start, Connell counseled.

Three Technology Investments to Buy: Beware of Regulation

The Biden administration’s regulatory reach into artificial intelligence innovation drew concerned comments from Richard Vigilante, a senior analyst of Gilder’s Technology Report, a monthly investment newsletter featuring technology futurist George Gilder. Subscribers of Gilder’s Technology Report are kept abreast of what Gilder and his senior analysts describe as top AI stocks with the monthly newsletter and weekly updates.

George Gilder discusses AI stocks in Gilder’s Technology Report and his trading services.

“What strikes me most is the breadth and generality of the order and the lack of evidence that the government knows what it is doing,” Vigilante opined. “What it says is sufficiently predictable that it could be a Chat GPT document, which does not encourage confidence in the analysis behind the order.”

Particularly mischievous are the non-discrimination provisions, Vigilante cautioned. As often is the case with the Biden administration, “disparate outcomes” are interpreted as evidence of discrimination, leading to an outbreak of lawsuits, he added.

Also scary is that AI could be a great tool for screening out potential frauds, bad actors, destructive tenants and more, but not if users are threatened with criminal prosecution for protecting themselves, Vigilante warned.

Similarly worrisome is mention of sentencing, parole and probation. AI could introduce some objectivity into these murky areas, but the likelihood of disparate outcomes could derail that effort, Vigilante counseled.

Three Technology Investments to Buy: Political Risk Rises

Russia’s invasion of Ukraine remains a big worry, as well as the outbreak of war in the Middle East following the brutal sneak attack of Hamas inside Israel. To help fund its sustained invasion of Ukraine, Russia has committed to limiting production of oil to keep prices up. OPEC leader Saudi Arabia also has curtailed production to help draw down global inventories.

Political risk could rise further after the Russian Defense Ministry released documents recently indicting its military spending could rise by more than 68% in 2024 to reach $111.15 billion. That amounts to about 6% of Russia’s gross domestic product (GDP), more than the country’s spending on social programs, according to Moscow Times. Russia’s military spending is set to total about three times more than education, environmental protection and health care spending combined.

The three technology investments to buy can be purchased at reduced prices following their recent pullbacks. Investors need to be able to accept rising political risk as wars rage.

Paul Dykewicz, www.pauldykewicz.com, is an award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)