For the past six weeks, the market rally has lifted almost all sectors out of some very bearish downtrends, the financials being one of them. While there is a base case for wanting to own the bank stocks against a more constructive outlook for the economy and interest rates, there are some major hurdles facing the regional banks that have to be cleared for this sector to be on longer-term sound footing.

I’ve itemized the areas of where there is current and future stress facing the sector:

- Regional banks have seen hundreds of billions of dollars in customer deposits flow out of their accounts and into money markets at major brokerage firms like Schwab while seeking higher yields.

- Regional banks bought hundreds of billions of dollars of low-yielding, long-dated Treasuries when the Fed flooded the system during the COVID-19 outbreak, resulting in massive unrealized losses of 30-40% on their balance sheets.

- Regional banks have over $1.5 trillion in commercial real estate loans on the books that are all due to be refinanced between 2024-2027.

- Regional banks are currently coping with increased regulatory standards and more stringent lending criteria to businesses and individuals following the spring 2023 banking crisis that the Fed and FDIC had to intervene in with a $500+ billion bailout and guaranteeing all deposits.

- Regional banks are now facing a highly inverted yield curve where lower interest rates that impact Net Interest Margin (NIM), a measurement comparing the net interest income a financial firm generates from credit products like loans and mortgages, with the outgoing interest it pays holders of savings accounts and certificates of deposit (CDs). The discount rate at which banks pay the Fed to borrow money is currently at 5.5%. With lending rates coming down along the yield curve, profits are squeezed.

For 2023, the FDIC has reported four regional bank failures with total assets of $753 billion that had to be resolved by seizure and sale of assets.

Source: https://www.fdic.gov/bank/historical/bank/bfb2023.html

The KBW Nasdaq Regional Banking Index (KRW) seeks to reflect the performance of U.S. companies that do business as regional banks or thrifts. From the one-year chart below, it is easy to see how the market euphoria of the past two months has the index right back up to where it broke down in March, triggered by the Silicon Valley Bank, Signature Bank and First Republic Bank failures.

Source: www.bigcharts.com

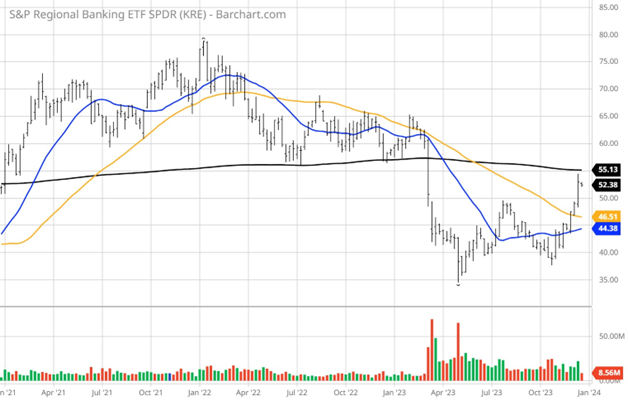

When looking at the SPDR Regional Banking ETF (KRE), it too has a very similar chart showing key technical resistance just overhead where its 200-week moving average (black line) lies. The issues hampering the regional banks earlier this year haven’t improved other than the perception that conditions will improve in 2024.

It’s hard to argue with the Fed’s pivot that fueled massive short-covering and the notion that consumer and business lending will experience more favorable borrowing terms. But I think the 800-pound elephant in the room is the commercial real estate refinancing dilemma facing the regional banks. Scores of commercial properties have seen their valuations fall by as much as 50% in major cities amid sky high vacancy rates.

America’s office market is still in the midst of a major correction, and office buildings still have another 20% price plunge ahead, according to Capital Economics. “Persistent weak growth and elevated (albeit soon-to-be-falling) interest rates continue to spell trouble for real estate values,” the research firm said in a note on Friday. “Offices still face a substantial value adjustment, with another 20% fall to come in our view.”

“Meanwhile, property owners who are able to refinance their mortgages are having to do so at much higher interest rates. That could bring on a wave of distressed debt, some economists warn, as there’s around $1.5 trillion of commercial real estate debt maturing over the next few years.”

Based on how the market has seemingly turned a blind eye to these risks, one could argue the recent spike in the regional bank sector is a prime setup for a shorting opportunity following a torrid rally for the major averages. I’m not saying to fight the tape or the Fed, but there are some deep-set problems within the regional banks that will likely dampen top- and bottom-line growth going forward. And when the profit taking shows up, and it will, there could be some fat profits made from downside bets.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)