Three aerospace investments to avoid after Boeing 737 MAX 9 malfunction face open-ended risk from a fuselage door plug blowing out of the Alaska Airlines aircraft at 16,000 feet on Friday, Jan. 5.

The extent of the risk is beyond the control of Boeing, since aviation regulators now need to assess what corrective action is required to ensure the safety of the flying public. Boeing previously suffered two fatal crashes of Boeing 737 MAX aircraft between 2018 and 2019 due to a technical problem that took time to identify and fix.

The Federal Aviation Administration (FAA) acted on Sunday, Jan. 7, to ground the 171 Boeing 737 MAX 9 planes that installed door plugs, accounting for most of the roughly 218 Max 9s in service worldwide. With the FAA’s responsibility to ensure all those aircraft are inspected and safe to resume flying, the time required to return them to service is currently unknown.

Image of damaged Boeing 737 MAX 9 courtesy of the National Transportation Safety Board

Three Aerospace Investments to Avoid: Boeing 737 MAX Fleet Grounded

Investors need to be aware that regulators move at their own pace, not with the sense of urgency that typically would exist in the private sector to restore a plane to revenue-generating service as soon as possible. Industry analysts generally overestimated how quickly the Chicago-based Boeing Co. (NYSE: BA) would recover from its previous 737 MAX aircraft safety problems, so caution is warranted to sidestep a recurrence.

“Upon receiving the revised version of instructions from Boeing, the FAA will conduct a thorough review,” the agency announced. “The safety of the flying public, not speed, will determine the timeline for returning the Boeing 737-9 Max to service.”

Investigators at the National Transportation Safety Board, as shown in this video, inspected the damage to the plane, saying the inflight mishap occurred due to an emergency exit-sized door plug blowing out after it somehow becoming detached from the rest of the plane’s fuselage. Four bolts intended to keep the plug from moving out of alignment were missing, the investigators said.

Part of the investigation will determine whether the bolts had ever been installed, and, if so, how they ended up missing. The matter is highly significant, since roughly 60% of Boeing’s annual revenues come from its Commercial Airplanes manufacturing unit.

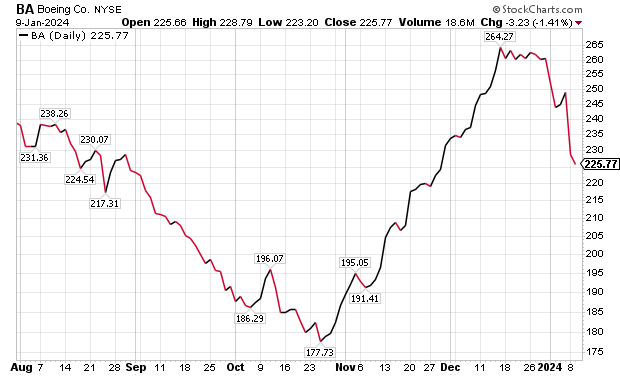

Three Aerospace Investments to Avoid: Boeing

Boeing still has its supporters. The stock recently gained a buy recommendation from BofA Global Research’s defense and aerospace analyst Ron Epstein. Boeing develops, manufactures and services commercial airplanes, defense products and space systems for customers in more than 150 countries and has a multi-year backlog of orders.

Boeing is steadily progressing toward its 737 annual production target, with 23 deliveries completed since the beginning of December, out of the 24 required to achieve the lower-end of its full-year target of 375-400 737s, Boeing’s aerospace and defense analyst Epstein wrote in a recent research note. He also speculated about the company’s potential return to a production rate of 31 a month.

BofA expects Boeing to generate $15 free cash flow/share by 2026. Epstein boosted his price objective on Boeing to $275 from $250 to reflect a re-rating due to the Fed’s planned interest rate cuts in 2024.

Chart courtesy of www.stockcharts.com

Chicago investment firm William Blair gave Boeing a buy recommendation last month and affirmed its rating on Jan. 8 amid a drop in the company’s stock price since the 737 MAX 9 incident on Jan. 5. The “terrifying” midair emergency aboard the Alaska Air flight with 171 passengers and four crew members, should not have a “major financial impact” on Boeing unless it happens again, wrote Louie DiPalma, an aerospace analyst at the company.

A less positive outlook for Boeing came from Michelle Connell, president and owner of Dallas-based Portia Capital Management, LLC. She is wary about the stock, as I personally have been since it had two Boeing 737 MAX passenger airline crashes on October 29, 2018, and March 10, 2019, respectively. Those accidents caused the deaths of 346 passengers and crew members.

Despite Boeing announcing new potential airline orders, Connell said she does not think Boeing is “out of the woods” with its safety issues. The Federal Aviation Administration (FAA) had announced before the Jan. 5 malfunction that the agency will begin further reviews of Boeing 737 Max planes to determine if they have problems with loose bolts, she added.

The company’s Boeing 737 MAX aircraft have been under scrutiny since before the pandemic and it may take “several years” to put those issues fully in the past, Connell continued.

Michelle Connell heads Portia Capital Management LLC.

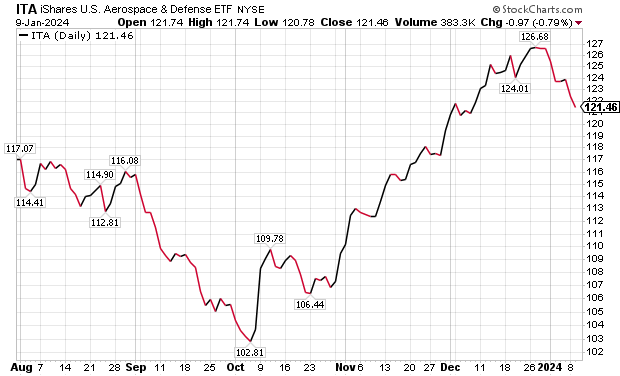

Three Aerospace Investments to Avoid: ITA

An aerospace fund to avoid for now is iShares US Aerospace & Defense (ITA). The fund has the lowest fees among its peers, but has the worst performance compared to the other two, said Bob Carlson, a former pension fund chairman who heads the Retirement Watch investment newsletter.

ITA seeks to track the Dow Jones U.S. Select Aerospace and Defense Index. Like some other defense and aerospace funds, this one is overweight toward industrials, while underweight toward technology and consumer cyclicals, Carlson said.

The fund recently owned 35 securities, and 76.8% of the ETF was in its 10 largest positions. The top five positions in the fund were Boeing, RTX, Lockheed Martin, Axon Enterprise (NASDAQ: AXON) and L3Harris Technologies (NYSE: LHX). Its dividend yield is 1.4%.

Connell criticized the concentration of ITA’s holdings in its largest positions. Boeing accounts for 19.26% of the fund, followed by RTX Corp., with 17.09%. RTX fell 13% in the past year to hold back the fund’s performance compared to its peers. Connell counseled.

Chart courtesy of www.stockcharts.com

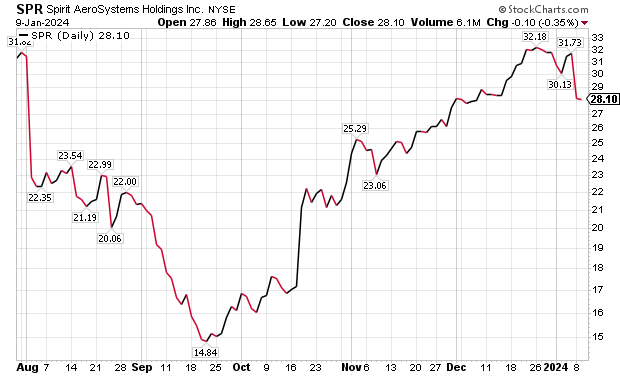

Three Aerospace Investments to Avoid: SPR

Spirit AeroSystems (NYSE: SPR) finished 2023 strongly but the Jan. 5 Alaska Airline emergency changed that trajectory quickly. The Wichita, Kansas-based company, formerly owned by Boeing, includes the production of fuselages among its key manufacturing roles. It also builds integrated wings and wing components, pylons and nacelles for aircraft.

Amid reports that Boeing, its most important customer, would boost production in 2024, the price of SPR shares rallied 15.6% in December. In just the past couple of days, the share price of Spirit AeroSystems fell close to 10%.

As a fuselage maker, the company faces the same uncertainty as Boeing about how long regulators may need to identify the cause of the latest Boeing 737 MAX scare and oversee a remedy. Such delays are bad for business, as well as revenues and profitability.

Chart courtesy of www.stockcharts.com

Other investment Opportunities Exist

Two proponents of national security stocks are Mark Skousen, PhD, and seasoned market observer Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Military Demand May Help Overcome Drag on Three Aerospace Investments to Avoid

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov. 16 at a national security conference. Prime examples of the need are multiple raging wars, including those in Ukraine and the Middle East, as well as a cold one involving China and its strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel triggered an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the national security conference held at Johns Hopkins University.

Russia’s 360-foot-long Novocherkassk war ship was damaged on Dec. 26 by a Ukrainian attack on a Black Sea port in Crimea. This video shows the ship exploding at the port when struck by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can require immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins attendees of a critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg remarked before the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center.

Michael Bloomberg, philanthropist and founder of Bloomberg L.P.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

The three aerospace investments to avoid may recover in the months ahead, but there is no need to take the plunge prematurely with many unknowns yet to be navigated.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)