The S&P and Nasdaq soared, and bond prices crashed upon last Friday’s release of the January employment data that blew past even the most bullish of estimates. The Labor Department reported the economy added a whopping 353,000 jobs with the three-month average for total nonfarm payrolls increased to 289,000 from 227,000. December nonfarm payrolls were revised to 333,000 from 216,000. November nonfarm payrolls were revised to 182,000 from 173,000.

January average hourly earnings were up 0.6% (Briefing.com consensus 0.3%) versus 0.4% in December. Over the last 12 months, average hourly earnings have risen 4.5%, versus 4.3% for the 12 months ending in December. The lower trend in job growth bottomed out in October 2023 and has been reaccelerating for the past three months as implied by the upward revisions. There are some changes in adjustments that the Bureau of Labor Statistics (BLS) has made to its data, which has critics of the BLS charging extreme data manipulation to generate such a strong report.

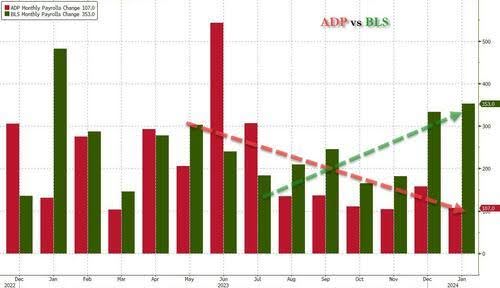

Now, let’s look at the ADP National Employment Report, which is a measure of the monthly change in nonfarm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is historically a particularly good predictor of the government’s nonfarm payroll report.

Private payroll growth slowed to just 107,000 in January, well below expectations of 150,000 and off from the downwardly revised 158,000 in December. “Private payroll growth declined sharply in January, a possible sign that the U.S. labor market is heading for a slowdown this year,” ADP reported Wednesday. Only one sector — information services (-9,000) — reported a decline, but hiring was slow across virtually all sectors. Vocal critics argue the use of benchmark revisions, seasonal adjustments and population controls are all keywords for what we can only describe as statistical magic.

In the latest Zero Hedge economic commentary, it was pointed out “the latest divergence between the Establishment (payrolls) and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 353,000 payrolls were added, the Household survey found that the number of actually employed workers dropped again, this time by 31,000 (from 161,183 to 161,152).”

The number of people employed has dropped in three of the past four months, including a drop of 683,000 people in December. The Challenger Job Cuts Report showed layoffs of 82,307 cuts for the month of January, a 136% increase from the previous month, a significant jump indicating layoffs are picking up. So, how can Friday’s through-the-roof employment report run so counter to that of the ADP, Household Survey and Challenger Job Cuts reports? I don’t have an empirical answer, but the data should correspond to a large extent, and it is not.

Source: ZeroHenge

The market’s reaction was manyfold as bond and commodity prices traded down sharply, Treasury yields and the dollar traded solidly higher with big-cap tech stocks leading a rally in the S&P to new all-time highs while the Russell 2000 traded lower on a dimmed outlook for any kind of rate cuts soon. Companies beating Q4 estimates are getting richly rewarded and those that miss are getting sold off aggressively.

The odds of a March rate cut are super low, with talk of a cut in May now being highly questionable. And despite all the euphoria surrounding a couple of big beats by the Magnificent Seven, there are dark clouds forming over some of the regional banks and foreign banks with too much of the wrong commercial real estate exposure. Bloomberg reported last Thursday night that Tokyo-based Aozora shares plunged by as much as 18.5% to their lowest levels since February 2021 in Tokyo trade.

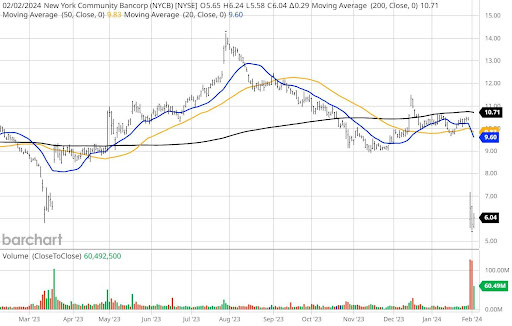

The Tokyo-based commercial lender said it now expects to post a net loss of 28 billion Japanese yen ($191 million) for the fiscal year ending March 31 after warning of U.S. commercial real estate losses. This report came on the heels of the earnings shocker out of New York Community Bancorp (NYCB), which posted an astonishing $522 loan loss provision related to the acquisition of Signature Bank and Flagstar Bank. NYCB also slashed its quarterly dividend by 70% to a nickel.

Shares of NYCB lost 40% of their value in three days. “Banks are facing roughly $560 billion in commercial real estate maturities by the end of 2025, representing more than half of the total property debt coming due over that period. And commercial real estate loans account for 28.7% of assets at small banks.” “It’s clear that the link between commercial property and regional banks is a tail risk for 2024,” said Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place. “And if any cracks emerge, they could be in the commercial, housing and bank sector.”

Being we are in a Presidential election cycle, markets tend to be optimistic and put off unwelcome news into the following post-election year. There is growing geopolitical risk and some fear of inflation re-igniting if supply chains face wider disruptions and a federal debt bubble, but the U.S. economy is reporting economic data that generally supports a market that can add to its gains. And with the dollar turning higher, that only attracts further foreign capital flows seeking dollar-based assets.

With that said, at some point, the market will care about these risks. Just as was in August through October last year, when the market swooned, there will be a change in the narrative from buying the dips to selling into rallies. At present, there is a strong bias to keep buying any pullbacks in stocks of companies posting great sales and earnings growth coupled with bullish guidance.