Any red-blooded American male will admit — it’s hard not to get caught up in the power of a persuasive “chick.”

But luckily for The Deep Woods readers, this is a special kind of “chick,” and a worldly one, if I may. But, before I go any further, I shall give you some background. This discussion starts in China and potentially ends in your portfolio. Here’s the deal: China has been so battered for so long, that there is a lot of deep value here for the “blood in the ‘red’ streets” investors.

While China battles less-than-favorable headlines, a struggling economic rebound and just an onslaught of difficulties, one area it seems to be excelling in is the consumer. One reason for this may be China’s recently instituted stimulus measures to jumpstart the economy.

Such measures include allowing the People’s Bank of China (PBOC) to hold reduced cash reserves and encouraging banks to lend to qualified developers. Actions such as these have spurred the International Monetary Fund to upgrade its global growth forecast for 2024 by 0.2 percentage points to 3.1%, according to CNBC.

As mentioned, the consumer is the emerging bellwether in China’s resurgence — but keep in mind, it’s important for investors to keep an eye on which specific sub-sectors are participating in this recovery and which are not.

But, valued reader, I would not be keeping true to the “In the name of the best within us,” if I did not share which of the sectors are important to keep an eye on. As it looks, the days of tremendous growth in traditional retail consumption appear to be stalling, but the service sector looks to be leading the charge with Chinese consumers once again pining for travel, making reservations for bars and restaurants and taking to the great outdoors.

Not only are the above categories trending higher, but automobile purchases are poised for growth as well — thanks in part to China’s announcement in 2023 that its main economic planning body created stimuli for increased household vehicle purchases.

Finally, while shock and awe can be fun, it will come as a surprise to no one that China represents the largest e-commerce market globally and continues to maintain that status. In 2023, the retail e-commerce sector saw sales of $3,331 trillion and 2024 forecasts predict upward of $3,565 trillion in sales.

I now will introduce our mystery “chick.”

The Global X MSCI China Consumer Discretionary (CHIQ) is an exchange-traded fund (ETF) that invests in mid- to large-cap consumer discretionary stocks that comprise the MSI China Index. The ETF includes all the major share classes: A-shares and H-shares, red chips, P chips and foreign listings. Now, out of these, the A-shares and H-shares may be the most noteworthy to break down.

H-shares are those traded on Hong Kong’s exchanges and regulated by Chinese law. These are traded in Hong Kong dollars and are freely traded by anyone, foreign investors included. On the flip side, A-shares represent publicly listed Chinese companies that trade on Chinese stock exchanges, including the Shenzhen Stock Exchange (SZSE) and Shanghai Stock Exchange (SSE). Unlike H-shares, these stocks trade in Chinese yuan renminbi (CNY) and Chinese law makes it immensely difficult for foreign investors to buy and sell A-shares.

Thus, our “chick’s” appeal continues to grow, as CHIQ holds both share classes, making it easier for investors to potentially secure stocks that may otherwise be difficult or near impossible to hold.

To sweeten the pot, CHIQ has $238 million in assets under management and its portfolio sells at 11x forward earnings, with five-year revenue projected at 19%. Further, the ETF pays a dividend yield of 2.5%, which is higher than the category average.

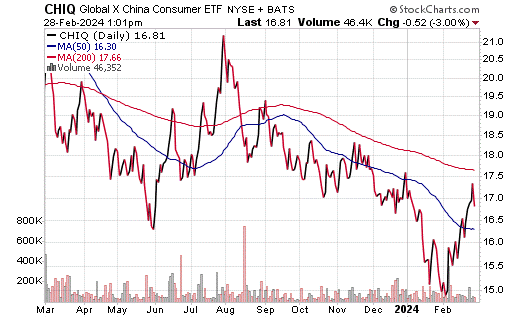

The chart here is a fairly typical depiction of the sector’s fortunes — up and down. However, what this chart also shows is that CHIQ has always able to pull itself from a slump. In fact, for every downward spike, there’s an even higher upward trend, just like the most recent one we are currently seeing.

Courtesy of stockcharts.com

While there was a downward tumble in early February, it has soared almost overnight and is trending back to its normal range within the past month.

Moreover, CHIQ’s portfolio aligns well with the specific areas of consumer spending discussed above, as its first, second and third largest sub-sector allocations are Internet Retail, Motor Vehicles and Apparel/Footwear, respectively. Its top 10 holdings include: PDD Holdings Inc. (PDD), 11.71%; Alibaba Group Holding Limited (9988.HK), 10.21%; Meituan (3690.HK), 6.26%; JD.com, Inc. (9618.HK), 5.56%; 01211 (01211), 4.99%; Trip.com Group Limited (9961.HK), 4.91%; Li Auto Inc. (2015.HK), 3.76%; Yum China Holdings, Inc. (YUMC), 3.52%; New Oriental Education & Technology Group Inc. (9901.HK), 3.37% and ANTA Sports Products Limited (2020.HK), 2.61%.

All quips aside, romance and investing have one thing in common: either is the ficklest of mistresses. But, when it comes to Global X MSCI China Consumer Discretionary (CHIQ), this is one “chick” that potentially ticks quite a few boxes for those interested in overseas portfolio additions.

With an economic jumpstart, the rejuvenation of social and outdoor activities and the country’s growth forecast, it may be time to let China out of the doghouse and make its stimulus work for us — and CHIQ may be just the investment vehicle to do so.

Not only do the holdings align with the specific growing sub-sectors of the Consumer Discretionary world, but it gives investors access to A-shares — which as discussed, are much trickier to obtain and hold outside of China. Moreover, it has a strong five-year growth projection and pays a tidy dividend.

Now that I’ve discussed what this “chick” has to offer, I’d like to rewind a bit and discuss “blood in the ‘red’ streets” investors.

There are several facets to investing, and for many, especially those who lean toward the Way of The Renaissance Man, one of the important ones is history. History is important as it guides us forward, teaches us how not to go backward and lets us soak in the wisdom of those who carved the paths for us.

Baron Rothschild was an 18th-century British nobleman and member of the Rothschild banking family. Rothschild made his legacy fortune buying into the panic that followed the Battle of Waterloo against Napoleon. And, while that is the utterly condensed version, it led to the roughly translated quote: “Buy when there’s blood in the streets, even if the blood is your own.”

Suffice to say, Rothschild was not one to follow the investing pack and was known as a contrarian investor. Simply, the worse things seem in the market, the better the opportunities are for profit.

That, my friends, is what we are doing here. And given the respect I have for readers; I won’t bother further explaining my own “red” tint on the quote — as we all know… China.

I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)