While most traders were focused on Reddit’s initial public offering (IPO) and the sudden surge in the share price of Donald Trump’s company, Truth Social…

… they arguably missed the most significant investment idea in 2024.

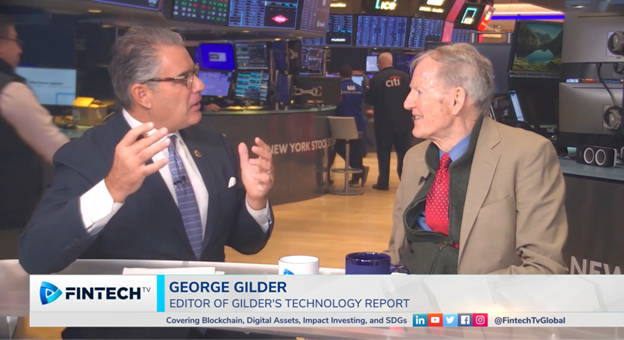

Just a few yards away from where Reddit began trading on the NYSE, George Gilder was sitting for an interview with Fintech TV and was laying out his top technology investment ideas.

Back in the ’80s, George was at the forefront of the semiconductor industry.

He saw its potential and more or less demanded the Reagan Administration take it seriously.

Now, he’s pounding the table on graphene, one of the world’s most incredible materials that has yet to take hold.

As George explains in the interview, its applicability to so many industries makes it a no-brainer investment.

…and yet… most people don’t even care.

They’re more interested in trying to catch a piece of the action on the latest hype and high flyers.

Chances are their trading accounts will take a beating instead.

You see, it’s easy to get caught up in the wonder and fervor surrounding the most popular stock of the week.

However, we will show you why both Reddit and Truth Social will flame out before long.

Cash is King

No company can survive without cash.

You can’t pay your bills with a profit and loss statement. And those, anyhow, can be easily manipulated.

Companies go through three stages of financial maturity.

First, they stop burning cash and generate positive cash flow from operations.

This allows them to pay their bills and either invest in the business or reduce their debt.

In the second stage, a company generates cash from operations and turns a profit on paper (i.e., its income statement).

Many high-growth tech companies take a long time to get to the second stage. Even though they generate plenty of cash, their income statements are weighed down by stock compensation, depreciating initial technology investments, etc.

Over time, they reach the second stage as income statements mirror cash flows.

In the third stage, a company reaches positive free cash flow. This is when shareholders finally get a return on their investment.

That excess cash is often funneled into dividends or share buybacks.

Neither Reddit nor Truth Social is anywhere close to the first stage.

Both are burning cash.

Reddit eats up nearly $75 million in cash annually, down from $94 million in 2022, although its IPO brought a $750 million infusion.

Truth Social has taken a little bit more digging since it went public through a special purpose acquisition company (SPAC) merger in 2021. We’d like to note that the majority of those SPACs from that craze turned out to be awful investments.

During the first nine months of 2023, the company booked just $3.3 million in revenues.

Before the merger, Truth Social was running desperately low on cash.

This is to say nothing of whether we like either company or believe they’re a needed counterbalance to the traditional social media monopoly.

Yet, it’s hard for any practically-minded investor to support an $8 billion valuation for a company that generates little, if any, revenue. Heck, that was what the dot-com bubble was all about.

In fact, the options market is pricing in a swift decline rather soon for the stock.

If you look at the price quotes for the options on Thursday at the end of the day, when the stock was trading around $66.20, you’ll see that the prices for the puts and calls for the two strikes closest to that price are very different.

The puts were trading at $19.10-20.65, while calls were at $10.05-11.05.

Typically, the calls and puts for the at-the-money strike price trade pretty close to one another.

In this case, the cost of those bearish puts is nearly twice the cost of the calls, because everyone, including the market makers, is betting on the stock crashing hard.

Say what you will, but market makers rarely lose money in this type of situation.

But What If….

Our goal isn’t to disparage either company, but we simply want to point out that neither presents a compelling investment.

But what if these stocks were cheaper… like pennies on the dollar?

Now you’re talking turkey.

Neither of these companies is a great buy right now.

But if the stocks get cheap enough, they absolutely are.

That’s the fundamental misunderstanding people have about investing.

It’s not about a stock’s share price but its total worth (market capitalizaton) relative to what it can do now and in the future.

Obviously, money now is more valuable than down the road, which is why both Truth Social and Reddit are fundamentally overpriced.

That equation completely changes if we expect to generate billions of profits in the near future.

And it’s why folks who got in on Truth Social back during the SPAC but are now sitting on a fortune after the craze finished.

It’s all about timing and getting in before everyone else.

That’s easy to say but tough to accomplish… or is it?

Right now, there’s a lucrative investment opportunity with enormous growth potential…

…and it has yet to catch the attention of the average investor.

But when it does, those first movers will even put the early Facebook investors to shame.

Now, you can choose to ignore it and try to chase meme stocks with the rest of the crowd.

You can also click here to see how graphene could change the world.