Cole Turner

Intrinsic and Extrinsic Value – Options Trading

The intrinsic and extrinsic value of an option make up the total value of the option, or the price paid for the option by the buyer to the seller. It is important to understand what intrinsic and extrinsic value is in order to see how option contracts get their prices. This article will explain intrinsic […]

How to Deal with Noise and Distractions in the Market – Bob Lang

Bob Lang is the Founder and Chief Options Analyst at Explosive Options, as well as the President and CEO of Aztec Capital. Through Explosive Options, Bob acts as an options trading mentor and is focused on providing his clients with his technical expertise. Bob also serves as a go-to technical expert on Jim Cramer’s show, […]

Interview with John Dobosz – Investment Expert and Writer

John Dobosz is the editor for two widely-read investment newsletters: Forbes Dividend Investor and Forbes Premium Income Report. Before working at Forbes, Dobosz gained experience working with CNN Financial News and Bloomberg TV. He is an investment expert who focuses on options-selling trades on dividend-paying stocks which generate superior levels of income and total returns. […]

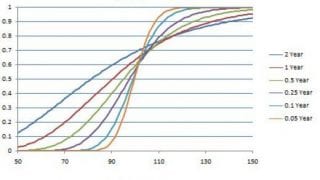

The Definition of the Greek Letter Theta – Options Trading

In relation to options, the Greek letter, Theta, represents how much an option’s price will decline due to the passage of time. It is also known as an option’s “time decay.” By reading this article, an investor will gain a better understanding of what Theta is, and how it can be used to better his […]

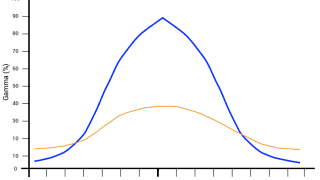

What does the Greek letter Gamma mean in Options Trading?

In regards to options, the Greek letter, Gamma, indicates how much the Delta will change given a $1 change in the underlying security. Delta shows how a $1 change in the underlying security affects the option’s price. The Gamma is used to show how the Delta might change with that same $1 move. This article […]

What does the Greek Letter Delta mean – Options Trading

In terms of options, the Greek letter, Delta, is a theoretical estimate of how much an option’s price may change with a $1 change in the underlying security’s price. This article will explain what Delta is, and how it works in real-world examples. Understanding Delta is a tool an investor can use to advance his […]