With the highest population of any country, China has a huge consumer base. The Global X China Consumer Exchange-Traded Fund (ETF) (CHIQ) aims to take advantage of that by investing in a basket of stocks that are focused on the consumer discretionary and consumer staples sectors in China.

The fund invests the majority of its $66.12 million total assets in companies domiciled in or with their main business operations in China. Only securities which are tradable for foreign investors without restrictions are eligible. CHIQ has a dividend yield of 1.52% and makes annual distributions. The fund has an expense ratio of 0.65%.

While CHIQ holds far fewer names than a typical China consumer-based fund, it captures both consumer cyclical and non-cyclical sectors. CHIQ opts to go lighter in retailers and automobile manufacturers and invests heavily in food, tobacco and beverage sectors. It does not have a high daily trading volume for an ETF in general, but its efficient access to the consumer sector makes it one of the most popular sector-specific China ETFs on the market.

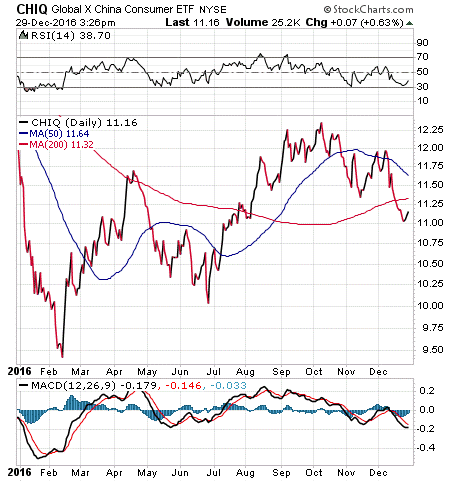

Investors often use CHIQ as part of a long/short play or as a complement to other ETFs that they hold, as the consumer sector is frequently underrepresented in many of China’s funds. From the chart below, you can see large up-and-down fluctuations for 2016 in CHIQ’s net asset value. CHIQ’s year-to-date return is down 0.16%, while the S&P 500 is up 10.08%.

CHIQ’s top five holdings are Galaxy Entertainment Group Ltd, 5.73%; JD.com Inc. ADR, 5.08%; Techtronic Industries Co Ltd, 4.64%; China Mengniu Dairy Co Ltd, 4.64%; and WH Group Ltd, 4.62%.

Almost 60% of the fund’s holdings are in the consumer cyclical sector, which means the fund relies heavily on the business cycle and economic conditions in China, and a small boost in China’s economy should enhance the fund’s value considerably.

If you believe in the growing economy of China, I encourage you to look to Global X China Consumer ETF (CHIQ).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF

Doug Fabian is the editor of three publications: Successful ETF Investing, ETF Trader’s Edge, and Fabian’s Weekly ETF Report. Doug was previously known as one of America’s top mutual fund advisors, but in recent years he has made a revolutionary 100% shift to exchange traded funds (ETFs). He regularly appears at seminars around the country.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)