The full-scale invasion by Russia into Ukraine began on February 22, 2022. At that time, the S&P 500 was trading at 4,500. As of last Friday, it traded around 5,123, representing a 13.8% gain over the 26-month period. Not great, but not bad either. The Nasdaq was trading at 13,400 and closed last Friday at 16,175, representing a gain of 20.7%, the Dow has gained 11.1% and the Russell 2000 has broken even.

Despite the war in Ukraine, the long recovery from Covid, 11 rate hikes by the Federal Reserve, ongoing tensions and tariffs with China, a high-profile shuttering of five notable regional banks, a soaring Federal debt that is growing by $1 trillion every 100 days, a spike in inflation, the total collapse of FTX and an ongoing crisis on the U.S. southern border, the Dow, S&P 500 and Nasdaq hit new all-time highs the first week of this month.

Now, investors have to contend with a whole new geopolitical risk that might involve direct U.S. military engagements, and I don’t know anyone outside the military-industrial complex (MIC) that wants another Iraq or Afghanistan situation that extends out over several years and administrations. The MIC has never met a war they didn’t embrace, but with the annual interest on the national debt now surpassing the annual defense budget, ramping up for a regional war with Iran and other Arab nations would put tremendous fiscal pressure on the government.

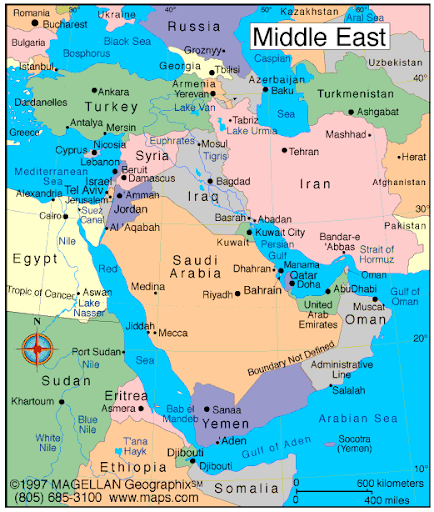

But the direct attack by Israel on the Iranian consulate and the Iranian response of directly firing 300 drones and rockets at Israel over the weekend plainly shows Iran’s proxy war with Israel is now a full-on direct war between the two countries. Being Israel is militarily way superior to Iran, with Jordan, Iraq and the northern tip of Saudi Arabia standing between Israel and Iran, the war will be fought offensively and defensively by air, with Hezbollah representing a land threat that Israel will eventually have to neutralize just as has been done with Hamas.

If the United States can defend and protect its advanced military and intelligence lines to Israel, it is probable that Israel can finish the job of eliminating Hamas, take out Hezbollah in due course and neutralize Iran’s military threat to a point of mutual ceasefire. But not before Iran exhausts its abilities to conduct further ballistic missile attacks, cyber attacks on key infrastructure, beefing up Hezbollah and the use of asymmetrical methods of warfare that include guerrilla tactics, sabotage and suicide bombers, as has been its practice. Israel has shown the resolve and fortitude to withstand these threats, and it goes without question that the United States stands shoulder-to-shoulder with Israel.

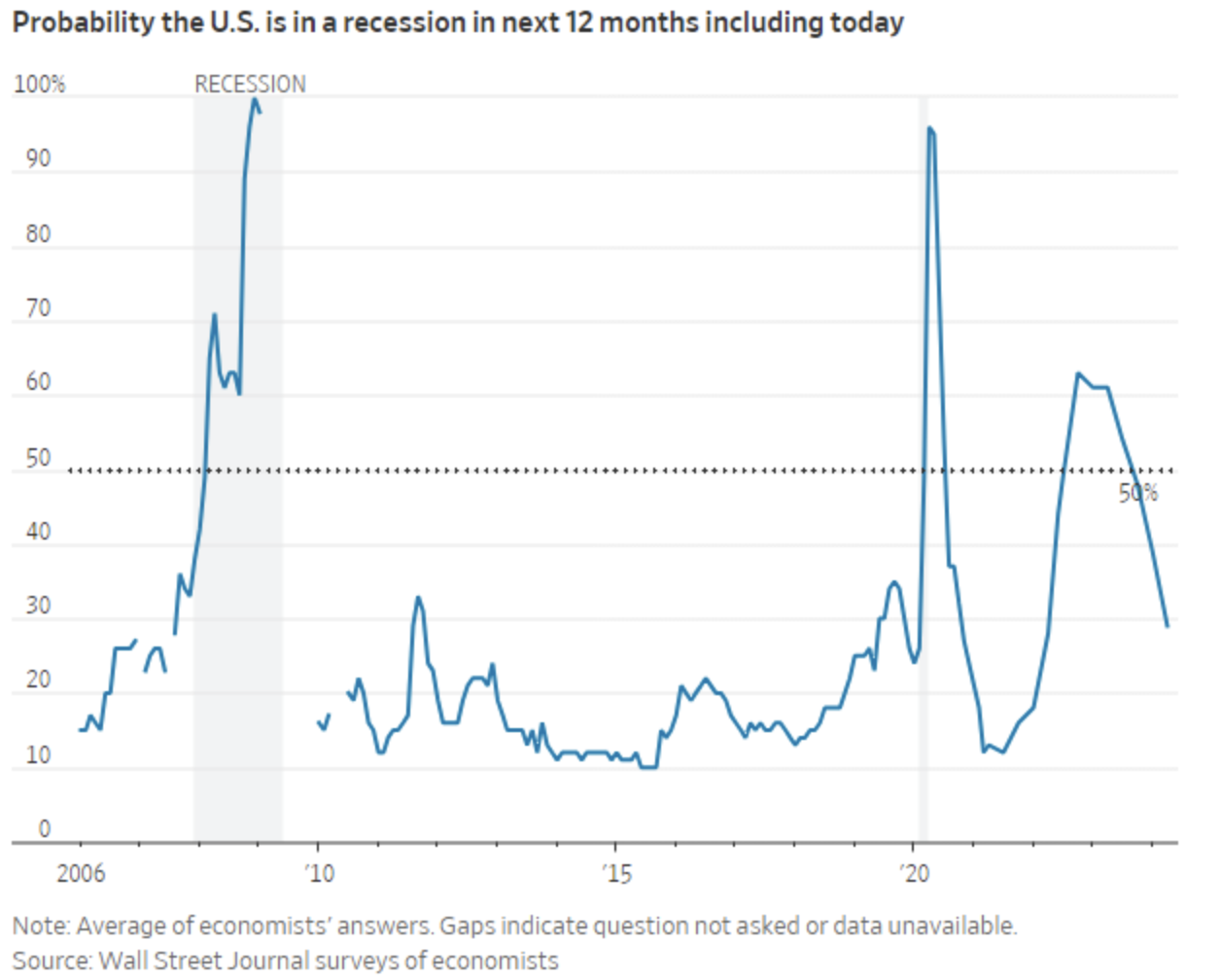

Going forward, and considering the Israel-Iran conflict, the U.S. economy is demonstrating a level of resilience that shows few signs of slowing. Over the weekend, the Wall Street Journal published a survey where “business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability since April 2022, when the chances of a recession were set at 28%. Just 10% of survey respondents think the economy will experience at least one-quarter of negative growth over the next 12 months, down from 33% in January.”

Regardless of the optimistic outlook from the WSJ survey, which was conducted before the weekend attack on Israel, market volatility is back on the rise with the CBOE Volatility Index (VIX) trading at 19.0 and the highest level for 2024 year to date. One can easily argue that with the oil prices spiking, coupled with the unknown level of U.S. military engagement in the Israel-Iran war yet to be determined, investors should consider staying focused on the major secular themes that have led the market to date.

Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Robotics and Automation, Cloud Computing (Data Centers), Edge Computing (processing data closer to devices) and Software-as-a-Service (SaaS) are interconnected in vast numbers of ways and extend across various sectors of the broader economy and the world.

Clearly, the technology-rich Nasdaq has been where the best performance has been generated, and by looking at the internal and external risks to the broader stock market, big-cap tech remains in my view the one sector that will offer up the best risk-adjusted returns for investors for 2024. As the market landscape becomes more uneven, investors can look forward to what should be a strong first-quarter earnings season and the ability to initiate and add to positions in America’s greatest technology companies.

P.S. I will be holding a subscribers-only teleconference on April 24 at 2 p.m. EST entitled “The AI Game is the Same – But the Names Have Changed.” The event is free to attend, but you must register here. Don’t miss out!

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)