This week’s exchange-traded fund (ETF), the iShares TIPs Bond Exchange ETF (TIP), invests in U.S. Treasury Inflation Protected Securities (TIPS).

The TIPS are indexed to inflation to protect investors. TIPS are considered to be extremely low-risk because they are backed by the U.S., government and their value rises with inflation.

The fund typically invests 95% of its assets in U.S. government bonds. It also may invest up to 5% of its assets in repurchase agreements (Repos) collateralized by U.S. government obligations or otherwise hold the 5% in cash and cash equivalents.

Following its December 2003 inception, TIP had a roughly 3.5-year head start to build its asset base before ETFs started to really attract the attention of investors. TIP’s first-mover advantage has allowed it to accumulate $22.69 billion in total assets, as well as enjoy a massive average daily trading volume of $148.46 million. In addition to liquidity, TIP’s portfolio is broad and well-diversified.

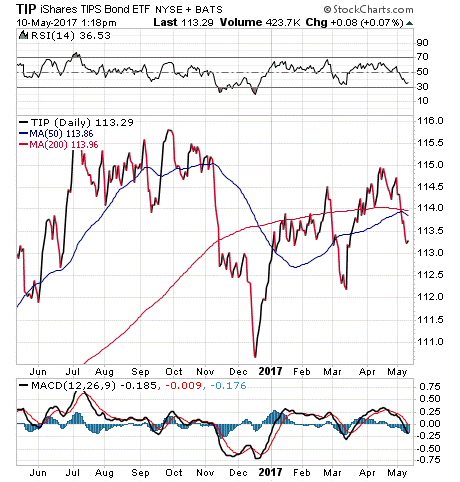

From the chart below, you can see that the fund was hurt by the Trump rally in December but has rebounded since then. The fund’s year-to-date return is 0.90% versus the S&P 500’s 7.11%. TIP’s total return since inception is 4.17%. TIP has a distribution yield of 3.03% and an expense ratio of 0.20%.

TIP’s top five holdings in the portfolio are U.S. Treasury Notes with various maturity dates: 7.94% Notes with a maturity date of 7/15/2024; 6.34% Notes with a maturity date of 4/15/2019; 4.94% Notes with a maturity date of 4/15/2021; 4.51% Notes with a maturity date of 1/15/2024; and 4.47% Notes with a maturity date of 4/15/2025.

If you are seeking exposure to U.S. treasury bonds while steering clear of inflation risks, I encourage you to look into iShares TIPs Bond Exchange ETF (TIP) as a potential investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)