This week’s exchange-traded fund (ETF), the iShares S&P 500 Growth ETF (IVW), is a one that grants its investors exposure to large-cap U.S. companies.

More specifically, IVW tracks an index that selects stocks exclusively from the S&P 500. Launched way back in May 2000, IVW is one of the most established and popular growth-focused ETFs on the market.

The fund selects companies based on three growth factors: sales growth, earnings growth and momentum. Currently, the fund has $19.08 billion in total assets and daily trading volume of around $83.39 million, making it extremely liquid. This liquidity allows investors of all sizes to trade IVW with ease.

Several other growth-focused funds, such as the Vanguard S&P 500 Growth ETF (VOOG), track the same index with a similarly low cost, but very few can match the liquidity and the trading ease of IVW.

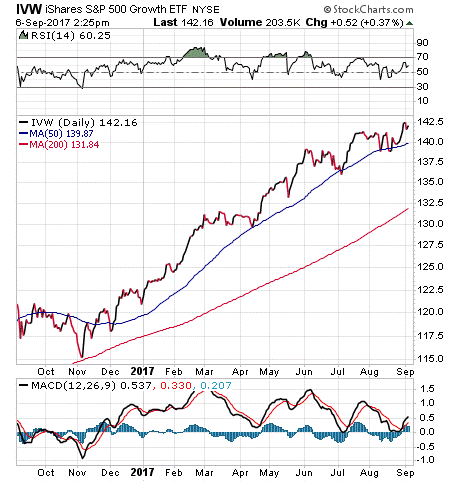

Year to date, IVW has returned 16.07% to beat out the S&P 500’s return of 9.53%. Recently, IVW has been trading around $142. Analysts from Zacks Research see more upside and have set a price target of $152.50 for the fund.

The fund has a dividend yield of 1.30% and a relatively low expense ratio of 0.18%.

The fund’s top five holdings are Apple Inc. (AAPL), 7.14%; Microsoft Corp. (MSFT), 4.80%; Facebook Inc. A (FB), 3.41%; Amazon.com Inc. (AMZN), 3.23%; and Alphabet Inc. A (GOOGL), 2.37%. With 326 holdings, IVW is well diversified.

As with most growth funds, IVW has a heavy focus on technology with 36.34% of the fund’s money going to the IT sector. IVW then has around 16% each in consumer discretionary and health care, both of which are relatively fast-growing sectors.

For those who seek long-term capital appreciation in their investments, the iShares S&P 500 Growth ETF (IVW) may be worth adding to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)