There is a lot of fresh fanfare about the supposed rebalancing of the global oil supply amid new forecasts that predict higher demand in 2018 and compliance with the OPEC-led production cuts.

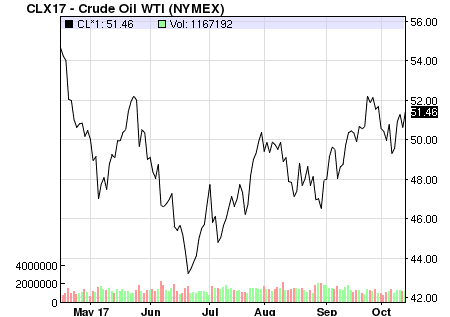

The price of WTI crude has responded well, rallying from a recent low of $45/bbl. to its current level of $50-$51/bbl. after trading briefly above $53. The OPEC oil cartel announced on Oct. 11 that it sees the glut in oil supplies that has hammered crude prices disappearing as global economic growth picks up. However, costs are expected to remain stable.

In its regular monthly report, the Organization of the Petroleum Exporting Countries said that “increasing evidence that the oil market is heading toward rebalancing” led to increases in oil prices last month.

OPEC’s reference basket price for a barrel of oil hit $53.44 in September, its highest value since July 2015. The cartel raised its forecasts for global oil demand due to the improving outlook for economic growth, which increases thirst for crude and other sources of energy. Increasing demand for oil will be matched by added supplies, but OPEC’s forecasts for the balance of supply and demand foresee a greater reliance on the cartel’s output.

The rally in crude has been impressive, staging a four-month rebound from the June low of $43/bbl. Compliance with the production cuts has been the driving factor that, in my view, is a temporary fix before OPEC members, and non-members like Russia, raise production levels to shore up their sagging economies. It’s just a matter of time and is why, if investors are going to allocate capital to the energy sector, doing so within the integrated companies that have upstream, midstream and downstream operations is the best avenue for risk-adjusted returns.

On the face of these obviously pro-oil bullish comments, shares of the major international integrated oil companies have rallied sharply. The stocks of Chevron (CVX), BP plc (BP), Royal Dutch Shell (RDS.A) and Total S.A. (TOT) have exhibited the best performance within the sector, with the biggest player, ExxonMobil (XOM), bringing up the rear. Dividend yields for these stocks range from 3.6% for Chevron to 6.15% for Royal Dutch.

Buying these stocks in early September before crude rallied 20% has produced big gains. Most of the optimism is not necessarily on the back of the hope of higher prices for crude going forward, but instead on rising forecast of demand for refined products, such as gasoline, diesel and jet fuel.

The global reflation trade that is lifting all economies, both developed and emerging, is a shot in the arm for the refining business, which, unlike the exploration and production sub-sector of the energy sector, has limits to its output capacity.

The tone of the conversation surrounding the energy patch has definitely turned considerably more bullish about the demand side of the equation. That ultimately supports higher organic pricing.

However, there is a very notable disconnect in the overwhelming underperformance of the oil and gas infrastructure sub-sectors. In short, the energy pipeline stocks are trading like bag of soggy shoes, bumping along the 52-week lows even though these master limited partnerships (MLPs) sport tax-favored distribution yields averaging 6% or higher.

The lack of participation by the MLPs is concerning for two reasons. Either there is a growing view that the sector has priced in capacity of both the number of miles of pipeline that is in place, as well as future pipelines to be constructed, or, there is an unknown fear that the end demand for oil and gas in the United States is peaking, with the advent of renewable energy taking more of the share of various markets.

Maybe it’s a combination of both, but the way some of the leading stocks in the MLP space are trading is troubling. This is why I advised my subscribers not to be tempted by the steep discount these stocks are trading at right now. The tale of the tape is telling me to avoid the majority of these MLPs for the time being. This is especially true at the year’s end, when tax-loss selling kicks in and investors pair off winners with losers to minimize their taxes to Uncle Sam.

I certainly hope the sector comes back to life as it is truly one of the great income streams for investors to embrace. But when the underlying prices of the stocks are trading at or near 52-week lows in a sector that just enjoyed a torrid rally in the very commodity it is built on, then the caution flag is raised until the sector trades more constructively.

A good yield is only as good as the price stability of the stock that is paying it. More insight as to when investors should up their exposure to the MLP pipeline sector is necessary. Over the next few months, we’ll all have an opportunity to determine whether it is a great buying opportunity or something more fundamentally bearish that isn’t obvious yet.