While the Bitcoin craze has been grabbing headlines of late, there are some other not-so-risky areas of the market that are awakening like sleeping giants set to squash competition in their respective sectors.

One of these areas is Liquefied Natural Gas, otherwise known simply as LNG. I’ve been writing about the virtues of LNG for the better part of three years, and the future of LNG is here and now in a big way.

Even though LNG is a fossil fuel, natural gas burns cleaner than coal, a lot cleaner. This is why it is on a rapid rise in China and India to replace high-sulfur-burning coal plants that are literally choking society daily. Bloomberg reported that China’s air pollution kills 4,000 people every day. Beijing’s push to replace coal with gas for heating as it tries to reduce chronic air pollution in urban areas and a lack of coal in India have driven up the price for the supercooled fuel.

As such, demand from China, India and South Korea is sending LNG prices to a 10-month high, reflecting a scramble for supplies ahead of the northern hemisphere winter. The Platts Japan Korea Marker, the Asian spot LNG index, reached $9.35 per million British thermal units (MMbtu), the highest level since mid-January and almost a third higher than the same time last year. This comes at a time when prices in the United States are running under $4.00/MMbtu.

However, the gas trading markets around the globe are still quite regionally segmented, with enormous price spreads between the United States, Europe and Asia due to highly specific and variable factors such as pipelines, shale gas, geography, geopolitics, supply, demand and shipping costs. Although the size of the gas trading market may be such as to call for a global benchmark price, setting a gas price the way oil has may not even be a medium-term possibility.

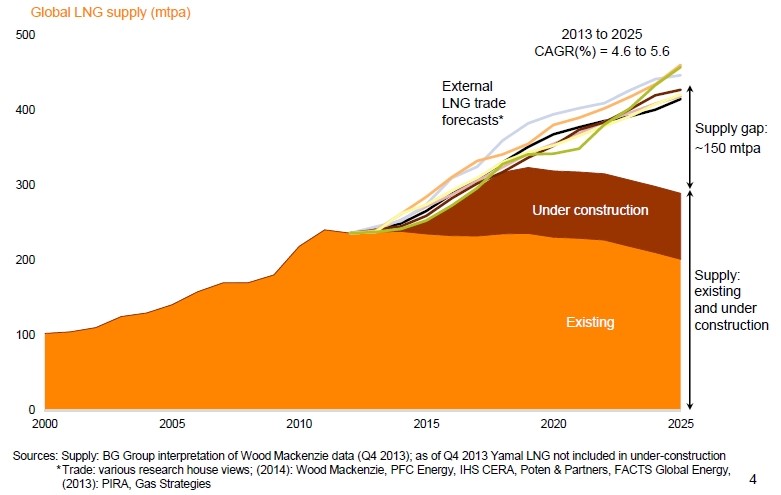

Also, it’s not just winter demand, since China’s summer natural gas demand was up 30% above last year on a monthly basis. Plus, year-to-date gas consumption is tracking 18% above the same period last year to spur sharp increases in LNG imports. The main issue, and therefore the bullish thesis for LNG pricing, is that demand is expected to outstrip supply by a widening margin beginning in 2018, as the chart below illustrates. There is plenty of natural gas in the world, but the lack of capacity in converting it to LNG and transporting it to end markets is creating a supply gap.

Hence, the investment proposition for LNG. Being invested in companies that already have capacity and are aggressively adding to it are where the opportunities lie. Fortunately, there are a few master limited partnerships (MLPs) that are squarely in the center of this promising demand curve. Income investors can own these MLPs for what I believe will be a long and profitable secular bull market that is just now unfolding.

In my view, this bull market should last for 5-7 years before the threat of overcapacity enters the picture. Until that time, companies like Golar LNG Partners L.P. (GMLP) that own and operate LNG ships and regasification terminals stand to offer attractive risk-adjusted returns.

At its current price of $21, shares of GMLP sport a distribution yield of 10.85% with a solid payout ratio of 86.84%. Golar LNG Partners L.P. and other LNG plays have been sorely out of favor for most of 2017, partly caught up in the uncertainty of the crude oil market being kept afloat by a negotiated production cut by OPEC and non-OPEC nations. The crude oil infrastructure around the world is almost fully in place where prices are measured in West Texas Intermediate (WTI) or North Sea Brent. That situation is not the case for natural gas where infrastructure in emerging markets is in the nascent stages of development. Thus, the regional price disparities will take years to balance.

As 2017 ends and winter temperatures are about to take hold of most of Asia and India, the LNG story should begin to take on a much more important place within investment circles after everyone has bought their Bitcoins that, by the way, take up a ridiculous amount of energy to produce. At a minimum, current worldwide Bitcoin mining could power the daily needs of 821,940 average American homes, and it’s very early in this digital wave of cryptocurrency. Why not own the other side of that trade and be long in the dominant feedstock to the growing number of utilities that are supplying the power?

In case you missed it, I encourage you to read my column from last week about how the year-end forecast is affecting stock and bond markets.