After a steady decline in the first half of 2017, crude oil prices rose more than 40% since the beginning of July 2017.

Strong demand and reduced oil inventories drove the prices higher. Companies planning expansion investments and a potential economic expansion spurred by the tax cut bill passed in December 2017 should support rising demand for oil in 2018.

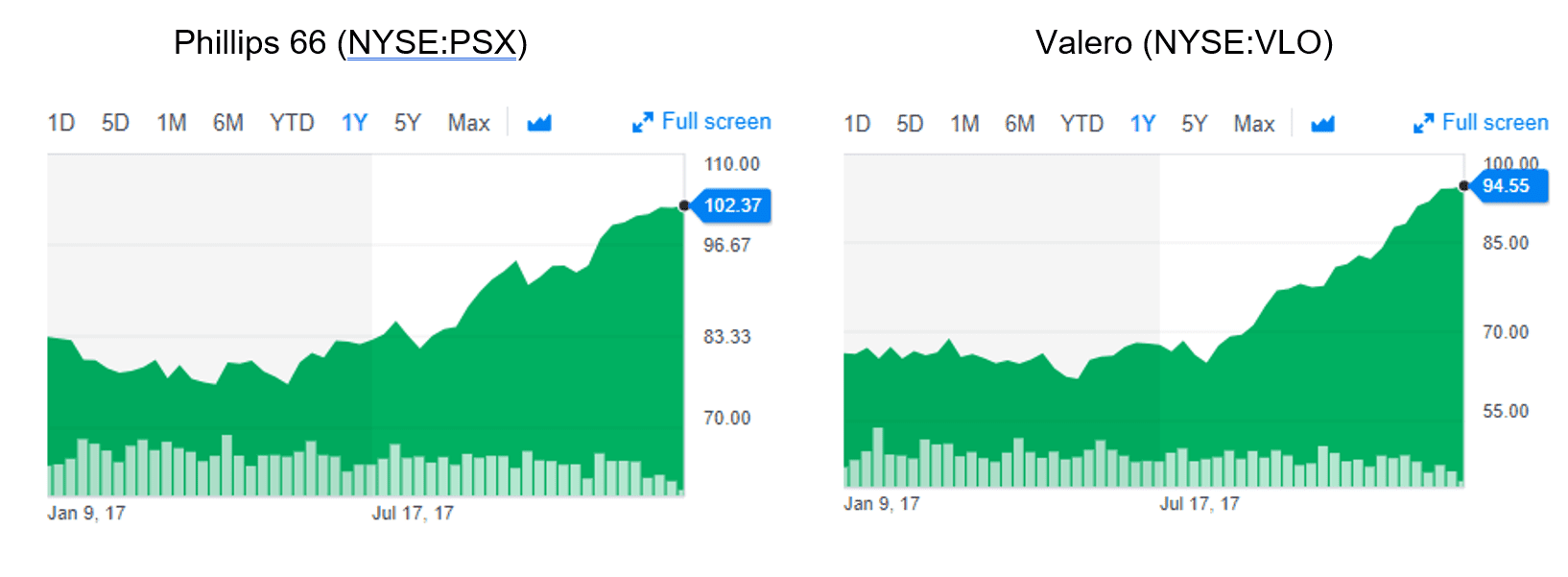

In the wake of these rising oil prices, Zacks Equity Research evaluated two major oil companies – Phillips 66 (NYSE:PSX) and Valero (NYSE:VLO) – to suggest which one seems like a better investment choice going into 2018.

Share prices of both companies held steady through the price drop during the first half of 2017 and took advantage of the rising oil prices in the second half to appreciate by double-digit percentages. Valero has the advantage in this category with 39% share price growth versus the 24% rise for Philips 66 in 2017.

Both companies provided comparable results in terms of dividend distributions. PSX paid a total annual dividend of $2.80 for 2017 which is equivalent to a 2.74% yield, using the January 10, 2018, share price. VLO distributed a total annual dividend of $2.60 in 2017. However, because of a lower January 2018 share price, VLO’s yield is 2.97%. While both companies provided higher returns than the 2.6% average yield for the entire sector, Valero scored another point in this category, albeit by a smaller margin than the share-price growth.

VLO provided a 45.7% combined total return to its shareholders over the past 12 months and PSX’s total return over the same period was 25.1%. Valero scored better in most other comparison categories – liquidity, return on capital and price-to-earnings (P/E) ratio – and is Zacks Equity Research’s recommendation by a small margin.

Some investors might prefer to invest in sectors with higher potential returns, such as technology or financials. However, Valero and other companies in the oil sector could be useful alternatives for investors looking for portfolio diversification.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)