The iShares S&P GSCI Commodity-Indexed Trust (GSG) provides investors with exposure to a broad range of commodities. The fund does this by following the S&P GSCI index, which is composed of a diversified group of commodity futures.

One unique feature about GSG is that it is not a standard exchange-traded fund (ETF), but rather a commodity pool. A commodity pool uses investor contributions as leverage in the commodities trading markets. Also, commodity pools are regulated by the Commodity Futures Trading Commission and not the Securities and Exchange Commission (SEC).

GSG does not hold contracts in the underlying commodities (energy, industrial and precious metals, agricultural and livestock) like many other funds, but instead holds only long-dated futures contracts on the GSCI itself, as well as substantial cash and treasury bills as warranted. Investors can use GSG as an easy way to diversify their portfolios, since the fund’s huge total assets of $1.45 billion and daily trading volume of 1.2 million give it great liquidity.

In terms of offering exposure to various commodities, GSG more or less covers the normal broad spectrum. However, the fund does place a heavier emphasis on energy commodities. WTI crude, crude oil, natural gas and other energy commodities make up 61% of the index’s exposure. Agriculture commodities account for 16%, while industrials metals compose 11%, livestock take 7% and precious metals comprise 4%.

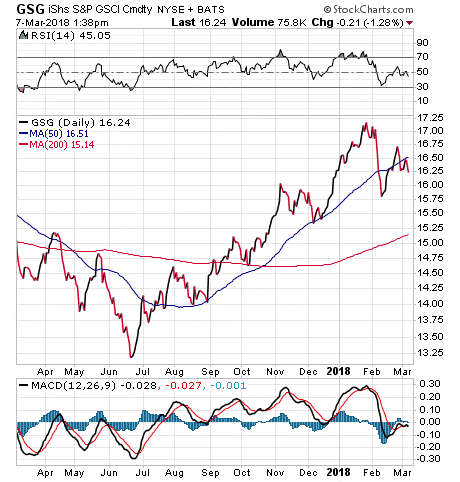

GSG is something of a turnaround play. The fund, launched in July 2006, originally traded above $30 a share before falling by more than half in 2014 and 2015. The fund’s one-year return is 4.48%, and it currently is almost 25% above its low of $13.17 on June 22, 2017. GSG carries a rather high expense ratio of 0.75% and does not pay a dividend.

For investors who are seeking a convenient way to make a play on the overall commodities market, I encourage you to consider the iShares S&P GSCI Commodity-Indexed Trust (GSG).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)