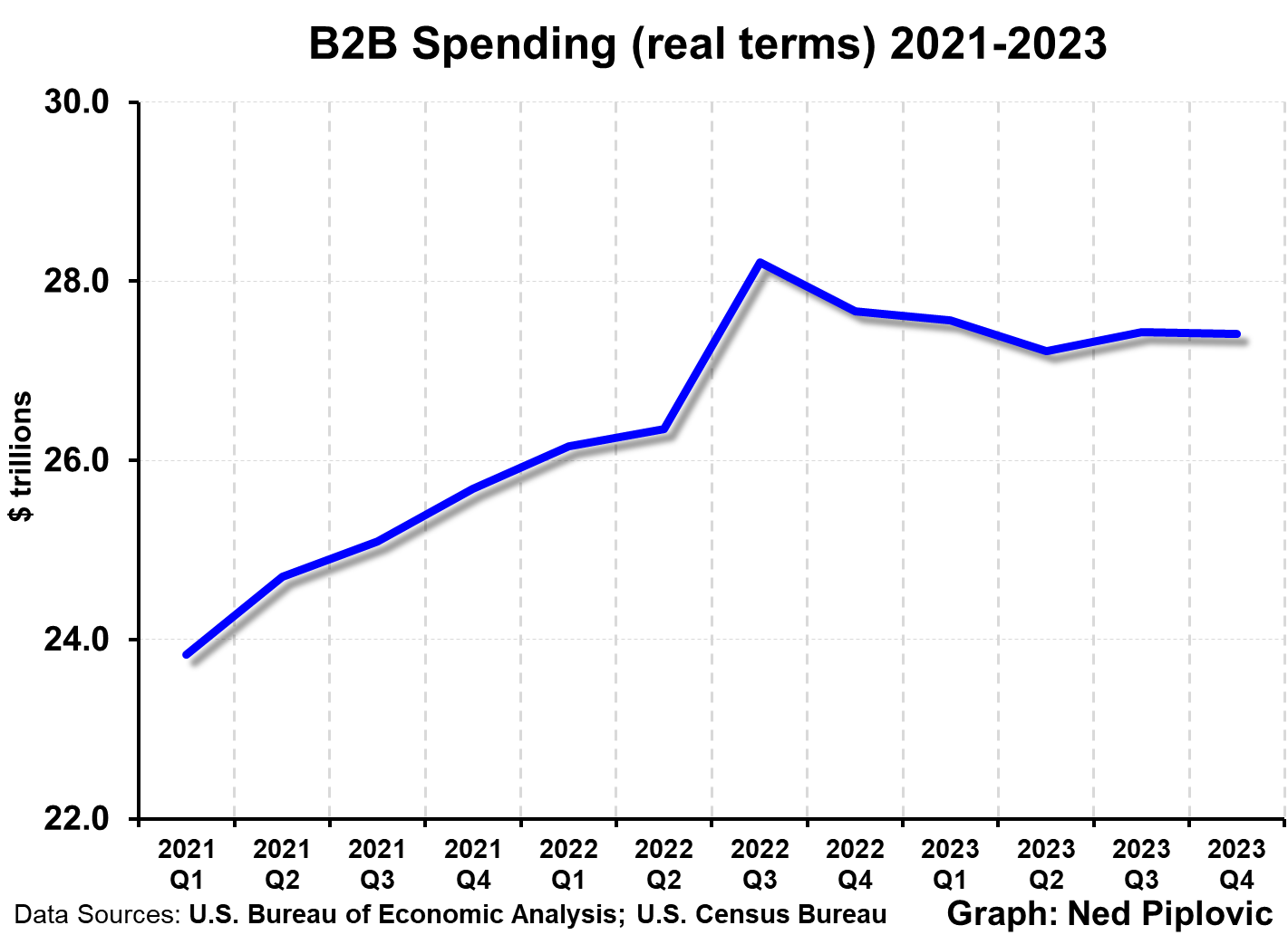

Special Alert: The Wall Street Journal published my op ed on the latest gross output (GO) data showing business-to-business (B2B) spending in a two-year decline, suggesting a slowdown or recession in 2024.

Watch for it online tonight at https://www.wsj.com/ or in the printed version of op ed page of the Journal tomorrow.

“It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.” —Dennis Gartman, editor, The Gartman Letter

“Every quote is a lesson in finance. It’s my favorite book.” — Kim Githler, president and founder, The MoneyShow

Over the years, since publishing “The Maxims of Wall Street,” I’ve seen countless examples of important lessons of investing.

Here are three:

#1: ‘Bull markets climb a wall of worry’

I can’t tell how many times investors panic when bad news hits the front page of the financial news and media outlets.

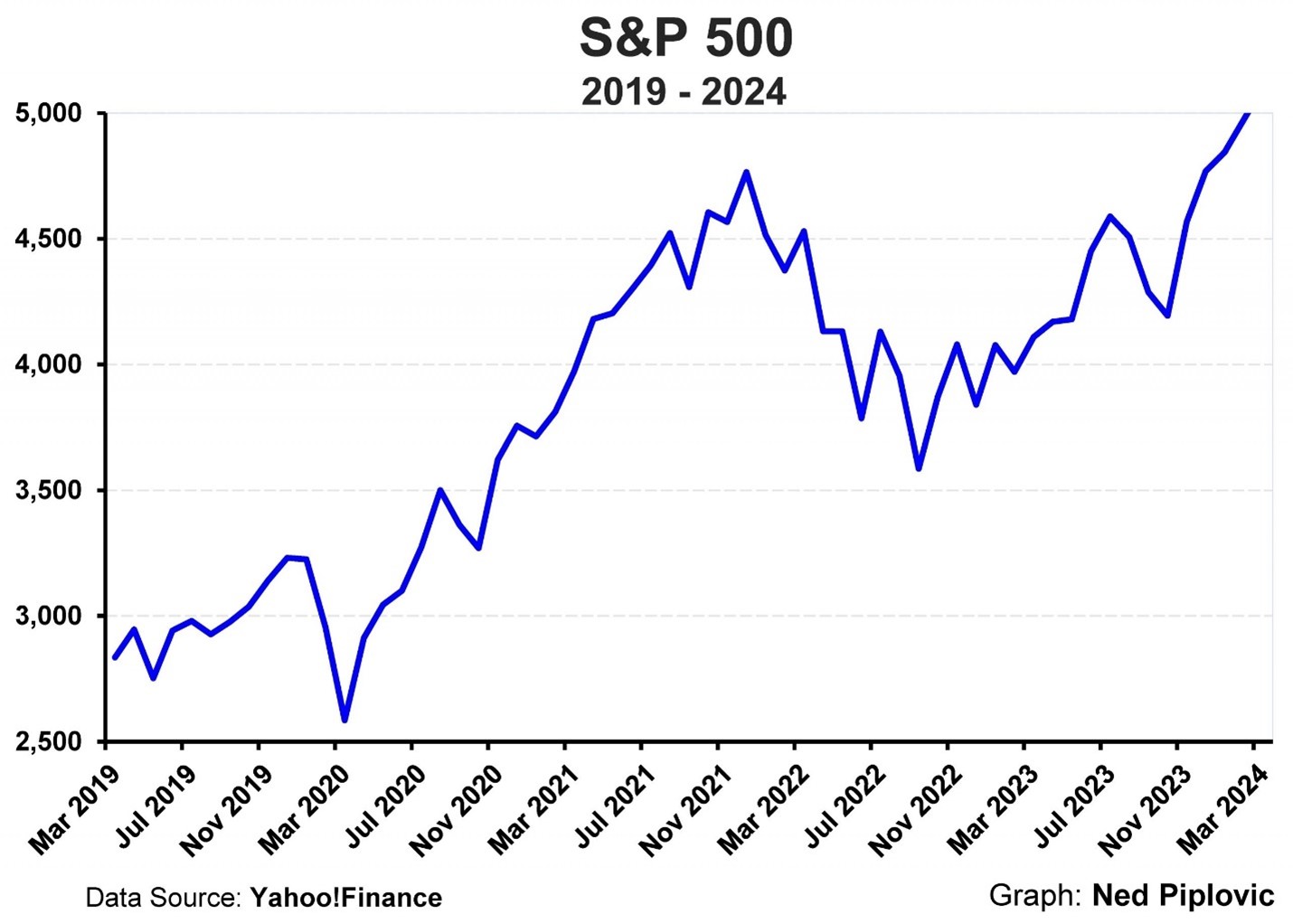

We were told in 2022 that the Federal Reserve’s policy of raising interest rates to fight inflation would cause a bear market. It did, but for only a year, and those who held on have been immensely rewarded.

The bull market that began in early 2023 and continued into 2024 has been one of the most profitable in modern history. Yet, how many investors got out after reading the first signs of trouble of rising inflation and interest rates?

It reminds me of 1962, when fears of a recession caused the stock market to tumble 30%. Headlines portended doom and gloom: “Black Monday Panic on Wall Street… Investors Lose Billions as Market Breaks… Nation Fears New 1929 Debacle.”

Many investors sold in the face of these headlines. Steve Forbes said it best: “Everyone is a disciplined, long-term investor… until the market goes down.” (Maxims, p. 135)

At the time, J. Paul Getty, one of America’s billionaires, was asked his opinion. He said, “There was nothing basically wrong with the American economy nor the vast majority of companies whose stocks were listed on the New York Stock Exchange.” He was a buyer, not a seller, of stocks.

I quote his wise advice in “the Maxims” on p. 136: “The seasoned investor buys his stocks when they are priced low, holds them for the long-bull rise and takes in-between dips and slumps in his stride.”

On the same page, I add this quote from Getty: “The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator.”

Finally, Getty warns, “Businessmen can profit handsomely if they will disregard the pessimistic auguries of self-appointed prophets of doom.” (p. 110)

#2. ‘Nobody is more bearish than a sold-out bull.’

My second example is all about biases. When you sell out of a position, you’d like to be vindicated and see the stock go down. It’s easy to become super bearish and tell your friends why.

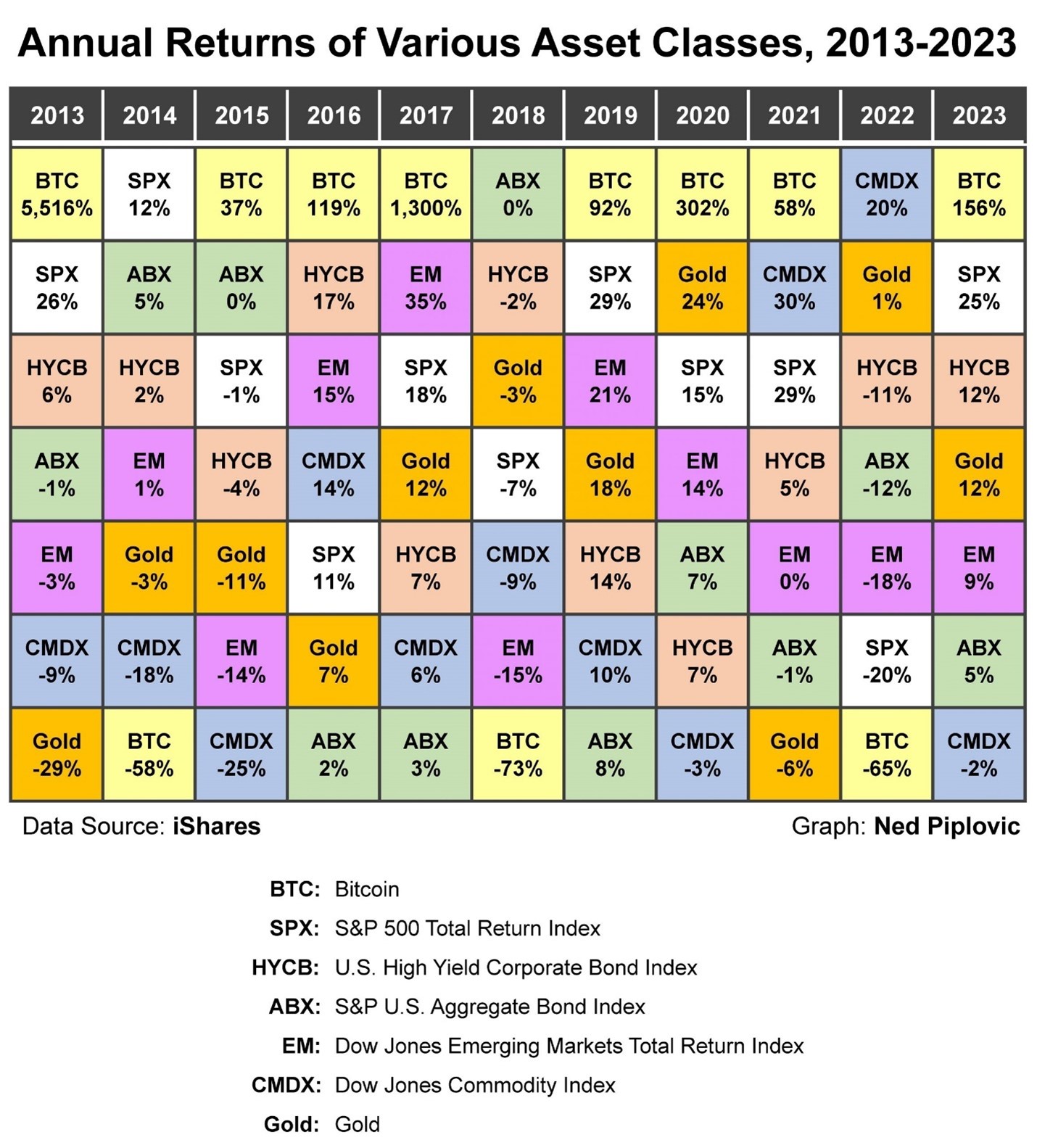

One of my friends is an investment advisor who is super-bearish on bitcoin and cryptocurrencies, arguing that digital currencies are a bubble and will eventually collapse.

Despite the fact that bitcoin has been the best performing investment asset since 2012 (see chart below), he has stubbornly refused to invest in bitcoin, even as a short-term speculation.

Bitcoin is also the best performing asset in 2024. But my friend refuses to take the plunge and continues to predict a total collapse.

He may be right in the long term, but in the short term, why not make some money? He is blind to the opportunity.

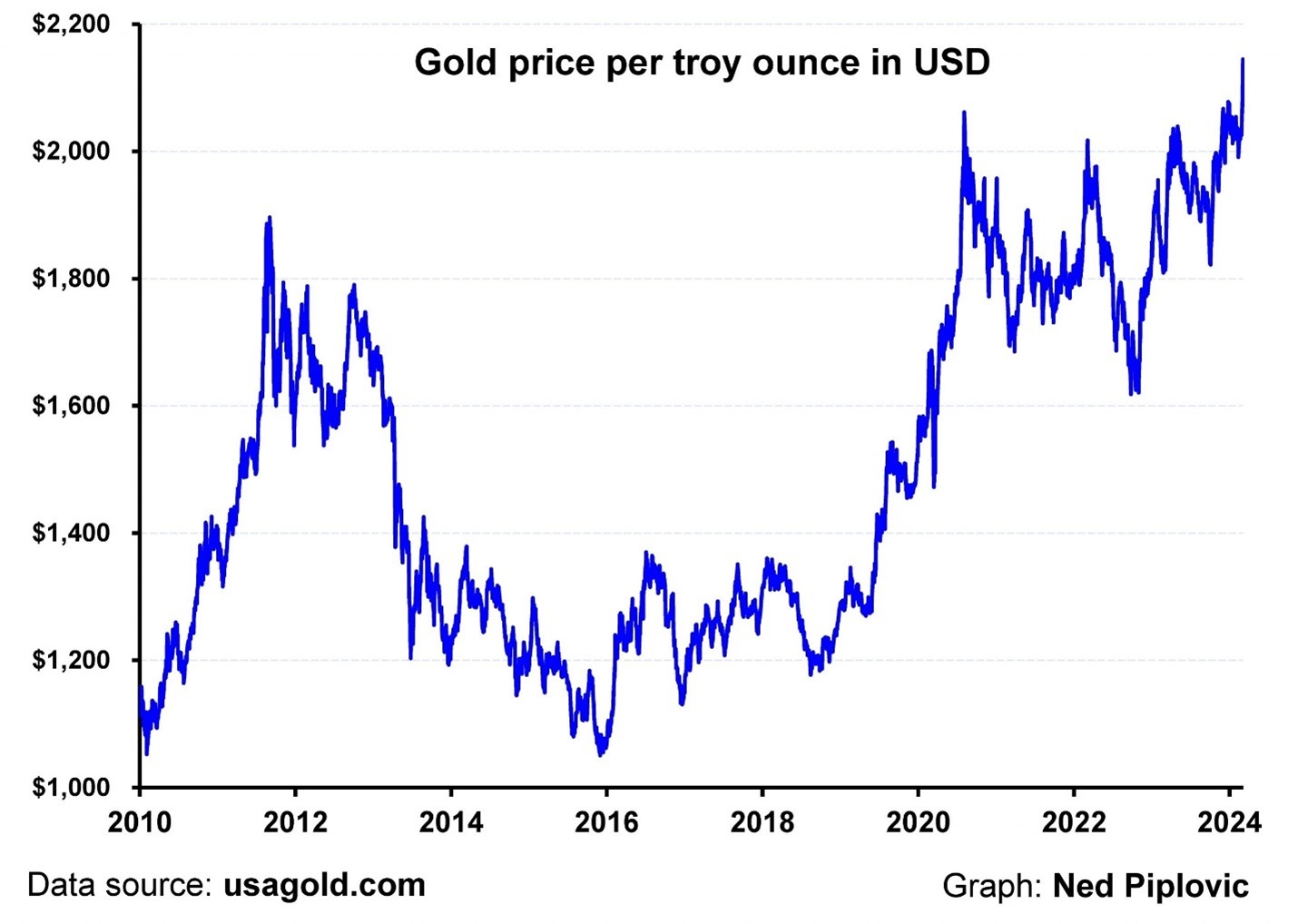

#3. ‘When the pundits say gold is dead, it’s time to look for a resurrection.’

My third quote is from Richard Band, who, for years, wrote the newsletter “Profitable Investing.” See p. 151 of “Maxims.”

Gold has tried the patience of many gold bugs. It can go for months doing nothing, and then suddenly take off. When it goes, be prepared to profit.

A year ago, gold was selling for below $2,000 an ounce. It passed $2,000 six times, only to fall back.

In 2024, we’ve seen stocks hit new highs…. then bitcoin… and now gold.

Gold is moving higher despite the strong dollar. It’s playing catch-up after all these years of stagnation.

We’re recommending all three investments — tech stocks, bitcoin and gold — in Forecasts & Strategies.

Sound Advice from the ‘Investment Bible’

“The Maxims of Wall Street” is truly the “Investment Bible” that will lead you to financial independence and help you avoid making some big mistakes.

Maxims has been an underground bestseller. It’s now in its 10th edition and has sold nearly 50,000 copies.

Jim Woods, my colleague at Eagle Publishing, is a big fan.

Jim states, “I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better ‘how to’ anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen. The ‘Maxims of Wall Street’ is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection. Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.”

If you don’t have an autographed copy of my collection of quotes, stories and wisdom of the world’s top traders and investors, please order a copy now.

It has been endorsed by Warren Buffett, Kevin O’Leary, Jack Bogle, Kim Githler, Alex Green, Bert Dohmen, Richard Band and Gene Epstein of Barron’s.

Cheaper by the Dozen

I offer the new 10th edition cheaply to my Skousen CAFÉ readers: Only $21 for the first copy, and all additional copies are $11 each (they make a great gift to clients, friends, relatives and your favorite broker or money manager). I sign and number each one, then mail it at no extra charge if you live in the United States.

If you order an entire box (32 copies), the price is only $327. As Hetty Green, the first female millionaire, once said, “When I see a good thing going cheap, I buy a lot of it!”

To order, go to www.skousenbooks.com.

Upcoming Appearance

Menlo Forum, Menlo Park, California, Saturday, April 20: I will be speaking on “Why Inflation Is Permanent and Growing: What Are the Best Inflation Hedges?”, where I will talk about the outlook for stocks, technology, gold and bitcoin. My wife, Jo Ann, will be joining me to talk about our latest book, “There Were Giants in the Land: Episodes in the Life of W. Cleon Skousen,” and why it was banned in China. We will also give an update on FreedomFest and the Anthem Film Festival. It will be held at the Masonic Hall, 651 Roble Ave., Menlo Park, California, from 9 a.m.-12 p.m. Our host is Robert Mish, president of Mish International, one of my recommended rare coin dealers and a big supporter of FreedomFest. There is a $10 charge for this event (pay at the door), and you need to register by emailing menloforum@hotmail.com.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed it!

The Golden Emcee at FreedomFest

“All that glitters isn’t gold, but the really good stuff is.” — Chip Wood

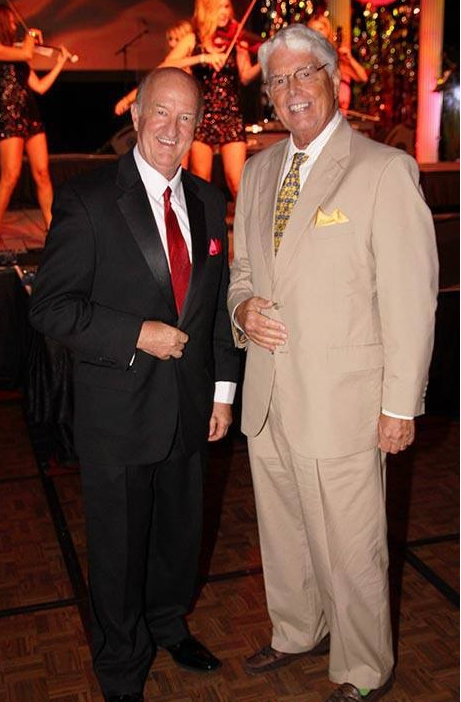

Mark Skousen and Chip Wood celebrating FreedomFest in 2011.

My long-time friend Wallis W. “Chip” Wood (1941-2024) was FreedomFest’s emcee extraordinaire for the first eight years of the show (from 2007 to 2016). He was a wonderful friend, known for his optimism, kindness and golden voice. I often introduced him as “the #2 best voice in the world… God is #1!” A comedian once said, “Chip Wood is a man whose name is a sentence!” He passed away peacefully at home on Saturday, March 16, 2024, after suffering from leukemia.

We are planning to dedicate the main stage convention hall to him at this year’s FreedomFest. That’s where he spent most of his time. He set the gold standard of broadcasting excellence. He never just read the printed introduction but said something unique about each speaker. You can watch him in action in this video.

Known by everyone as Chip, he published best-selling books in the 70s, hosted a popular radio show on CBS radio (WRNG) in Atlanta, Georgia in the 80s and founded Soundview Communications in 1990, a notable marketing and publishing company. He was a strong advocate for liberty and the gold standard. He worked closely with the late Larry Abraham on a number of projects related to the hard-money movement. Chip won numerous broadcast and journalism awards, including “excellence in broadcast journalism” by the Georgia Associated Press in 1987.

Chip brought his endless optimism and good cheer to everyone he met. He was known for his joyful spirit, big smile and boundless curiosity. Chip loved international travel and enjoyed many cruise ship adventures over the years, as well as hiking, boating, diving, land tours and safaris. Most importantly, he had love for his wonderful family and the nation he grew up in.

His wife, Nancy, plans to be at FreedomFest to celebrate her late, great husband. Join us, will you? Click here for more information.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)