As part of the series of currency exchange-traded funds (ETFs) offered by Invesco PowerShares, the CurrencyShares British Pound Sterling Trust (FXB) is designed to track the price of the British pound sterling, the official currency of the United ingdom.

Incorporated in the United States, FXB holds British pounds in a deposit account. Investors also should do their due diligence regarding the fund’s tax efficiency, since any distributions or capital gains are taxed at ordinary income rates, without regard to the holding period.

With $4.76 million in daily trading volume and a tight average 60-day trading spread of just 0.02%, analysts rate FXB highly in terms of trading liquidity. Thus, both large and small investors should be able to trade the fund easily.

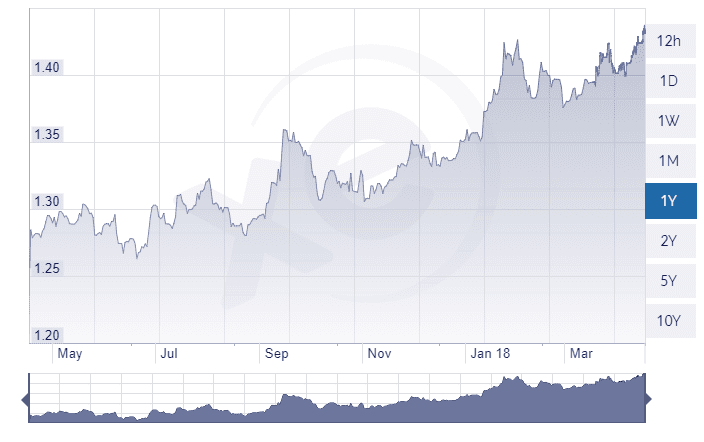

FXB, with $197.10 million in total assets under management and an expense ratio of 0.40%, uses JPMorgan as its depository bank. Below is a chart of the exchange rate from British pound (GBP) to U.S. dollar (USD) over one year. The overall trend has been a strengthening in the pound versus the dollar.

However, keep in mind that this increase in the value of the British pound comes at a time of a weakening dollar and international volatility. Thus, interested investors are encouraged to do their own due diligence before investing in this fund.

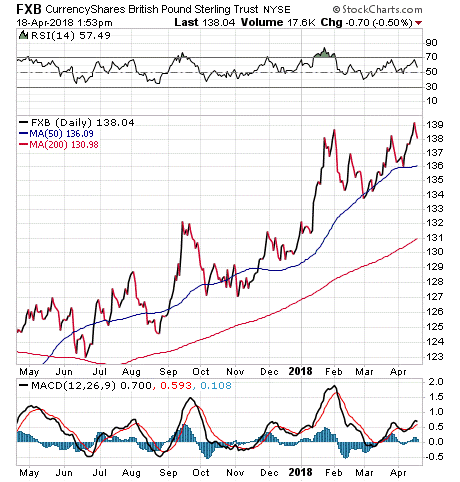

Below is a chart of FXB’s one-year performance, which largely matches the performance of the GBP versus USD seen in the chart above. The fund is currently trading near its 52-week high and has returned 3.87% year to date.

For investors who believe in the strength of the pound sterling, I encourage you to look into the CurrencyShares British Pound Sterling Trust (FXB).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)