Tesla privatization plans and their rationale, revealed by CEO Elon Musk on Aug. 13, confirmed that Saudi Arabia’s sovereign investment fund is among the potential investors that may provide the estimated tens of billions of dollars likely needed for the public company to change form.

Also, Musk acknowledged in his Aug. 7 tweet that the “secured” funding did not mean that financing had been finalized for taking his electric car company, Tesla Inc. (NASDAQ: TSLA), private, but rather that Saudi Arabia’s sovereign investment fund sought to participate and help finance such a move. The CEO blogged on Aug. 13 that he had informed the auto company’s board of directors of a positive July 31 meeting between himself and the head of the Saudi Arabian sovereign fund, in which they wanted to explore the possibility of privatization that could be in Tesla’s “long-term interest.”

The board of directors agreed at its Aug. 2 meeting that Musk could reach out to the company’s largest shareholders to learn whether they had the “ability and desire” to remain investors if the company went private. When tweeting about the Tesla privatization possibility from his personal twitter account, Musk indicated he was speaking for himself as a “potential bidder” and wanted to share the development with all investors in a public forum.

Tesla Privatization Talks Started Nearly Two Years Ago

“Going back almost two years, the Saudi Arabian sovereign wealth fund has approached me multiple times about taking Tesla private,” Musk wrote in his Aug. 13 blog. “They first met with me at the beginning of 2017 to express this interest because of the important need to diversify away from oil. They then held several additional meetings with me over the next year to reiterate this interest and to try to move forward with a going private transaction. Obviously, the Saudi sovereign fund has more than enough capital needed to execute on such a transaction.”

The Saudi fund recently had bought “almost 5 percent” of Tesla’s stock through the public markets, Musk confirmed.

The Saudi fund’s managing director has “expressed support” to pursue a Tesla privatization, subject to financial and other due diligence, as well as its internal review process for obtaining approvals, Musk indicated. The fund’s managing director also asked for additional details on how the company would be taken private, including any required percentages and any regulatory requirements.

“If and when a final proposal is presented, an appropriate evaluation process will be undertaken by a special committee of Tesla’s board, which I understand is already in the process of being set up, together with the legal counsel it has selected,” Musk wrote. “If the board process results in an approved plan, any required regulatory approvals will need to be obtained and the plan will be presented to Tesla shareholders for a vote.”

Tesla Privatization Would Cost Less than a Leveraged Buyout

The funding required for a Tesla privatization has not been determined, but Musk said it would take much less than the $70 billion initially speculated if the deal was structured as a conventional leveraged buyout (LBO). The $420 a share buyout price Musk proposed for a Tesla privatization only would be used for shareholders who do not remain investors if the company no longer is public, added Musk, who estimated roughly two-thirds of the company’s shares owned by current investors would roll over into a privately held entity.

A Tesla privatization would mean no more quarterly earnings releases to the public, an end to existing shares that short sellers have been trying to drive down in price to profit from the company’s struggles and fewer questions directed at Musk by critics and others about the currently unprofitable company.

Hilary Kramer, a prominent Wall Street investment professional who sometimes recommends auto companies, said she appreciates first-hand the extreme challenges of founding and owning a business. Musk has worked nearly 24 hours a day for years to grow Tesla, she added.

“Musk was under so much pressure from his critics that he had a temper tantrum from all of the condemnation and attacks, broke from his composure and had a momentary knee-jerk reaction in the form of a tweet and now he and the board are trying to recover,” Kramer opined. “This has created management distraction.”

In addition, Tesla “desperately needs cash,” Kramer said.

“Those stocks go lower, not higher,” Kramer continued. “This deal cannot happen — the cash flow capability is not there. Banks and junk bond investors do not care about a company’s long-term plans. These debt holders want their interest payments.”

However, a Tesla privatization could proceed if the Saudis and possibly others agree to become part-owners with Musk to prevent the company from taking on onerous debt, added Kramer, who recently recommended the sale of Ford Motor Co. (NYSE:F) in her Turbo Trader and Inner Circle advisory services.

Dr. Mark Skousen’s Forecasts & Strategies investment advisory service occasionally recommends auto stocks and produced a 64.1 percent return in then-struggling Ford between December 2009 and January 2011. He is not recommending Tesla, regards the stock as overvalued and expressed concern about its continuing losses.

Tesla Privatization Path Has Many Hurdles

“Any go-private transaction still had numerous hurdles in front of it,” commented Brian A. Johnson, an auto industry analyst with Barclays, in an Aug. 14 research note. He reiterated his $210 a share price target on Tesla and “underweight” rating on the stock.

“What that means is that taking money off the table at current prices could be better than risking a deal falling through,” along with facing related litigation, Johnson wrote.

Investors who prefer to wait to receive Musk’s suggested price of $420 a share in cash would be wise to take it as a “better deal” than “illiquid equity” in a private Tesla, Johnson opined.

Certain institutional investors may be reluctant to take an equity stake in privately held Tesla due to the lack of transparency and limited liquidity, Johnson added.

Index funds that currently own shares in Tesla may be unable to retain their holdings once the company no longer is traded on a stock exchange. Other investors simply may choose to sell their shares at a profit while they still have an opportunity.

Tesla Privatization Price Would Offer Big Premium to Those Who Sell

Tesla’s share price soared 10.99 percent on Aug. 7, when Musk tweeted that he is considering privatizing the company at $420 a share, offering a premium of 19.89 percent above the company’s closing price on Aug. 6. That jump followed the company’s 16 percent climb to $349.54 on Aug. 2, after the announcement of better-than-expected second-quarter financial results late the day before.

Based on the proposed $420 per share price, Tesla would be valued at roughly $70 billion if it pursued a conventional LBO. If Musk’s estimate is correct that only one-third of the shareholders would opt to take the $420 a share offer and become the biggest LBO in history, the deal’s size would barely exceed $23.31 billion and fall short of the largest LBO of $33 billion for hospital operator HCA Inc. The latter deal was a combined equity and debt privatization on November 16, 2006.

Tesla showed a reduced cash burn rate, much-needed production increases for its Model 3 cars and better-than-expected sales in its second-quarter results.

Despite the operational improvements, the company Musk founded in July 2003 lost $718 million, or $4.22 a share, in its latest second quarter, more than double its loss of $336 million, or $2.04, in the second quarter a year ago. Analysts differ about whether the stock next will rise or fall.

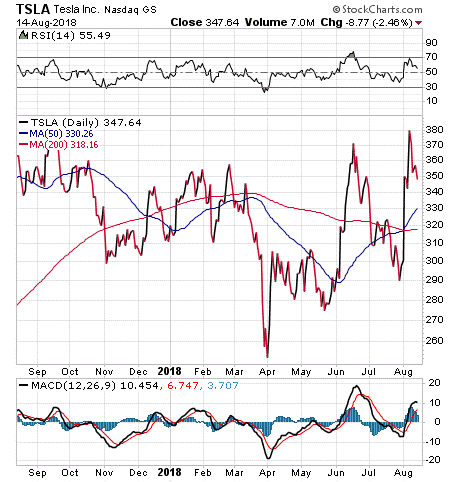

Chart courtesy of stockcharts.com

Musk wrote to Tesla employees in an Aug. 7 email that its current structure as a public company subjects them to the quarterly earnings cycle that puts huge pressure on management to make decisions that may be reasonable for a given quarter but not necessarily best for the long-term.

“Finally, as the most shorted stock in the history of the stock market, being public means that there are large numbers of people who have the incentive to attack the company.” Musk said.

Goldman Sachs last week boosted its six-month price target for the company to $210, up from $195. Analyst David Tamberrino gave Tesla a “sell” rating and valued its automotive segment at $15 a share higher to $185 from $170, its Tesla Energy Segment at $20 and its SolarCity segment at $45.

Analysts who wrote bullishly about Tesla, even before Musk’s privatization tweet, included Nomura/Instinet analyst Romit Shah and Guggenheim analyst Robert Cihra, whose per-share price targets on the company reached $450 and $430, respectively.

Tesla Privatization Would Sidestep Short Sellers

Despite Musk’s business successes, his grand ambitions and need for billions of dollars in cash to fulfill his current pursuits with Tesla and SpaceX have turned him into a target for short sellers. Musk said he is considering whether to try structuring Tesla similarly to privately held SpaceX in which shareholders may buy and sell shares at pre-planned intervals. When I spoke to SpaceX President Gwynne Shotwell on March 14, she indicated no public offering is expected to be considered for her company until it was flying regular missions to Mars.

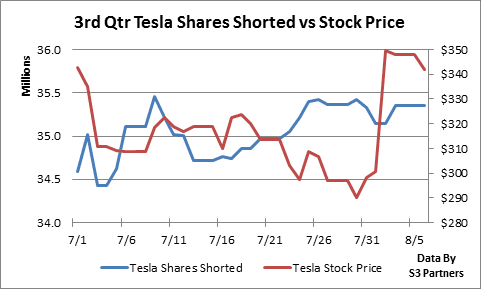

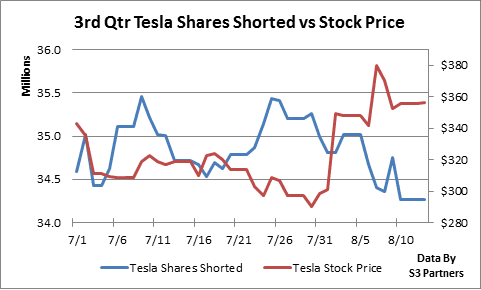

Short selling is an indicator of a potential stock-price plunge and Tesla ranks as the most heavily shorted company in the public market with short interest totaling $12.1 billion, according to S3 Partners, LLC, a New York-based financial technology company. That total is based on 34.27 million shares shorted as of the stock’s Aug. 13 closing price of $356.41. Short-sellers incurred a $1.71 billion mark-to-market paper loss on Aug. 2, the day after the company reported better-than-expected financial results. Out of 169.97 million shares outstanding, more than 20 percent currently are sold short.

Short sellers are down $2.57 billion, or 23.57%, in year-to-date mark-to-market losses and $864 million, or 6.9%, since Musk’s Tesla privatization tweet on Aug. 7, said Ihor Dusaniwsky, managing director and head of predictive analysis at S3 Partners. However, short sellers recouped $461 million of the $1.3 billion of losses they took on Aug. 7 through Aug. 13, he added.

The number of Tesla shares shorted increased 3.8 million for the year, or 12.6%, but are down 407,000, or 1.2%, since the Aug. 7 tweet, Dusaniwsky said.

“We’ve seen the large longer-term shorts keeping their positions stable or adding some additional short exposure, while smaller short-term more momentum-based shorts have been covering some of their positions, Dusaniwsky said. “There has not been a mass short squeeze in the stock. Some of the smaller shorts might have closed their positions after taking a punch to the gut.”

However, most short sellers are holding on and waiting to see how “this all plays out,” Dusaniwsky said.

Musk has used Twitter comments to take verbal jabs at short sellers who have absorbed big paper losses for betting Tesla will tank. Certain short sellers and other investors wasted little time in filing lawsuits due to Musk’s tweets this month.

The Tesla privatization could get sidetracked or delayed significantly. If Musk’s guidance that Tesla could turn cash flow positive in the second half of the year proves prescient, he and his board of directors may have the track record to stay public and offer increased appeal from those seeking it to go private.

______________________________________

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.