The summer stock market rally has been led by the heavily weighted information technology (IT) sector, which accounts for 26% of the S&P 500.

Investors who have their portfolios heavily into big-cap tech stocks were enjoying a good year of solid performance, right up until this week’s rout that shaved about 200 points off the Nasdaq like a hot knife through butter. While the hearings on Capital Hill targeting Facebook (Nasdaq: FB), Google (Nasdaq: GOOGL) and Twitter (NYSE: TWTR) over social media and search bias was a net negative, it was hardly the cause of why the broad sell-off caught most investors by surprise. The Nasdaq was overbought, plain and simple.

September, like August, is historically a trickier month to make money in the market. After the torrid August rally, don’t be surprised if stocks oscillate for the next week or so to consolidate the market’s recent gains. However, as foreign markets lag, the U.S. market continues to be the oasis for capital flows targeting equity ownership. I think this condition will continue to benefit domestic stocks for now, even though traders would love to pounce on beaten down Chinese ADRs and other emerging market exchange-traded funds (ETFs).

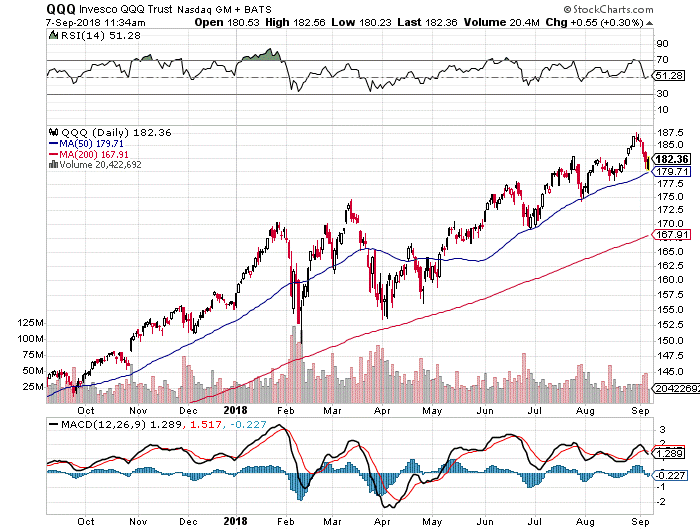

It is clear to me that fund mangers and investors are squarely focused on owning high-tech stocks on any constructive dips. The most widely traded instrument that embraces the tech sector is the Invesco QQQ Trust ETF (Nasdaq: QQQ), which owns the following:

The information technology (IT) sector makes up about 26% of the S&P 500 and, therefore, does most of the heavy lifting for the broad market. With stocks like Apple (Nasdaq: AAPL), Amazon (Nasdaq: AMZN) and Microsoft (Nasdaq: MSFT) leading the way, it shouldn’t be surprising that the broader market trends the way these tech stocks, and a few others, are going. This past week saw the tech-rich QQQ pull back to a key rising uptrend line, its 50-day moving average at about $180, where good support is evident. The five-day correction relieved the market of its overbought condition and now offers an excellent entry point for investors to go long.

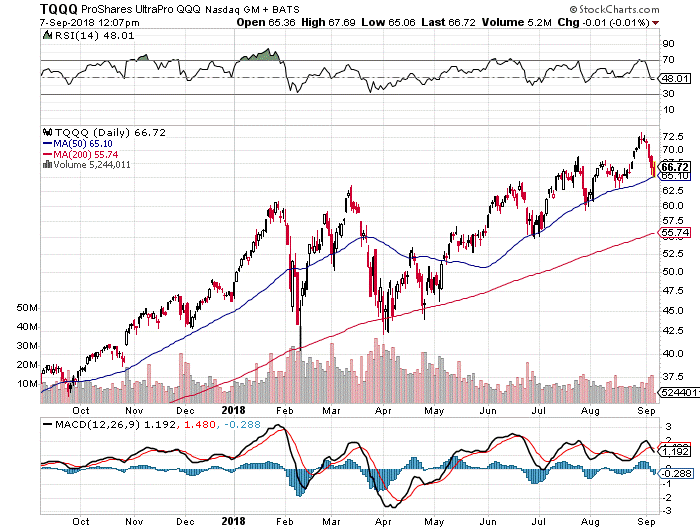

On Aug. 15, I recommended buying the ProShares UltraPro QQQ (Nasdaq: TQQQ), a leveraged ETF that moves 3x that of QQQ’s, in my Quick Income Trader weekly advisory service. Leverage of 3x essentially means that when QQQ is trading up 1%, shares of TQQQ are trading higher by 3%.

In addition to buying TQQQ, I recommended subscribers sell the TQQQ Sept. 21 $70 calls to gain some additional premium. Shortly after recommending these trades, the stock shot up from our published buy price of $63.26 to over $73 a share, and as a result, the TQQQ September calls were executed at $3.00 per contract.

The execution of these sold options gave my subscribers some fantastic, short-term covered-call option premium right when the Nasdaq was trading at an extended level relative to its moving averages. If all goes according to plan, one of two scenarios will unfold.

The first scenario would be that shares of TQQQ, which currently trade around $67, close above $70 on Sept. 21 when the calls expire. If this happens, the position will be called away for a total return of 15.4% (capital appreciation, plus the call premium received). This wouldn’t be a bad return for a five-week holding period.

Alternatively, if the stock closes below $71 on Sept. 21, Quick Income Trader subscribers keep 100% of the $3 call premium, wait for the stock to trade back up towards $73 again and then aim to sell the Oct. 19 $75 Calls. Even if the trade doesn’t work like planned the first time, investors essentially get free money in their trading accounts and can simply repeat this practice month after month.

Either way, I think this TQQQ trade is a great way to cast a net over the blue-chip tech sector and walk up QQQ on a leveraged basis. The economy is on a roll, and third-quarter earnings for the S&P 500 are expected to grow by 20.7%, which is probably on the light side of how the numbers will come in. I predict big-cap tech again will be front and center, reflecting increased business investment in IT budgets.

So, while the market will probably experience some short-term volatility, selling covered calls into strength on a basket of the very best tech stocks is a strategy that can be used in taxable and tax-deferred accounts with relative ease, no matter the market conditions. The hard part of this deal is timing the purchases and executing the right option contracts at the right prices, but that’s where I come in. For each trade, I provide specific parameters to follow so that all one needs to do is pour a cup of coffee and enter the details I provide.

Click here to learn more about how Quick Income Trader pumps up monthly income from being smack in the center of what the market cares about most. It’s easy and quick!