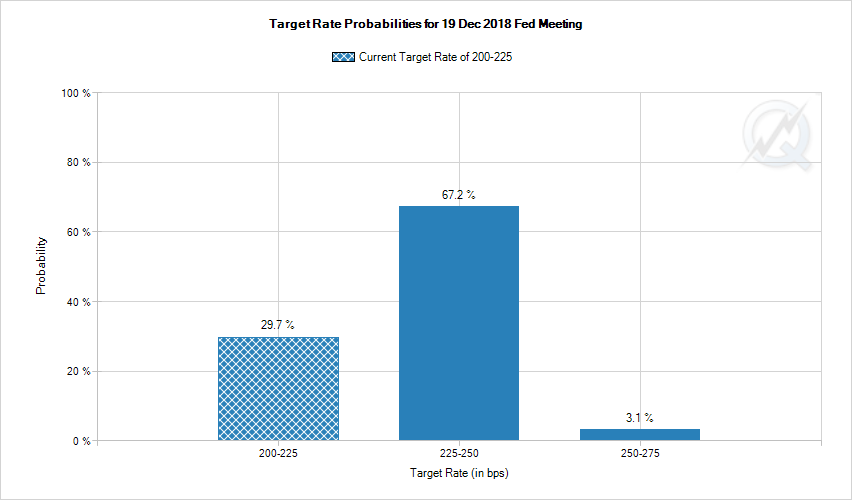

The narrative has been the same all week: slow global growth, a trade war with China, a major rift between Italy and the European Union (EU) and a more hawkish Fed policy. The latest read on third-quarter gross domestic product (GDP) of 3.5% pretty much validates the prior rate hike, but the probability of a hike in December has come down by 21% in the past week to 67%, according to the FedWatch Tool.

Stocks took a sharp drop at the open on Friday as the S&P 500 traded lower by 1.6% right from the opening bell. A stronger-than-expected advance Q3 GDP reading paled in comparison to discouraging earnings reports from Amazon (NASDAQ:AMZN), down 8.0%, and Alphabet (NASDAQ:GOOGL), the parent of Google, down 4%. The Dow Jones Industrial Average opened down 1.1% and the Nasdaq Composite fell by 2.1%.

Separately, the CBOE Volatility Index (VIX) has jumped 8.1% to 26.17, reaching its highest level since February’s S&P 500 correction. Only 40 stocks within the S&P 500 are trading in the green in the early going. So, in general, today will be a risk-off day even after getting a great GDP report that showed benign inflation.

With respect to key technical levels for the market, the S&P needs to find support at 2,600, while the Nasdaq currently trades at 7,130 and needs to hold 7,000. The selling pressure on Friday could be described as indiscriminate and smacks of investor capitulation, which is what a number of technicians have been wanting to see in order for the market to reach “seller exhaustion,” which typically defines a bottom.

I’m still of the view that seasonality will surface after the mid-term elections and take the market higher by the year ‘s end. The United States is clearly the finest of all global equity markets. The current correction has removed any fluff and separated the good from the bad with money flow clearly getting involved with the crème de la crème stocks. A rally is ensuing, but fewer stocks will be on the back of the bull on the rebound.

What investors should consider is rotating into big-cap institutional favorites, since that is where money is likely to be strongest on any rally attempts. But there is a lot of debate on just what those institutional darlings are. There has been a breach of trust in the FANG stocks of Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google/Alphabet (GOOGL). The sectors of tech, industrials, aerospace/defense, biotech and consumer discretionary all led the market to new all-time highs in the first week of October before the market swooned.

Paying up for utilities, health care and consumer staples is the most alluring path investors might want to take, but is it smart? The answer is that no one really knows until we get past the mid-term elections, get through the second half of earnings season and obtain more data on the domestic economy.

My Cash Machine high-yield advisory service pays a current yield of 9.05% with a portfolio consisting of 22 holdings, one of which is a market volatility hedge exchange-traded fund (ETF) that has helped to cushion the blow of the current sell-off. On Aug. 10, I recommended investors put 10% of their investible capital in the iPath S&P 500 VIX Short Futures ETN (VXX) at a price of $30. As of last Friday, shares of VXX traded at $40.

Investors seeking yield in assets that are sensitive to higher rates and inflation should click here to visit my website and take a hard look at Cash Machine as way to generate a constant return approaching double-digit percentages when the market is facing what likely will be a long period of consolidation. Going forward, I think investors are going to be more defensively minded after the white-washing correction of this month that will go down in history as one of the swiftest and most painful.

Market shakeouts are never fun or easy to absorb, but they are constructive to the long-term health of the bull market. Over 2,500 companies are set to report earnings over the next three weeks. When the investing world digests the thrust of the just how well the economy performed in the third quarter, I believe the market will reward those who took measures to position their portfolios for a slower growth bull market for 2019.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)