The SPDR Bloomberg Barclays Investment Grade Floating Rate ETF (FLRN) is an exchange-traded fund (ETF) that focuses on securities that have between one month and five years until maturity.

FLRN tracks an index of U.S. dollar-denominated, investment-grade floating notes. Investing in this fund exposes the investor to floating-rate notes that are spread around the world (since U.S. issues make up a little more than half of the FLRN’s debt holdings) and have a low expense ratio.

The fact that the portfolio is full of floating-rate notes means that the value of the notes will be less affected by changes in the interest rate. As a result, investing in FLRN or a similarly structured ETF might be a wise idea at a time when the Federal Reserve has decided to finally increase interest rates.

Indeed, the Fed had increased the federal funds rate from 2% to 2.25% at the end of September and will very likely increase it again it to 2.5% in December. Given that the last increase caused a panic on Wall Street and a plunge in the value of many stocks, it is conceivable that some prospective investors might want to consider a fund that is less vulnerable to interest rate changes.

Furthermore, FLRN’s portfolio has the indications of being a strong portfolio since the majority of this portfolio’s assets are in AAA, AA or A backed securities and there are no assets invested in what have been popularly called “junk bonds.” In terms of sector, FLRN is most heavily invested in financial institutions, then industry, then supranational organizations and then agencies. Not surprisingly, most of its funds are in corporate bonds from issuers such as Morgan Stanley (NYSE:MS), the Inter-American Development Bank (NYSE:ITAD), Goldman Sachs (NYSE:GS), the Asian Development Bank (NYSE:ATB) and the UBS AG London Branch (NYSE:AG).

It is also important to note that the fund currently has $4.49 billion in assets under management, has a $41.83 million average daily trading volume and has an average 60-day spread of 0.03%. It also has an expense ratio of 0.15%, meaning that it is relatively cheap to hold in comparison to other exchange-traded funds.

The returns from FLRN’s holdings have been weaker than the segment benchmark over the course of the past three years. For instance, FLRN’s holdings have grown 2.12% over the course of the last year, but the Bloomberg Barclays U.S. Floating Rate Note Index has risen 2.39% over the same period.

In short, while FLRN does have several advantages over some of its peer funds, its risks are not zero. Interested investors should, as always, do their due diligence and decide whether the fund is suitable for their portfolios.

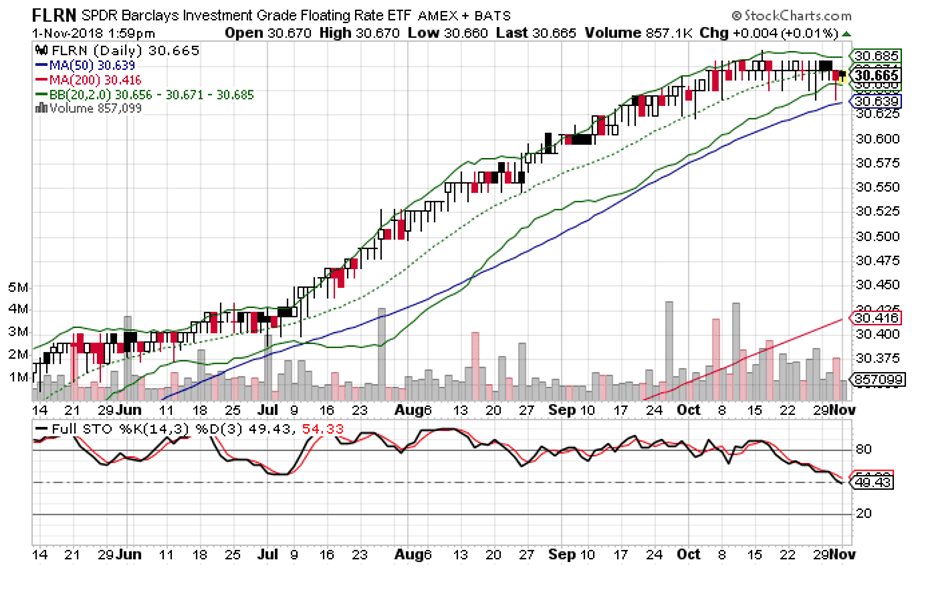

Chart Courtesy of stockcharts.com

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)