The Invesco Russell 2000 Pure Value ETF (PXSV) tracks an index of U.S. value stocks that are ranked by size from 1,001 to 3,000 of market capitalization.

The fund, based on the Russell 2000 Pure Value Index, has stock holdings that are selected and weighted by price to book, historical sales growth and growth forecast. PXSV will invest at least 90% of its total assets in the component securities that comprise the index.

The fund changed indexes in May 2015, but it remains one of the few “pure” value funds in the small-cap space. Its fee, which is among the highest in its fund segment, also has not changed. However, the revamped PXSV emphasizes exposure to stocks with stronger value characteristics than the traditional Russell value indexes. The fund’s previous index did this, too, but used a Research Affiliates Fundamental Index (RAFI), which is a fundamentals-based methodology.

Before the change to the new index, the fund only held about $70 million in assets. Low assets led to a low trading volume that raised transaction costs at the retail level. Still, the fund offers a valid alternative to vanilla value fund competitors that may help to attract investors.

The top PXSV sectors include financial services, real estate, industrials, consumer cyclicals, technology and energy. The fund’s top 10 holdings, consisting of 9.61% of the total, are Iridium Communications Inc. (IRDM), Esterline Technologies Corporation (ESL), Natural Grocers by Vitamin Cottage Inc. (NGVC), Genworth Financial Inc. (GNW), Mallinckrodt PLC (MNK), Cooper Tire & Rubber Co. (CTB), PDL BioPharma Inc. (PDLI), DHT Holdings Inc. (DHT), ATN International Inc. (ATNI) and Independence Realty Trust Inc. (IRT).

PXSV currently has $76.78 million in net assets and an average 0.40% spread, which is the difference between the bid and asking prices of a security. It has a 2.21% yield and a year-to-date return of 9%. The fund also has an expense ratio of 0.35%, so it is relatively cheap to hold in comparison to other exchange-traded funds.

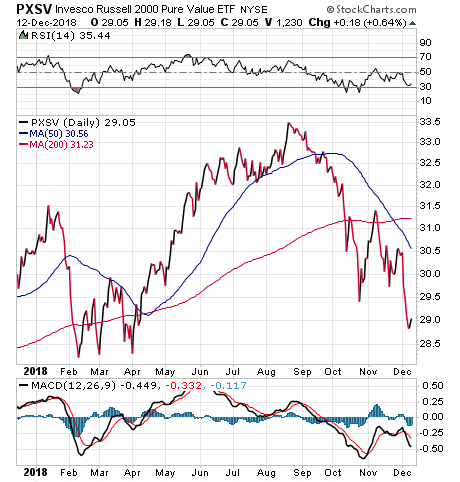

Credit goes to Stockcharts.com

To sum up, this ETF presents a viable option for investors seeking to add a small-cap fund to their holdings. PXSV has a high fee but focuses on stocks with strong value characteristics and remains one of the few options for investors interested in small-cap, “pure” value funds. Investors should, as always, exercise their own due diligence to decide whether or not PXSV is a worthwhile investment.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)