When you want to figure out the state of your physical health, you go to a doctor to help diagnose your condition.

And when you want to figure out the state of the market’s health, there’s also a doctor who can help diagnose the condition. The doctor I’m referring to here is “Dr. Copper.”

Just who is this Dr. Copper and what’s his latest prognosis? Well, Dr. Copper is the nickname market watchers have given to the industrial metal’s prognostication abilities. It is sometimes said that copper has earned a PhD in global economics because of its importance in helping determine future conditions.

Today, I have decided to hand over some of the lead-column real estate to my friend and technical analyst extraordinaire Tyler Richey. Tyler is the Co-Editor of the Sevens Report, a daily market news and analysis publication that I strongly recommend.

Tyler also holds the highly respected Chartered Market Technician®, or CMT, professional designation. So, when he analyzes a market sector, I take particularly good notes.

In this analysis, you’ll learn why copper has been a very consistent and accurate leading indicator for stocks, and why the latest action in Dr. Copper could be pricing in rising odds of both a U.S.-China trade deal and a rebound in the global economy.

And now, I give you Tyler Richie and the diagnosis from Dr. Copper.

******

Over time, a discernable relationship has developed between certain commodities such as industrial metals and energy and the broader stock market.

From a macro analysis standpoint, it is a very logical correlation, especially in situations where global growth concerns are a major influence on the market (like right now). And generally speaking, those commodities tend to lead equity markets, in many cases accurately forecasting volatility, which is why we include them as part of our monthly Sevens Report Economic Breaker Panel.

This concept has been especially true for copper in recent years because of how important Chinese growth has become to the health of the global economy. The industrial metal has even been given a theoretical PhD on the street, labeling it “Dr. Copper” thanks to the elevated sensitivity industrial metals have to China’s economy.

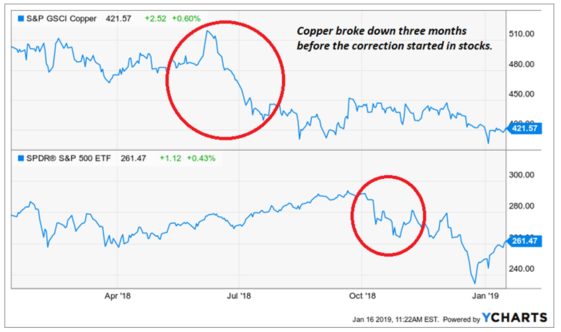

Note that China has had at least some sort of influence on most of the bouts of stock market volatility over the last five years. To that point, copper has been a very consistent and accurate leading indicator for stocks, because more often than not, where copper goes, the Chinese economy is going.

For example, back in summer 2015, copper futures hit fresh multi-year lows in the first week of July before Chinese currency drama sparked a huge wave of selling in the third week of August (a warning signal that turned out to be six weeks prior to the stock market pullback).

More recently, last year copper futures fell sharply to new 52-week lows, again in July, as trade war concerns and the threat tariffs had on global growth continued to be shrugged off, until they weren’t, at the start of Q3 earnings season, and stocks proceeded to get pummeled.

To start 2019, copper again spiked down to fresh 52-week lows, although the calendar was very likely playing a role in the price action as traders rebalanced books into the new year. Futures have since recovered modestly, but copper is still trading at the lower end of a three-month trading range, and again is on the verge of breaking down.

The encouraging part, however, is that futures have not ended a week below the September weekly closing low, and for longer-term chart reading we prefer the weekly time frame for technical analysis. Additionally, the pullback in December was on steadily declining volumes, suggesting a lack of downside conviction.

Bottom line, a material drop below $2.60 would be another warning sign for stocks, maybe not for the immediate future, but for the weeks or even months ahead. For now, copper futures are largely holding the October lows, and if that continues and futures are able to rally to (or even better, through) the top end of the Q3-Q4 trading range (around $2.85), “The Doctor” would be pricing in rising odds of both a U.S.-China trade deal and a (related) rebound in global economic data. –TR.

******

Thanks again to Tyler Richie of the Sevens Report for providing us with his expertise on Dr. Copper. I know I will be watching copper prices closely here to help determine the next intermediate-term direction for markets. And, when a significant trend change develops, I will be sure to share it with you.

*********************************************************************

Millionaire Madness

“Aww, is the poor millionaire mad because he has to pay taxes?”

— Friend who shall remain anonymous

If you’re successful, you don’t get much sympathy even from your friends when it comes time to send in your quarterly tax payments. And for many of us, Jan. 15, April 15, July 15 and Oct. 15 are the dreaded dates on the calendar where we have to send the U.S. Treasury what we estimate we will owe in taxes for that year.

The sad irony here is that we have to send them what we think we’re going to owe even while lawmakers and the executive fail to get it together enough to fund everyday government operations. So, we still have to pay, but they don’t have to do their jobs. Welcome to 21st-century American dysfunction.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.