One of the most interesting and potentially disruptive technological innovations of the digital age has been the rise of 3D printing.

Indeed, the advent of this new technology has raised questions about intellectual property rights, aerospace regulation and gun legislation that have yet to be answered satisfactorily. At the same time, this invention also has triggered new opportunities for investors.

For instance, the Ark 3D Printing ETF (BATS:PRNT) is the first such fund on the market that can provide investors with exposure to companies that are involved in 3D printing and 3D printing businesses. Currently, PRNT limits its geographic reach to companies that are based in the United States, non-U.S. developed markets and Taiwan.

PRNT’s underlying index is made up of five components related to 3D printing. Those components are 3D printing hardware, CAD and 3D printing software, 3D printing centers, scanners and measurement and 3D printing materials. While each of these components is weighted differently (50%, 30%, 13%, 5% and 2%, respectively), selected securities within each category receive the same weight.

Some of this fund’s top holdings include ExOne Co. (NASDAQ: XONE), Stratasys Ltd. (NASDAQ: SSYS), MGI Digital Graphic Technology (OTCMKTS: FRIIF), Prodways Group SA (EPA: PWG), Reinshaw plc (OTCMKTS: RNSHF), 3D Systems Corporation (NYSE: DDD), HP Inc. (NYSE: HPQ) and Organovo Holdings Inc. (NASDAQ: ONVO).

While these companies are mainly in the computers, phones & household electronics sector (25.95%), this ETF also has holdings in companies that produce software and IT services (24.32%), machinery, equipment and components (16.83%), professional & commercial services (8.25%), biotechnology and medical research (5.09%) and health care equipment (5.09%).

The fund currently has $38.45 million in assets under management and an average spread of 0.97%. It also has an expense ratio of 0.66%, meaning that it is more expensive to hold in comparison to other exchange-traded funds.

In terms of PRNT’s MSCI ESG Fund Quality Score, PRNT’s score of 5.75 ranks in the 51st percentile within its peer group and in the 58th percentile within the global universe of all funds in the MSCI ESG Fund Metrics coverage.

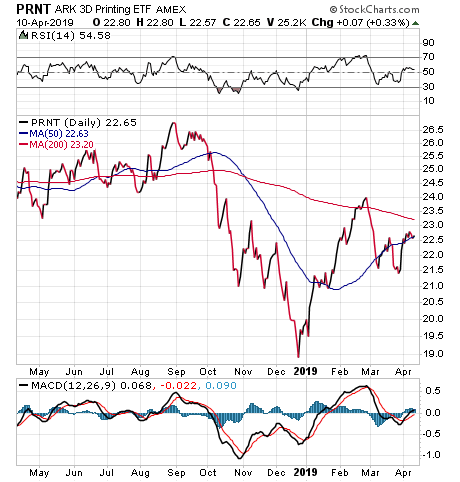

This fund’s performance has been quite solid in the long term. While it only has climbed 0.01% in the past month, it rose 12.04% during the past three months and jumped 14.81% year to date.

Chart courtesy of StockCharts.com

In short, while PRNT does have several advantages over some of its peer funds and provides an investor with the ability to profit from some truly cutting-edge technology, this ETF’s risks and costs are not zero.

Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)