The U.S.-China trade tariffs are creating investment opportunities that may be worth pursing through beaten-down stocks that could rebound if negotiations turn fruitful and climb further if an agreement is reached to protect the intellectual property of American companies.

In any trade war, the biggest threat is “demand destruction,” said Hilary Kramer, a Wall Street money manager who leads the Value Authority, GameChangers, Turbo Trader, High Octane Trader and Inner Circle advisory services for individual investors. If tariffs drive customers away entirely, businesses would end up unable to produce revenues, but such dire consequences are highly unlikely.

Businesses always have the option to find new sources to sustain their supply channels or, in the worst-case scenario, attempt to pass along higher import costs to their own customers. Kramer said she focuses on “revenue risk” when evaluating the impact of various trade proposals on stocks.

U.S.-China Trade Tariffs May Lead Fed to Ease Monetary Policy

The trade uncertainty is heightening risk, along with weakening economic data that can lead to a market drop. However, Fed Chairman Jerome Powell has expressed a willingness to reduce interest rates to counter any pronounced economic declines, despite the U.S. central bank raising rates by 25 basis points three times in 2017 and four times in 2018 due to concerns the economy was growing too strongly.

Such a monetary policy adjustment to cut rates could help to keep the stock market from falling. A rate cut also could aid the Fed in fulfilling its dual mandate of seeking to foster maximum employment and price stability.

Investors seeking to profit from the U.S.-China trade conflict need to be able to accept risk by taking a chance on technology stocks that conduct business in China and have fallen the most since China reneged on verbal agreements with U.S. negotiators and spurred President Trump to respond with tariffs. Once negotiations broke down, investors began to bail out of technology stocks that would be affected by the U.S.-China trade dispute.

Revenue Risk from U.S.-China Trade Tariffs Mainly Hits Tech Stocks

Revenue risk in the S&P 500 from the U.S.-China trade tariffs is concentrated in the technology sector, specifically semiconductors, touch screens and other components that go into mobile computing devices, Kramer said.

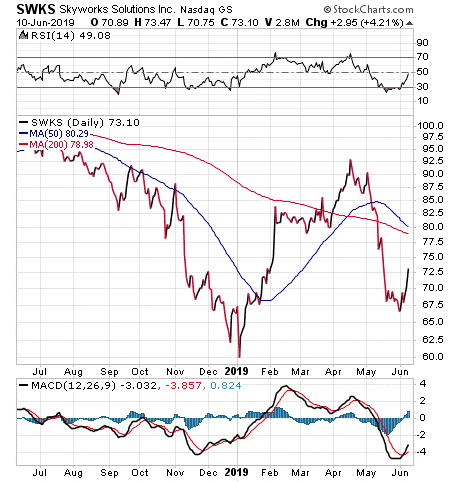

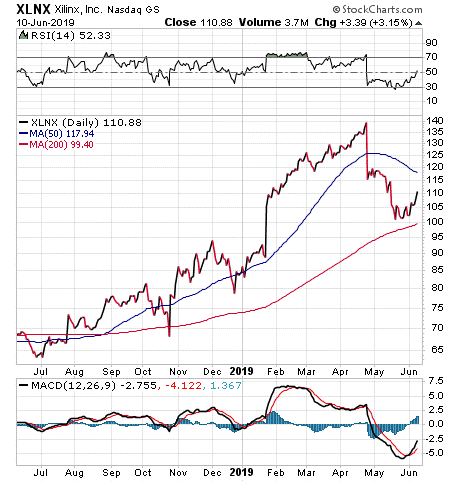

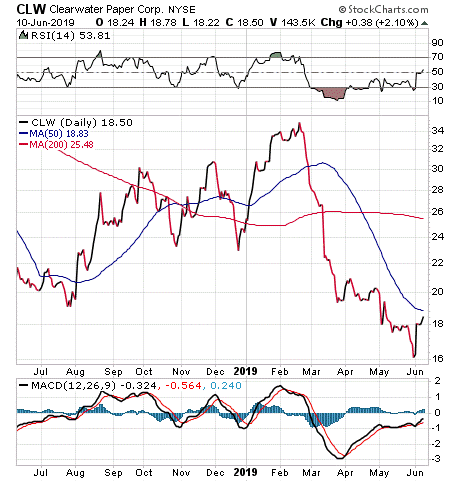

Tech companies that Kramer is watching for a possible recommendation include: Woburn, Massachusetts-based Skyworks Solutions (NASDAQ:SWKS), a manufacturer of semiconductors for radio frequency and mobile communications systems; Xilinx, Inc. (NASDAQ: XLNX), a San Jose, California, provider of intelligent computing; and Corning Inc. (NYSE:CLW), a Corning, New York, maker of glass displays for mobile phones.

Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com

Chart courtesy of stockcharts.com

Other technology companies worth monitoring are Silicon Valley semiconductor giants such as Santa Clara, California-headquartered Intel (NASDAQ:INTC); Dallas-based Texas Instruments Inc. (NASDAQ:TXN); Boise, Idaho’s Micron Technology (NASDAQ:MU); Santa Clara, California; artificial intelligence (AI) computing company NVIDIA (NASDAQ:NVDA); and consumer technology company Apple (NASDAQ:AAPL), of Cupertino, California.

For example, Micron sells 50 percent of its semiconductor chips to China and its stock is down roughly 50 percent, Kramer said.

“Many of these stocks currently reflect what amounts to complete demand destruction from China,” Kramer said. “The math on many of the largest is simple. The percentage points they’ve fallen from last year’s peaks is almost exactly the proportion of their sales footprint in China.”

Further stocks worth tracking include Agilent Technologies (NYSE:A), a life sciences, diagnostics and applied chemical markets company headquartered in Santa Clara, California; AO Smith (NYSE:AOS), a Milwaukee, Wisconsin, global water technology company; and IPG Photonics (NASDAQ:IPGP), an Oxford, Massachusetts-based provider of high-power fiber lasers and amplifiers for materials processing and other applications.

Certain Tech Stocks Plunge Amid U.S.-China Trade Tariffs

“IPGP is only a little less vulnerable but is in roughly the same battered position,” Kramer said. “In our view, these companies are only fairly valued for a total trade war in which Beijing bans U.S. technology or makes it so expensive to import these components that Chinese device makers will build domestic substitutes into their products instead.”

The latter possibility is unlikely, since it takes time to source substitutes and, when they aren’t readily available, develop them domestically, Kramer said. As a result, stripping U.S. screens, processors, memory and other systems out of Chinese phones, for example, will knock those manufacturers out of the global market for at least a year, if not two years, she added.

“Maybe they’ll be happy to focus on their domestic market in the meantime, but even so, Samsung (KRX:005930) would be equally happy to expand at their expense,” Kramer said. “For any Chinese manufacturer looking to move up market, it would be a disaster. In some cases, it may truly be impossible — worse than the threat that our manufacturers would lose access to Chinese rare earth materials.”

China is the world’s largest refiner of rare earth metals that are used in a variety of electronics. The communist nation cut back on overseas shipments of the elements in the first five months of 2019, amid calls by nationalists there to restrict access in retaliation for President Trump’s unwillingness to sign a trade agreement that would not include protections from the theft of U.S. intellectual property. China’s exports of rare earth elements fell 16 percent in May from a month earlier to 3,640 tonnes.

Demand Will Adjust Across National Borders Due to U.S.-China Trade Tariffs

Furthermore, demand will adjust across national borders, Kramer predicted. If China buys fewer Corning screens, Korea and Taiwan will buy more to keep the same number of phones flowing into consumer hands around the world, she added.

In the wake of the tariffs on imported goods from China, U.S. companies are shifting the purchases of goods targeted by the sanctions to other countries. For example, products such as furniture, refrigerators and car tires are increasingly coming to the United States from countries such as Vietnam, South Korea, Taiwan and Mexico.

The bottom line is that total Chinese demand destruction is not going to happen, Kramer predicted.

There are companies that do substantial business in China that have other problems, so their stocks have fallen more than their footprint in the country would otherwise suggest. NVIDIA only sells 20 percent of its processors to Chinese customers, but the stock is down 50 percent to reflect a global slowdown in high-end computer sales.

“A breakthrough in trade negotiations would only help that stock recover some of its lost ground,” Kramer said. “The rest will take time. The same applies to Western Digital Corp. (NASDAQ:WDC) and Flex Ltd. (NASDAQ:FLEX), which do 22 percent and 29 percent of their business in China but are down a harrowing 55 percent and 40 percent, respectively.

Kramer said she has no plans to recommend Western Digital, which has other problems beyond the tariffs on imports from China.

Other Asian Nations May Benefit from U.S.-China Trade Tariffs

The best opportunities that likely will emerge from the trade war between the U.S. and China are in other Asian nations, said Bob Carlson, who heads the Retirement Watch investment advisory service. The economies of these other Asian nations tend to be highly correlated with the Chinese economy.

“They should do well as long as China continues growing,” Carlson said. “The trade conflicts have added two new dimensions. U.S. businesses are seeking supply sources outside China, and they’re generally finding them in the other emerging Asian economies. In addition, China-based companies are quietly moving some of their operations to neighboring nations in hopes of minimizing the impact of future trade conflicts.”

To benefit from these trends, Carlson recommended that investors consider buying shares in a mutual fund that invests in growing Asian companies outside China. A good choice would be T. Rowe Price New Asia (PRASX), Carlson added.

The T. Rowe Price New Asia fund, which I personally have held shares in for many years, invests in a few Chinese companies such as Tencent Holdings Ltd. (OTCMKTS: TCEHY), a Chinese multinational investment holding company whose subsidiaries specialize in internet-related services and products, and Alibaba Group Holding Ltd. (NYSE:BABA), a Chinese e-commerce, retail, internet and technology company. But those companies do not rely on exports to the United States.

The fund also invests in a range of growth companies outside of China, Carlson said. In total, the fund invests in about 80 stocks and 39 percent of its holdings are in the 10 largest positions.

Funds Offer Another Way to Profit from U.S.-China Trade Tariffs

“I am a huge opponent of tariffs, not only because they are ineffective, but also because they are a tax on the American people and American companies,” said Jim Woods, editor of Intelligence Report and Successful Investing.

“That said, if the U.S. and China do reach an agreement, there will be a rebound in many of the leading large-cap industrial stocks out there, especially the kind that can be found in the SPDR Industrial Select Sector SPDR Fund (XLI),” Woods said. “There will also be opportunity in basic materials stocks such as those found in the Materials Select Sector SPDR Fund (XLB).”

Whether investors favor tariffs or not, they need to stay focused on the best ways to profit. There clearly are many stocks and funds worth weighing for potential investment as the negotiating tactics and strategies of U.S. and Chinese representatives ultimately lead toward a trade agreement.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.