(This is the first in an 11-week series on the Select Sector SPDR Funds).

The Communication Services Select Sector SPDR Fund (NYSE: XLC) has taken some damage to its share price recently due to threats of antitrust investigations into some of the companies that are part of the exchange-traded fund’s holdings in telecommunications stocks.

The fund recently has begun to recover, despite U.S. regulators looking into antitrust concerns about some of XLC’s biggest positions, including Facebook (NASDAQ: FB) and Google’s parent company Alphabet (NASDAQ: GOOG). XLC’s share price subsequently slid in the past six weeks after reaching its 52-week high of $52.11 on April 29, prior to falling almost 9% since then.

Regulatory authorities at the Federal Trade Commission and the U.S. Department of Justice could begin an antitrust investigation over political bias at Facebook and Google, respectively, The Wall Street Journal reported. The threats of antitrust lawsuits might be overblown, but the news has created volatility for some of the companies held in the fund. A recent Morningstar report claimed that the regulatory risks already have been accounted for in the share price of those stocks.

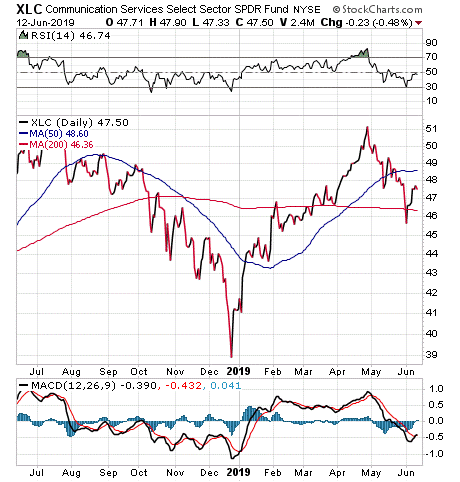

It appears that investors have priced in the regulatory threats, as XLC is up more than 5% since its one-month low of $43.35 a share on June 3. The impact of the threats from U.S. authorities dwarf in comparison to the overall market correction in December 2018. However, the fund’s share price then dropped to its 52-week low of $38.97. Even so, the share price has risen to $47.60, up solidly with a 15.84% year-to-date return to sit at a price of about $47.60, as shown in the chart below.

Chart courtesy of StockCharts.com

As an ETF, XLC sometimes invests all, or at least 95%, of its assets in its holdings. The fund was created in June 2018 and began paying a dividend the following September. It paid a $0.132 dividend on September 21, 2018, a $0.134 dividend on December 21, 2018, and a $0.083 dividend on March 15, 2019. Its ex-dividend date is June 21, 2019.

With more than $5 billion in assets under management, XLC invests in blue-chip companies that are directly involved in telecommunications. Its top 10 holdings, which comprise 75.99% of total assets, include Facebook (NASDAQ: FB), 19.54%; Google’s parent company Alphabet Inc. Class C (NASDAQ: GOOG), 11.29%; Alphabet Inc. A (NASDAQ: GOOGL), 11.02%; The Walt Disney Co. (NYSE: DIS), 6.15%; and Charter Communications (NASDAQ: CHTR), 5.05%. The final five in that group of holdings are Comcast Corp. (NASDAQ: CMCSA), 4.86%; Activision Blizzard Inc. (NASDAQ: ATVI), 4.67%; AT&T Inc. (NYSE: T), 4.62%; Netflix Inc. (NASDAQ: NFLX), 4.44%; and Verizon Communications Inc. (NYSE: VZ), 4.35%.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)