The Financial Select Sector SPDR Fund (XLF) tracks an index of S&P 500 financial stocks, weighted by market cap.

The exchange-traded fund (ETF) seeks to provide precise exposure to companies that are involved with diversified financial services such as the insurance, banks, capital markets, mortgage real estate investment trusts (REITs), consumer finance and thrifts and mortgage finance industries. XLF offers extremely liquid exposure to the heavyweights in the U.S. financials segment.

Its cap-weighted, S&P 500-only portfolio means that it concentrates on large banks and avoids small-caps. The fund is large and massively liquid, far outpacing its peers in trading volume. A low fee and tight tracking make for very low all-in costs.

For many investors and traders, XLF is the go-to exchange-traded fund for financials exposure, although there are more comprehensive funds out there for long-term exposure. It is important to note that XLF spun off its real estate exposure in September 2016, consistent with the Global Industry Classification Standard (GICS) reclassification that elevated real estate to sector-level status.

The change was material, since real estate comprised about 20% of the fund at the time. For each share held, XLF shareholders as of September 16, 2016, received 0.139146 shares of XLRE, State Street Global Advisors’ real estate ETF.

Among the fund’s top holdings are Berkshire Hathaway Inc. Class B (NYSE: BRK.B), JPMorgan Chase & Co. (NYSE: JPM), Bank of America Corp (NYSE: BAC), Wells Fargo & Company (NYSE: WFC) and Citigroup Inc. (NYSE: C). Top sectors include Banking Services, 47.13%; Insurance, 32.11%; and Investment Banking, 17.02%.

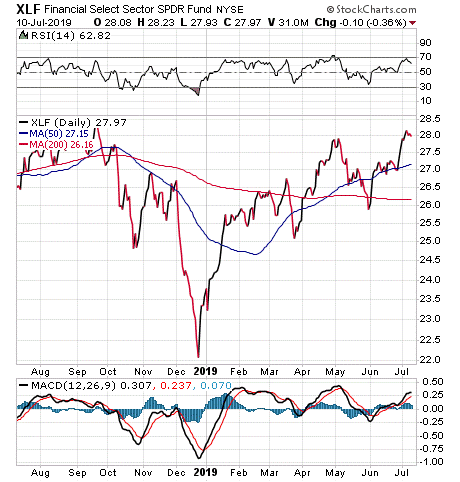

Chart Courtesy of StockCharts.com

The ETF has a weighted average market cap of $165.43 billion, $24.92 billion assets under management and 69 holdings. The expense ratio is 0.13%, meaning it is relatively less expensive to hold in comparison to other ETFs. The fund pays a $0.14 dividend, giving it a 1.58% yield.

A wide array of diversified financial service firms, insurance, banks, capital markets, consumer finance and thrift companies are featured in this index. While XLF does provide an investor with the ability to profit from the world of financial services, this sector may not be appropriate for all portfolios. Thus, interested investors always should exercise their own due diligence to decide whether this fund is suitable for one’s own investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)