The ProShares Short Russell 2000 (RWM) exchange-traded fund (ETF) provides inverse exposure to a market-cap-weighted index of U.S. small-cap companies.

RWM offers a bet against the Russell 2000’s index of 2,000 small-cap firms that attract enough daily liquidity to make it a viable trading tool. The non-diversified fund uses both ETF and index swaps to achieve its inverse exposure.

As with most leveraged and inverse products, RWM is designed to provide its -1x exposure for the short term. Anyone holding it for longer periods will have their returns affected by the effects of compounding, which cause returns to drift away from the expected inverse exposure to the 2,000 small-cap stocks that comprise the Russell 2000 Index.

The fund is sufficiently popular to allow investors to use it for short-term tactical trading, with heavy daily trading activity and narrow spreads. Its fees are comparatively high for an ETF, though in line with other funds found in the inverse equity segment.

The ETF currently has more than $307 billion in assets under management and an average spread of 0.02%. It currently sits at just under $40 a share and has a 1.34% yield. With an expense ratio of 0.95%, it is more costly to hold relative to some other exchange-traded funds.

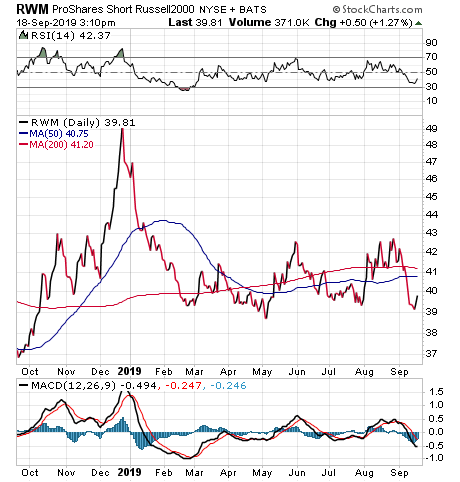

Chart Courtesy of Stockcharts.com

The ProShares Short Russell 2000 has an MSCI ESG Fund Rating of A, based on a score of 6.70 out of 10. The MSCI ESG Fund Rating measures the resiliency of portfolios to long-term risks and opportunities arising from environmental, social and governance factors. Highly rated funds consist of companies that tend to show strong and/or improving management of financially relevant issues.

While RWM facilitates the opportunity to profit at a time when the Russell 2000 Index is at risk for producing negative returns, inverse ETFs may not be appropriate for all portfolios.

As always, interested investors should exercise due diligence to decide whether the fund fits their individual investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)