“Berkshire’s long-term gains… cannot be dramatic and will not come close to those of the past 50 years. It is harder to double the market value of a $100 billion company than a $1 billion company.” — Warren Buffett, 2014

A couple of weeks ago, I wrote a column, “Has Warren Buffett Lost his Magic Touch?” (September 6, 2019 Skousen CAFÉ)

I noted that the Oracle of Omaha had fairly consistently beaten the market since he took over Berkshire Hathaway in 1965. I’ve been a long-time shareholder of the company and have benefited from his incredible run.

But this year, he has vastly underperformed the market, which is up 18% year to date. Is this the end of an era?

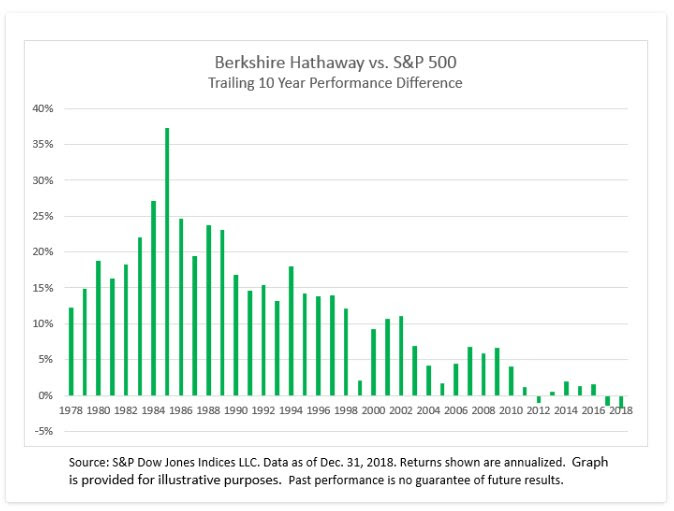

It may be. Business Insider published the following incredible chart demonstrating that Buffett’s Berkshire Hathaway performance gradually has lost its ability to beat the market. (Thanks to Nicholas Vardy of the Oxford Club for pointing out this chart.)

Chart Courtesy of Business Insider

What’s fascinating is that his ability to beat the market peaked in 1985, the year Buffett turned 55. Buffett is 89 years old today.

Both numbers are Fibonacci numbers!

Fibonacci numbers (2, 3, 5, 8, 13, 21, 34.…) are a fascinating mathematical sequence that technical traders use to determine the tops and bottoms of markets.

My goal is to keep writing my newsletter, Forecasts & Strategies, until my next Fibonacci number (age 89) — in 2036!

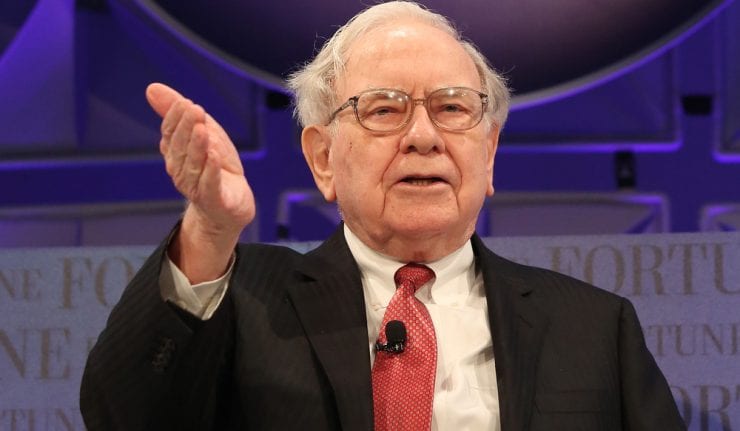

Buffett Recommends Indexing!

Since 2014, Buffett has recommended that investors and even his own family members invest in a stock index fund. They should not count on his investment company to outperform in the future.

The reason? Berkshire is just too big. In his 2014 annual letter to shareholders, Buffett admitted that “Berkshire’s long-term gains… cannot be dramatic and will not come close to those of the past 50 years. It is harder to double the market value of a $100 billion company than a $1 billion company.”

He recently told CNBC, “You should consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.”

In 2008, Buffett famously bet a hedge fund manager from Protege Partners that a portfolio of hedge funds would not beat the S&P 500 over a 10-year period. He easily won the bet and donated his $1 million prize to Girls, Inc., a non-profit organization in Omaha.

That’s quite a change from his approach in the early days of trading. In his 1988 annual shareholder report, he criticized the efficient market theory and indexing: “Observing correctly that the market was frequently efficient, they went on to conclude incorrectly that it was always efficient. The difference between these propositions is night and day.”

Indeed, he told the story of his mentor Ben Graham and his arbitrage trading system, which averaged a 20% per year return over a 63-year period.

“Over the 63 years, the general market delivered just under a 10% annual return, including dividends. That means $1,000 would have grown to $405,000 if all income had been reinvested. A 20% rate of return, however, would have produced $97 million!”

But apparently those days are long gone, due to the law of diminishing returns and the size of BRK.A.

What’s Better Than Berkshire Hathaway?

There are some actively managed funds still exist and outperform the indexes. I recommend one in my Forecasts & Strategies newsletter. Actually, it is the only mutual fund I recommend in my newsletter. Furthermore, it has been beating the market for years and is still open to investors. It is one of my largest holdings. If you are not a subscriber, click here to become one.

Warren Buffett’s Favorite Quote Book

Warren Buffett is a big fan of my classic book, “The Maxims of Wall Street.” He wrote me, “I love your book and plan to steal some of its lines.”

Warren Buffett and Mark Skousen share ideas in New York in 2010.

It is the one and only compendium of financial adages, ancient proverbs and worldly wisdom — it has sold over 28,000 copies. Alex Green calls it a “classic.”

Commodity guru Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

The “Maxims” book is available for only $20 for the first copy, and all additional copies are $10 each. And if you order an entire box of 32 books, you pay only $300. Plus, I pay postage and autograph each copy. It is the perfect gift for investors, clients, money managers and stockbrokers.

To order, call Harold at Ensign Publishing at 1-866-254-2057, or go to www.skousenbooks.com.

By the way, if you’re curious about how I’m investing my own money these days, I recently recorded a video that “lets the cat out of the bag,” so to speak. In it, I reveal the single largest investment in my personal IRA. Click here to find out what it is, and why it’s my biggest retirement holding.

Good investing, AEIOU,

![]()

Mark Skousen

Upcoming Appearance

Gold is back! Join Me for the New Orleans Investment Conference, Nov. 1-4, 2019, Hilton Riverside Hotel. With gold and silver moving up sharply, I urge you to attend the New Orleans Investment Conference, the annual gathering of gold bugs. I will be there, as I have spoken at every New Orleans conference since 1976! Speakers include Dennis Gartman, Kevin Williamson, Steve Moore, Rick Rule, Mary Anne and Pamela Aden, Doug Casey, Adrian Day and Peter Schiff. This is the granddaddy of gold bug conferences. All details can be found at http://neworleansconference.com/noic-promo/skousen/.

Click here to register.

Be sure to mention you are a subscriber!

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)