An interesting development occurred late last week when the employment data was released showing the economy added 303,000 non-farm jobs to payrolls, a full 50% more than had been forecast. Nonfarm Private Payrolls increased 232,000, also considerably higher than the 160,000 estimate, which followed the ADP Employment report for March that showed an increase of 184,000 jobs that, too, was well above the 150,000 forecast. Without question, it was a good week for the U.S. labor market.

On most other occasions, such a strong report that takes the market by total surprise and sends bond yields higher would be met with widespread selling of stocks under the belief that any future rate cuts would be delayed indefinitely. But instead, stocks rallied, the takeaway being that a strong labor market seemingly bodes well for corporate earnings and the outlook for sustained economic growth. The 10-year T-Note settled the week out at a five-month high of 4.38% and the 2-year T-Note at 4.73%.

This data comes on the heels of some hotter-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data in mid-March followed by the Personal Consumption Expenditures (PCE) inflation data reported on Good Friday with the markets closed. Come the following Monday, stocks rallied on this report along with some soothing comments from Fed Chair Jerome Powell, only to see the market get sold off sharply from hawkish words out of Minneapolis Fed President Neil Kashkari and news of Israel canceling home leave for all combat troops in the event of an retaliatory attack by Iran after the Israeli strike in Syria that killed a top Iranian Revolutionary Guard Corps (IRGC) commander and five other IRGC officers.

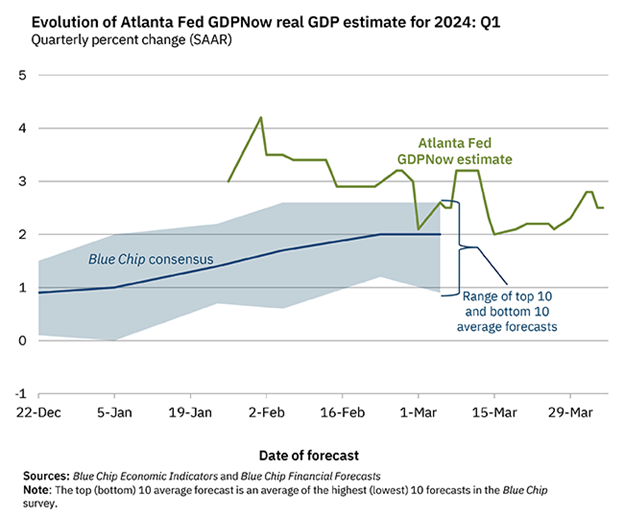

For the market to have regained its footing during Friday’s session was rather impressive, implying the “buy the dip” mentality is still very much intact heading into the first quarter reporting season that kicks off this week with big money center banks posting their results on Friday. Adding to the bullish sentiment, the Atlanta Fed GDPNow estimate for Q1 global domestic product (GDP) growth was raised to 2.5% from 2.1% at the end of March.

In another development, the managed care sector was sold off aggressively after the Centers for Medicare & Medicaid Services (CMS) set a lower-than-expected reimbursement rate for the privately run healthcare plans for 2025. The Biden administration’s decision to hold payment rates unchanged has surprised analysts, with JPMorgan noting that only once over the past 10 years have regulators failed to improve final rates from preliminary rates. “We now see the deteriorating rate environment becoming a risk to forward estimates,” Bank of America analyst Kevin Fischbeck wrote. This once-reliable growth and dividend sector is in full retreat.

In yet another development fueling market volatility is the price of West Texas Intermediate (WTI) crude topping $87/bbl last week amid Middle Eastern tensions and OPEC+ stating they will extend the production cuts of 2.2 million barrels per day for the second quarter of 2024. It reported that Mexico is also slashing exports, compounding American sanctions of Russian oil set to put more pressure on U.S. supplies as the summer driving season approaches. A further rise in oil prices and other commodities complicates future rate cut deliberations.

It’s no surprise the confluence of these situations has the CBOE Volatility Index (VIX) popping higher, along with the price of gold finishing the week out at a new all-time closing high of $2,3219/troy oz., even as the dollar ticked higher. In most circumstances, bullish domestic economic data and strong quarterly sales and earnings win out over geopolitical concerns and spikes in commodities, which are generally deemed to be temporary.

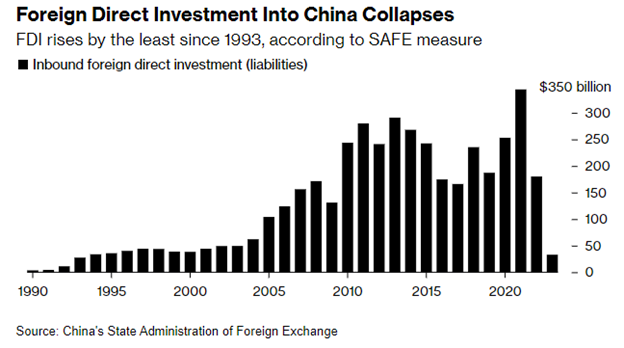

And this time around may prove to be no different than other periods of collective stress. The ballooning Federal debt, a high-profile boarder crisis and further destabilizing of the United States/China relationship are also clouding the investment landscape. The reshoring of industries away from China has resulted in a sharp decline investment into the world’s second largest economy. Analysts are concerned China will flood foreign markets with ultra-cheap pricing to spur its economy, threatening U.S. businesses.

Against this increasingly uncertain backdrop comes the potential for a promising earnings season that can provide impetus to cast aside these negative headline stories as noise and bring about a further rise for the market averages that has seen some broadening out of the rally. For Q1 2024, the estimated (year-over-year) earnings growth rate for the S&P 500 is 3.2%. If 3.2% is the actual growth rate for the quarter, it will mark the third-straight quarter of year-over-year earnings growth for the index. (FactSet Earnings Insight)

Without question, the market is seeking another great quarter from the leading artificial intelligence (AI) and technology companies, but there is also strong relative strength being exhibited in numerous leading industrial, transportation, communications, energy, materials and consumer discretion. The rally is better represented now by sector participation than at any time in the past year. But with the tech sector accounting for a 30.58% weighting of the S&P 500 and a 50.08% weighting for the Nasdaq, there is no doubt about which sector needs to deliver solid earnings, and more importantly, bullish forward guidance.