(Note: Fifth in a series of ETF Talks on the Millennial generation).

Esports not only allow video game enthusiasts a chance to compete against each other, they have become so popular they also now offer an investment opportunity.

Wall Street has taken notice and is providing a way to seek profits from the fast-growing trend by creating the ETFMG Video Game Tech ETF (NYSE: GAMR), one of a few millennial-based exchange-traded funds that have been launched to ride the wave. Esports events are filling arenas that are normally used for professional basketball, as ironic as that seems, and certain tournaments even are broadcast on major cable networks.

There are more than 90 million millennials — people who were born approximately between 1980 and 2000 — representing about 35% of the labor force today and an expected 75% of U.S. workers by 2030, according to Global X. So, the market is huge.

The age demographic of millennials recently replaced Baby Boomers as the largest in the United States. Investment firms have zeroed in on catering to millennials by studying their spending patterns, their gaming habits and other characteristics more than any other group. Additionally, millennials are making more money now than ever as the oldest ones have reached their late 30s. They’re also expected to receive $30 trillion in wealth from Baby Boomers.

GAMR’s top 10 holdings, which comprise 28.95% of its total assets, include major blue-chip names in the gaming industry such as Nintendo (OTC: NTDOY) and Electronics Arts (NASDAQ: EA), which is more commonly known as EA. If you don’t know these names, don’t worry. Trust me, they’re the most-recognizable stocks in the gaming industry.

Others holdings in the fund include: Square Enix Holdings (9864), 3.58%; Activision Blizzard Inc., (ATVI), 3.07%; CD Projekt SA (CDR), 3%; Micro-AStar International co. (2377.TW), 2.96%; Capcom Co. Ltd. (9697), 2.93%; NCsoft Corp. (036570.KS), 2.78%; Bilibili Inc. ADR (BILI), 2.76%; Take-Two Interactive Software Inc. (TTWO), 2.72%; Electronics Arts Inc., 2.59%; and Nintendo Co. Ltd. (7974), 2.56%.

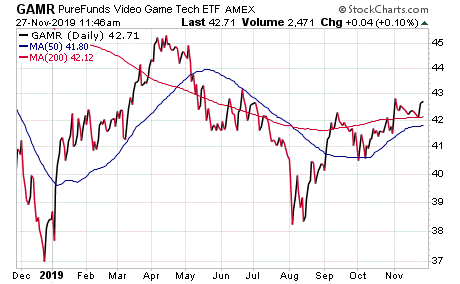

Chart courtesy of www.StockCharts.com

As you can see in the chart here, GAMR’s share price is up about 10% so far this year. After its investors received the company’s most recent dividend of $0.13 on Sept. 20, GAMR’s forward dividend yield equals about 1.55%.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)