At a time when corporate America is sitting on a record-breaking $10 trillion dollars of debt due to historically low interest rates, the phrase “junk bonds” conjures up images of so-called “toxic debt,” the causes of the 2008 global financial crisis and various types of risk.

This risk includes the possibility of corporate default that is accepted when holding these bonds. For that reason, the suggestion to invest in these types of bonds probably sounds so frightening that it might even scare off many potential investors.

However, the various exchange-traded funds (ETFs) that deal with these types of bonds may offer an alternative and less risky way to obtain high-yield returns. Here’s an example.

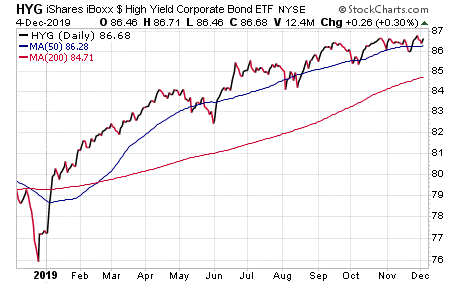

The iShares iBoxx $ High-Yield Corporate Bond ETF (NYSEARCA: HYG) is an exchange-traded fund that tracks a market-weighted index of U.S. corporate debt. HYG is also able to replicate much of the junk bond market successfully, albeit providing a shorter maturity, less interest-rate sensitivity and reduced yield than pure junk bonds.

The top 10 countries that this ETF is invested in include the United States (82.84%), Canada (5.47%), Luxembourg (2.74%), the Netherlands (2.43%), the United Kingdom (1.92%), Ireland (1.01%), France (0.95%), Italy (0.91%), the Cayman Islands (0.51%) and Germany (0.33%).

Some of this fund’s top holdings, which make up only 4.99% of the portfolio, include corporate debt from BlackRock Cash Funds Treasury SL Agency Shares, Altice France SA (OTCMKTS: ALLVF), Sprint Corp. (NYSE:S), TransDigm, Inc. (NYSE:TDG), VRX Escrow Corp, CCO Holdings LLC (NYSE:CCO), Diamond Sports Group LLC and Community Health Systems, Inc. (NYSE:CYH).

Chart courtesy of www.StockCharts.com

This fund’s performance has been passable in the short run. As of December 2, 2019, HYG is up 0.07% over the past month and up 0.93% over the past three months. It is currently up 11.87% year to date.

The fund currently has $18.80 billion assets under management and an expense ratio of 0.49%, meaning that it is more expensive to hold in comparison to other exchange-traded funds.

In short, while HYG does provide an investor with a chance to profit from the world of junk bonds, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their own due diligence and decide whether the fund is suitable for their investing goals. The risk of corporate default in this fund’s holdings underscores the need for investors to take that cautionary advice to heart, especially if the economy weakens significantly in the months and years ahead.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)