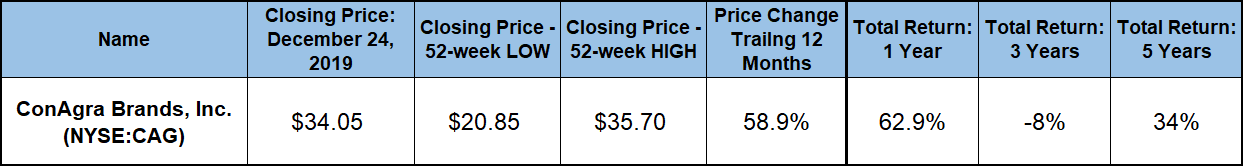

After losing more than 45% of its value in the fourth quarter of 2018, ConAgra Brands, Inc. (NYSE:CAG) delivered a gain of nearly 60% in 2019.

In addition to experiencing a share price surge in 2019, ConAgra has rewarded its shareholders with steady dividend income distributions. However, the dividend payouts were too small to overcome the share price decline over the past three years, which included the steep drop in late 2018. At the same time, the dividend income payouts were able to combine with the rising share price in 2019 in order to push the total return on shareholders’ investments above 60% over the last 12 months.

While the current share price surged slightly above the target average that had been put forth by Wall Street analysts, the stock still might have more room on the upside to advance. After dipping briefly below the 200-day equivalent, the 50-day moving average broke back above its 200-day counterpart on December 23, 2019.

More importantly, after fluctuating above and below the 50-day average and even dipping under the 200-day average on several occasions in October and November, ConAgra’s share price has been trading above both moving averages since mid-December. If the share price remains above both averages and the 50-day average continues to widen the distance above its 200-day counterpart, the stock could continue to appreciate deeper into 2020.

In addition to this relationship between the share price level and both moving averages, interested investors should monitor the company’s upcoming financial results announcements to confirm that the trend continues. Sometime in mid-to-late March, ConAgra will announce the financial results for the third quarter of its 2020 fiscal year, which will end in the last week of February.

Dividends

The company’s current $0.2125 quarterly dividend distribution is equivalent to an $0.85 annualized payout. At the current share price level, that annualized dividend distribution corresponds to a 2.5% forward dividend yield. The rapid share price growth has suppressed the current yield to a level that is almost 9% below the 2.74% simple average yield of the company’s peers in the Processed & Packaged Goods industry segment. However, despite paying the same flat quarterly dividend amount since mid-2017, ConAgra’s current dividend yield is now nearly 22% higher than the 2.05% yield average of the overall Consumer Goods sector.

Over the past two decades, the company has cut its annual dividend payout only three times. The company’s most recent cut occurred in 2017, when the company reduced its total annual distribution by 17.5% from $1.00 to the $0.825 total annual payout for that year. Over the past two decades, the company hsas hiked its annual dividend 70% of the time, reduced its annual dividend only two other times — in 2006 and 2007 — and paid a flat dividend in four years — from 2014 through 2016 and in 2019.

The company will maintain its current quarterly payout level for the next round of dividend distributions. The next pay date has been set for March 3, 2020. To claim eligibility for this round of dividend payouts in early March 2020, investors must own shares of the company’s stock before the January 21, 2020 ex-dividend date.

Share Price

The share price entered the trailing 12-month period on the tail of the fourth-quarter 2018 decline. Driven by the downward pressure from the correction of the overall stock market in late 2018, the share price extended its decline into early 2019. After declining nearly 3% in early January, the share price reached its 52-week low of $20.85 on January 14, 2020.

However, after bottoming out in mid-January, the share price reversed direction and advanced higher. By late April 2020, the share price had recovered more than half of its fourth-quarter 2018 losses. Following that recovery, the share price lost some of its steam and traded relatively flat for most of 2019. However, driven by positive financial results in late 2019 and the company’s strong outlook for 2020, the share price surged in the last month of the year to achieve its 52-week high of $35.07 on December 20, 2019.

Following the surge, the share price retreated by slightly less than 3% to close on December 24, 2019 at $34.05. The Dec. 24, closing price was only 22% higher than it was five years ago. However, that closing price was 59% higher than it had been one year earlier, as well as 63.3% above the 52-week low from mid-January 2019.

Despite steady income payouts, the dividend distributions were not sufficiently high to offset a share price decline over the past three years. Therefore, ConAgra’s shareholders suffered a 7.5% total loss over that three-year period. Furthermore, the share price drop in 2018 also diminished returns over a longer period and limited total returns over the past five years to just 34%. However, the robust share price advancement in 2019 delivered strong total returns to investors who had taken advantage of the share price pullback and assumed a long position in the ConAgra stock a year ago. While the one-year asset appreciation of 59% delivered most of the profits, the dividend income pushed the combined total returns above 63% over the trailing 12-month period.

ConAgra Brands, Inc. (NYSE:CAG)

Founded in 1919 and headquartered in Chicago, Illinois, ConAgra Brands, Inc., manufactures and distributes ready-to-eat, refrigerated and frozen food products. The company operates through Grocery & Snacks, Refrigerated & Frozen, International and Foodservice segments. While the Grocery & Snacks segment primarily offers shelf stable food products, the Refrigerated & Frozen segment provides temperature controlled food products through various retail channels in the United States. The International segment offers food products in various temperature states for retail and foodservice channels outside of the United States. Additionally, the Foodservice segment offers food products packaged for sale to restaurants and other foodservice establishments in the United States. ConAgra Brands, Inc. markets its products under multiple brands, which include Marie Callender’s, Reddi-wip, Hunt’s, Healthy Choice, Slim Jim, Orville Redenbacher’s, Alexia, Blake’s, Frontera, Bertolli and P.F. Chang’s.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.