Among the most cited investment objectives highlighted within various financial surveys is the desire to generate yield and income from invested capital.

For the past 10 years, yields on traditional asset classes have been dismal, not even keeping up with inflation and taxes. Rates on certificates of deposit (CDs), money markets, Treasuries, Government National Mortgage Association bonds (GNMAs), investment grade corporate bonds, preferred stocks and blue-chip stocks have sorely lagged the income needs of millions of Americans facing a rising cost of living every year.

Back in the late 1980s and early 1990s, the only real alternative to buying your own apartment complex to generate inflation-protected income, which is out of the reach of 99.9% of Main Street investors, was the junk bond market, or corporate debt rated below BBB+. But as time passed, some very creative asset classes evolved that offered unique ways to generate income, of which some have become quite popular. Investors just love finding ways to up their portfolio yield with the click of a mouse, and Wall Street hasn’t been shy on keying in on that objective.

Enter the world of high-yield assets, a wide variety of market sub-sets that ironically are more tied to the equity market than the bond market. If income-bearing assets aren’t rated by Standard & Poor’s or Fitch, they fall into a realm of relying on Wall Street and third-party research to quantify the fundamentals and ability of high-yield assets to deliver the heady yields they promise. But the appetite for outsized yield is so great among professional and retail investors that Wall Street and other boutique research firms have plunged into the high-yield universe, where professional ongoing coverage has become a lucrative business.

Today, there is a higher level of familiarity with most classes of unconventional income assets. However, even seasoned investors have limited experience in some of the more esoteric income vehicles. Here is where much of the investment activity takes place in the high-yield market:

- High Yield Corporate Bonds

- Convertible Debt

- Brick and Mortar REITs

- Non-Brick and Mortar REITs

- Energy Master Limited Partnerships (MLPs)

- Non-energy Master Limited Partnerships (MLPs)

- Business Development Companies (BDCs)

- Preferred Stock Exchange Traded Funds (ETFs)

- Leveraged Closed-End Debt Funds

- Buy/Write Closed-End Funds

- Private Equity Asset Managers

- Exchange-Traded Notes (ETNs)

- Floating Rate Senior Loan Funds

- Distressed Debt Funds

- Emerging Market Debt & Local Currency Debt Funds

- Hybrid Securities (Collateral Debt Obligations)

- Royalty Trusts

Investors focused on the high-yield market have some common investing goals:

- Desire for a portfolio where outsized yield is primary, and growth is secondary

- Look for securities paying yields of 8% to 15%

- Invest in asset classes with strong fundamentals in pockets of economic strength

- Rotate in and out of sectors of strength

- Target capital appreciation of 5-10% per year in addition to income.

In today’s market, where there is an emphasis on the strong domestic economy with nominal inflation, a top-down approach to selecting a well-rounded high-yield portfolio is a good working model to consider. With a cornucopia of choices to choose from, a well-researched high-yield portfolio of pass-through securities likely will be modeled as:

- Consisting of a portfolio of 15-20 non-correlating assets that together pay a blended yield of 8%-10% annually.

- Current asset classes include: Energy Infrastructure MLPs, LNG MLPs, Natural Resource MLPs, Floating Rate BDCs, Blue-Chip Covered-Call Closed-End Funds, High-Tech/Biotech Managed Income Closed-End Funds, Equipment Leasing Stocks, Convertible Debt Closed-End Funds, Specialty REITs (Hotel, Casino, Logistic Distribution), Option Income Funds, Private Equity Partnerships.

- Stated goal of holding each security a year and a day for tax efficiency purposes, but not a hard and fast rule.

- A strategy that is built for the high-yield stock investor who wants to maximize current income without the use of margin.

The one constant that should be fully understood before venturing in the high-yield market is that, like the stock market, the underlying assets will show wide price swings. Unlike a portfolio of three-to-five-year investment grade corporate bonds paying 3.00-4.00% that experiences minimal volatility, a portfolio structured with high-yield assets is not static, but instead very fluid.

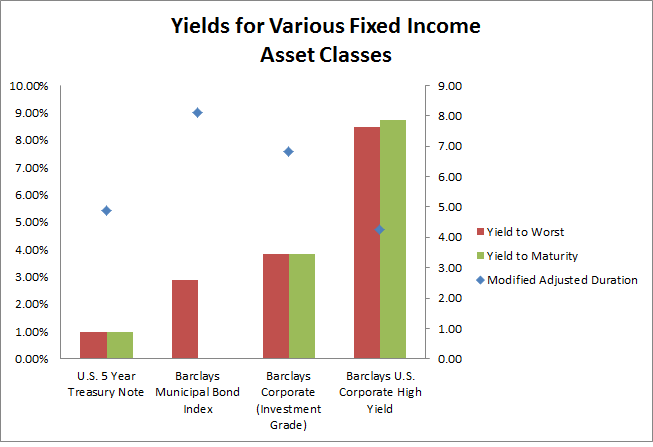

The chart below is going back to 2017, but is a fine illustration as to how high-yield corporate bonds trade against other lower-risk debt instruments. The spread is fairly wide, so it’s paramount to know the fundamentals of every high-yield ‘story’ that, if properly researched, can provide outstanding returns.

Source: seekingalpha.com

This is especially true in volatile markets when riskier assets that pay big yields are called into question. The fear of dividends, distributions and interest payments being cut or eliminated is always an ongoing concern and should be a major consideration when measuring the risk versus reward of high-yield investing. As is with any economic cycle, when the economy is expanding, high-yield assets outperform, and when the economy contracts, so do the prices of high-yield assets.

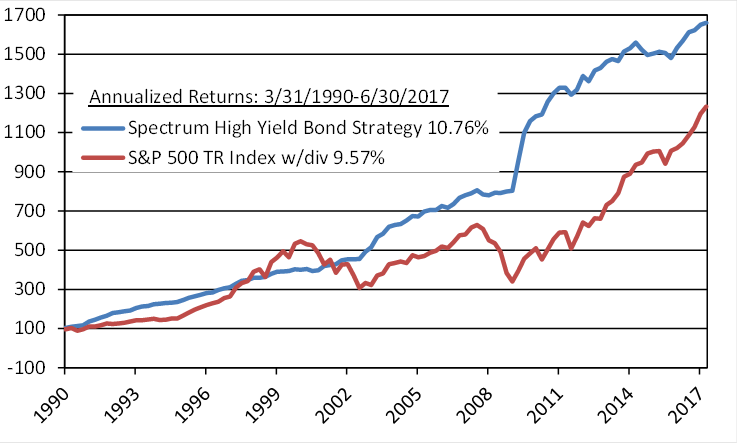

Historically, the corporate credit markets typically rally well ahead of when stocks rally when the economy is expanding and growing. The junk bond market has, in previous economic cycles, been a strong precursor of the future direction of where the stock market is headed. When there are economic tailwinds, the high-yield market typically outperforms the S&P 500 because of the hefty yields generated and rapidly improving creditworthiness of the debt or revenue and earnings prospects.

Just because an asset has a fat yield doesn’t mean it won’t get fatter resulting from a declining underlying stock price. The juicy income produced from a high-yield asset needs to be scrutinized as to whether that income is truly being earned or whether it is a function of extreme leverage, risky derivatives or a return of capital — all of which can and will vary over time.

By definition, high-yield assets are not considered a safe haven. But with the U.S. economy expected to grow by 2.0-2.5% in 2020 and core inflation forecast to be at 1.0-2.0%, high-yield assets that experience bouts of volatility and wide price swings can offer investors an attractive opportunity. Some of the smartest hedge funds in the world focus exclusively on distressed debt, and it is exactly when markets correct or show signs of uncertainty that great buy prices can be realized in solid companies.

High-yield investing is attractive to professional money for the fact that investment capital is always at work, earning income all the time and not just predicated on the hope of capital gains as a key motivator. Most large pension funds have an annual obligation of paying out 7% of assets to their pensioners, so finding assets with yield and potential for some marginal appreciation is what drives much of the high-yield market. The world needs income, and not just 3-4% annual income.

There is a buffet table of high-yield offerings to craft a portfolio that pays out a fantastic yield, but it takes knowing one’s risk tolerance and knowing what you own and why you own it. The bottom line is that it just takes good old-fashioned due diligence to be a successful high-yield investor, which is true in any endeavor that involves risk.

My Cash Machine high-yield advisory service is home to thousands of high-yield investors. Give your portfolio’s income stream a giant raise in 2020. Visit Cash Machine by clicking here and make a New Year’s resolution that really matters.