The best artificial intelligence stocks to buy feature many enticing choices for investors seeking to ride the technological wave into the future.

Artificial intelligence (AI) is an area of computer science that focuses on creating systems that perform tasks requiring human intellect such as visual perception, decision making, translation and speech recognition. The technology holds the potential to shift many functions now handled by people to machines that use artificial intelligence to perform them even better than humans.

“Cut through the utopian talk around AI and it really boils down to automation,” said Hilary Kramer, host of a national radio program called “Millionaire Maker.” “We want machines that can take over the work of people, which means programs sophisticated enough to negotiate obstacles and learn to anticipate them next time. There’s a whole chapter on this in my new book, ‘GameChanger Investing.’ It’s important because when machines learn from their early mistakes, they never make the same mistakes twice. Each generation of thinking machines gets safer, more reliable and more efficient, liberating us from the rote tasks we hate. Think of autonomous cars, communicating with each other to stay out of each other’s way. Think of robot factories that run around the clock.”

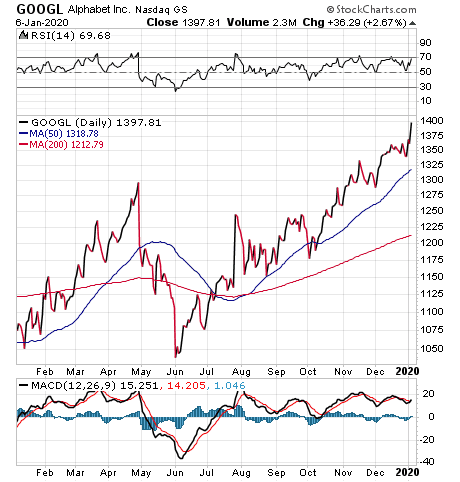

The Best Artificial Intelligence Stocks to Buy Include Alphabet/Google

Kramer, whose 2-Day Trader service has netted profits in 22 of its first 28 trades for an average return of 11.04 percent, said many big companies have invested heavily in AI research.

“Alphabet (NASDAQ:GOOGL) has bet its entire future on developing advertisements that predict consumer behavior,” said Kramer, whose GameChangers advisory service has booked 33 profitable trades in its last 39 closed positions. “Amazon has Alexa gathering data and building its skill library. IBM has Watson. And, of course, the car companies have their own development programs.

Chart courtesy of www.stockcharts.com

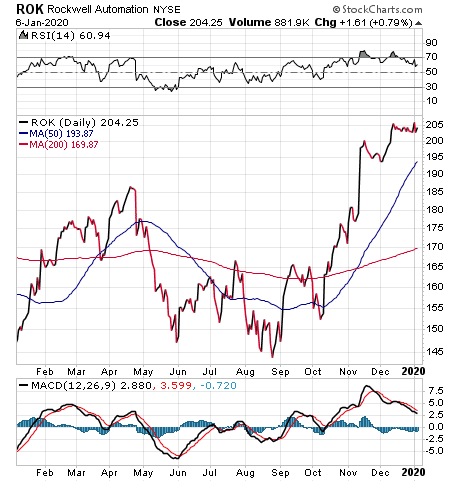

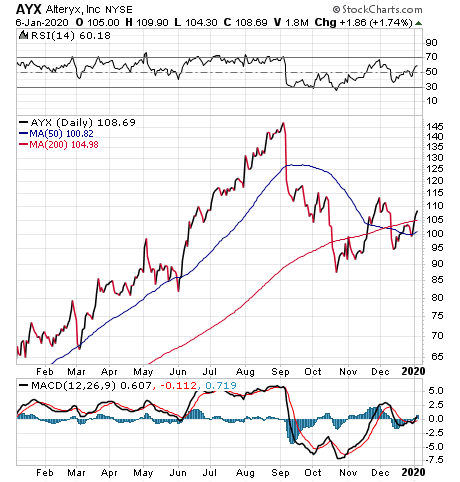

“I prefer to focus on smaller, purer plays like Splunk (NASDAQ:SPLK) and Alteryx (NYSE:AYX), which organize ‘big data’ into patterns that support machine learning. Nutanix (NASDAQ:NTNX) runs the sophisticated networks these devices will need to stay in communication with each other. My Turbo Trader subscribers have made money on that stock in the past. Between them, these companies have a very good chance of getting incorporated into Big Tech brains… either as licensors or, more likely, acquisitions. I’m also fond of Rockwell Automation (NYSE:ROK) as the company that programs the production lines of tomorrow.”

Chart courtesy of www.stockcharts.com

Rockwell Automation also offers a 2.01 percent dividend yield, so it has added appeal for income investors.

Paul Dykewicz interviews Wall Street money manager Hilary Kramer, whose investment advisory services include High Octane Trader and Inner Circle.

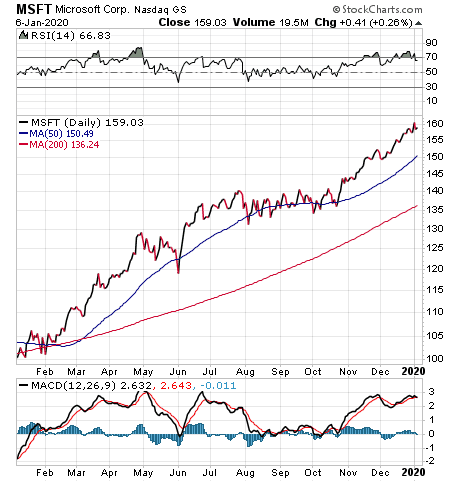

Microsoft Is Another One of the Best Artificial Intelligence Stocks to Buy

AI is a very resource-intensive field, said Bob Carlson, who leads the Retirement Watch advisory service.

“The best way to invest in AI directly probably is to buy stocks of the large software firms that lead in AI development: IBM (NYSE:IBM), Alphabet/Google (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT), Carlson said.

IBM, whose management claims it is the world’s largest IT services company, currently pays an enticing 4.82 percent annual dividend yield. But Morningstar cut its fair value estimate for the stock to $128 from $158 on Oct. 31 amid reduced projections for its future earnings potential due to the disruption of its business from the enterprise cloud transition. IBM has faced declines throughout its diverse IT product offerings due to cloud computing and open source software giving way to a mix-and-match IT infrastructure that now exists for many enterprises, Morningstar added.

Chart courtesy of www.stockcharts.com

Artificial Intelligence Stocks to Buy Build Technology Infrastructure

Microsoft also gives investors an extra reason to own its stock, with a 1.29 percent dividend yield to go along with strong capital appreciation in 2019, as reflected in the chart below. Plus, IBM, Microsoft and Alphabet have the lead in development and the resources to keep expanding and improving in the AI field.

Chart courtesy of www.stockcharts.com

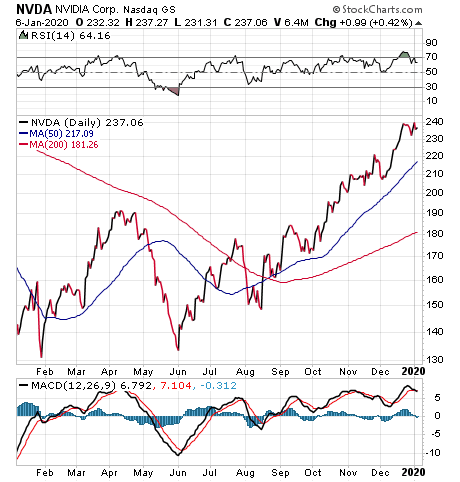

“A safer approach might be to invest in the leading firms that provide the infrastructure that AI needs: cloud computing, data farms and innovative chips,” said Carlson, who serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4.0 billion in assets. “In chips, consider NVIDIA (NASDAQ:NVDA), Intel (NASDAQ:INTC) and Micron Technology (NASDAQ:MU).”

Intel adds further appeal as an investment due to its 2.10 percent dividend yield. NVIDIA currently pays a small dividend yield of just 0.27 percent, so it does not offer much of a bonus for investors who also seek income.

Cloud Computing Companies are Among the Best Artificial Intelligence Stocks to Buy

The cloud computing heavyweights are Microsoft, Amazon (NASDAQ:AMZN) and Google, said Carlson. Microsoft and Google are key players in both software and cloud computing for AI, he added.

Another way to invest in AI’s future growth is through data storage companies, Carlson said.

“AI uses a significant amount of computer power,” Carlson said. “Firms that provide data storage for rent have done well the last few years and are likely to continue to benefit from the spread of AI, in particular, and cloud computing in general. These companies mainly are structured as real estate investment trusts (REITs). Be careful about buying them now. They had strong returns the last couple of years and trade at high valuations. Also, the large users of datacenters, such as Amazon and Google, are more inclined to build their own datacenters now than to outsource. Leading firms in the sector are Equinix (NASDAQ:EQIX), CyrusOne (NASDAQ:CONE) and Digital Realty (NYSE:DLR).”

NVIDIA Is ARK Invest’s Recommended Artificial Intelligence Stock to Buy

James Wang, an analyst with New York-based technology investment firm ARK Invest, said his favorite AI stock right now is NVIDIA Corporation (NASDAQ:NVDA).

The outlook for NVIDIA in 2020 seems strong in the wake of the company expanding its addressable market consistently for the past two years, Wang told me in a phone interview. NVIDIA first emerged as an artificial intelligence chip maker and now has a commanding 98 percent share of the market for providing computer chips for AI training, he added.

Chart courtesy of www.stockcharts.com

AI training is the process by which a machine is fed data to learn on its own about how to perform a task traditionally done by humans, Wang said. All AI algorithms start as blank slates, but they can solve big challenges with the help of computing power. So-called “trained” AI applications are used in large-scale, highly complex cloud datacenters that serve voice, video, image and recommendation services to billions of users.

The world’s largest industries, such as transportation, health care, logistics, manufacturing, robotics, retail and investing, use accelerated computing to unlock the promise of AI.

ARK Invest’s ETF Seeks to Buy the Best Artificial Intelligence Stocks

NVIDIA’s GPUs (graphic processing units) are electrical circuits, or chips, capable of displaying graphics on a computer device. Prior to joining ARK Invest, Wang helped NVIDIA launch GeForce Experience, a PC gaming application with more than 80 million users.

ARK Next Generation Internet ETF (NYSEARCA: ARKW) is an exchange-traded fund (ETF) managed by ARK Invest that has 2.5 percent of its assets invested in NVIDIA, Wang said. The fund invests in the next-generation internet technologies.

Another semiconductor stock with a heavy focus on AI is Xilinx (NASDAQ:XLNX), a leader in developing adaptable chips for various kinds of datacenter workloads, Wang said.

“The stock is trading at reasonable discounts to where it was a few months ago because of ongoing trade wars,” Wang said.

Xilinx, which offers a current dividend yield of 1.49 percent, is making a “push into datacenter hardware,” Wang told me.

Xilinx Again May Become One of the Top Artificial Intelligence Stocks

The stock peaked at $135 in April 2019 and closed at $99.31 on Jan. 6. Xilinx has boosted its dividend for 15 consecutive years, so it has established a clear rising dividend policy.

The stock soared in April 2019 when expectations grew about the prospects of 5G. However, Xilinx fell as the U.S.-China trade war basically banned the purchase in the United States of products from China’s telecommunications giant Huawei Technologies. In May 2019, the U.S. Department of Commerce put Huawei on a national security blacklist that halted the sale of U.S. technology, software and services to the Chinese company.

On the AI software side, Google is in an “interesting position,” Wang said. The company is a world leader in applying AI in widely adopted uses that include Google search queries, autonomous driving and maps, Wang said.

Alteryx Ranks as Another Top Artificial Intelligence Stock to Buy

Alteryx Inc. (NYSE:AYX) is the top AI stock recommended by Bryan Perry, who leads the Cash Machine advisory service. A leader in artificial intelligence analytics, Alteryx is one of the purest plays in that sector, he added.

Chart courtesy of www.stockcharts.com

The stock’s performance will be more reflective of the growth potential of AI than other companies that only include the technology in a segment of their business, said Perry, who also heads the Hi-Tech Trader and Quick Income Trader advisory services.

Cisco Systems (NYSE:CSCO), with a 2.94 percent dividend yield, and Intel (NYSE:INTC), offering a 2.10 percent dividend yield, are among other stocks that have an AI component, Perry said.

“Artificial Intelligence is integral to nearly 100 percent of the activities of hedge funds and proprietary trade firms, better known as prop shops,” Perry said. “Having neural tools on a platform that are always learning and constantly updating by the second provides traders and investors a fluid set of indicators that are hugely advantageous to eliminating risk and raising the probability of consistent positive returns.”

Artificial Intelligence Helps with Investing

What is so attractive about artificial intelligence is that traders and investors can custom tailor how they want an AI program to think and produce information to suit just about any investing style, thereby saving copious amounts of time to screen for the best investing ideas, Perry told me.

“I apply two separate AI-driven algorithms to my trading services that not only select the best stocks and ETFs to trade, but also help establish the points of entry and exit with confidence,” Perry said. “The probability indicators incorporate 10-day and 22-day time horizons for each trade. Trading and investing without the use of AI today seems almost inconceivable.”

Investors have plenty of opportunities to invest in public companies that are engaged in providing artificial intelligence capabilities. The key is to rely on experts to choose the ones that have the greatest potential and pose the least risk.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a motivational foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.