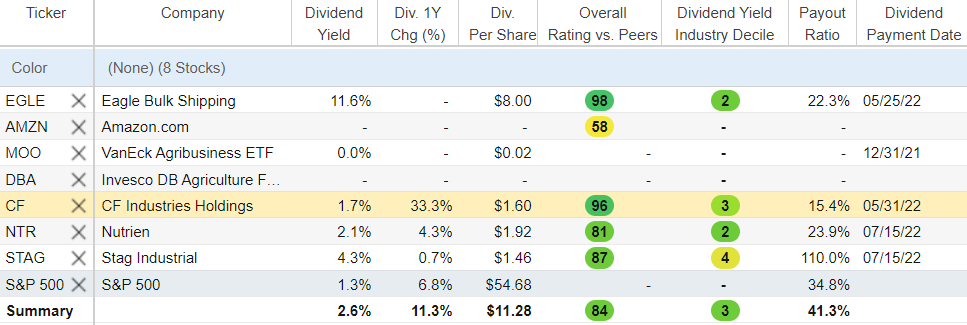

Seven food supply investments to buy present potent ways to profit and help ease a brewing famine faced by roughly 140 million people around the world who live in needy nations.

The importance of the seven food supply investments to buy took center stage Monday, June 6, at the United Nations Security Council when European Council President Charles Michel blamed Russia for causing a global food crisis by stealing and blocking shipment of Ukrainian grain. Russia’s UN ambassador Vassily Nebenzia stormed out of the UN Security Council meeting rather than responding point by point to the evidence cited by Michel or committing to assure food distribution unconditionally.

Russia’s President Vladimir Putin, who triggered the sanctions by sending his troops into Ukraine in violation of international law, previously had said he would require nations to cease those actions before he would allow the export of grain to resume. Russia’s invasion of Ukraine, called a “special military operation” by Putin, has shelled hospitals, schools, residential areas, churches, nuclear power plants, oil refineries and a theater used as a shelter, amid reports of his soldiers raping, torturing and executing Ukrainian civilians.

Seven Food Supply Investments to Buy Offer Shield from War

As Nebenzia left the Security Council meeting, Michel said Russia’s ambassador may not want to hear the truth. The 27-nation European Union (EU) voted on Tuesday, May 31, to remove 90% of its Russian crude oil imports in 2022 to limit funds that could be used to sustain the nation’s ongoing military action in Ukraine.

“The EU has no sanctions on the agricultural sector — zero,” Michel said in his speech at UN headquarters in New York. “And even our sanctions on the Russian transport sector do not go beyond our EU borders.”

The sanctions do not prevent Russian-flagged vessels from carrying grain, other food or fertilizers to developing countries, Michel continued. He also spoke out against sexual violence and other war atrocities reportedly committed by Russian forces in Ukraine.

Western leaders have urged their Russian counterparts to open ports and shipping corridors in the Black Sea to allow the transport of millions of tons of grain grown in Ukraine, a major agricultural producer. Russia has used its military might to capture important port cities such as Mariupol and Kherson, while also imposing a blockade on Ukraine’s imports and exports.

European Commission President von der Leyen cautioned that Russia is weaponizing food supplies as prices of grain, cooking oil and other food commodities climbed after Putin ordered the invasion of Ukraine, one of the world’s largest wheat producers. In the industrial part of Ukraine that Russia is occupying and attacking to seize land, Putin’s army is confiscating grain stocks and machinery, she said during a May 24 address at the World Economic Forum in Davos, Switzerland.

“When war is waged, people go hungry,” said UN Secretary‑General António Guterres at a May 19 Security Council open debate on conflict and food security, adding that 60% of the world’s 140 million undernourished people live in areas affected by conflict.

Ukraine normally provides food for 400 million people, said David Beasley, executive director of the UN World Food Programme, at the same May 19 Security Council event. The United Nations is trying to provide humanitarian assistance inside Ukraine, but its ports need to operate for 36 countries to import more than 50% of their grain from that region, he added.

For example, Ukraine and the Russian Federation had been exporting 67% of the world’s sunflower oil, according to the UN. In 2021, Ukraine itself exported more than $27 billion in agricultural products to the world.

Click here for a free two-week trial of Stock Rover.

Eagle Bulk Shipping Leads Seven Food Supply Investments to Buy

Eagle Bulk Shipping Inc. (NASDAQ: EGLE) recently became a recommendation in the Fast Money Alert advisory service co-led by Mark Skousen, PhD, and Jim Woods. They described the company as a “fast-money” shipping stock that is breaking out to new highs.

The company operates in the shipping and logistics industry and is engaged in the ocean transportation of dry bulk cargoes through the ownership, charter and operation of dry bulk vessels. Eagle Bulk Shipping’s fleet is comprised of Supramax and Ultramax bulk carriers.

Eagle’s services include commercial operations and technical supervision, vessel maintenance and repair, vessel acquisition and sale, finance, accounting, treasury and information technology services and legal, compliance and insurance. It transports a broad range of major and minor bulk cargoes, including coal, grain, ore, pet coke, cement and fertilizer.

Paul Dykewicz meets with Jim Woods, leader of the Successful Investing and Intelligence Report newsletters, plus High Velocity Options and Bullseye Stock Trader.

Improved Delivery Can Aid Seven Food Supply Investments to Buy

With optimism that supply chain issues are will be resolved in the months ahead, the world should return to demanding more and more goods and services, Skousen and Woods wrote to their subscribers. Those goods are transported by big cargo ships such as those operated by EGLE.

“That business has been fantastic of late, with the company growing its earnings per share (EPS) some 396% in its most recent quarter vs. the same quarter last year,” they reported in Fast Money Alert.

That move higher in earnings has resulted in a 76.92% jump upward in EGLE stock so far in 2022. Yet, EGLE may not be overextended. In fact, it’s just breaking out of a bullish base-building pattern that’s developed over the past month.

Chart courtesy of www.stockcharts.com

The chart above shows EGLE’s climb in recent few weeks. The soaring stock price has jumped 8.95% in the past week, 15.20% in the last month, 45.39% in the past three months and 82.68% for the past year.

Amazon Earns Spot Among Seven Food Supply Investments to Buy

Amazon (NASDAQ: AMZN) became a major provider of food in 2017 when it paid $13.7 billion to acquire Whole Foods Market, Inc. The company gained even more appeal after its recent 20-for-1 stock split.

A stock split by itself does not increase the value of a company, since the market capitalization stays the same. But it cuts the price of a stock to allow additional shares to be bought for the same amount of money.

Amazon’s price drop since April gained the attention of Skousen, who recently recommended it in his TNT Trader service. Skousen, who also leads the Forecasts & Strategies investment newsletter and the Five Star Trader, Home Run Trader, Fast Money Alert services, picked a good time to recommend the stock as began to recover and has risen more than 20% since he added it to his TNT Trader portfolio.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

There are two key reasons for a stock split, Skousen said. One is to give a psychological lift to investors who may prefer to own more shares for the same amount of money. A second reason is that individual investors may shy away from companies whose stock is priced at $1,000 or more for a single share.

An extra reason for Amazon to pursue a stock split is to position it to one day become part of the Dow Industrials Average. The Dow typically will not take on any stock whose price is too high, Skousen said.

Chart courtesy of www.stockcharts.com

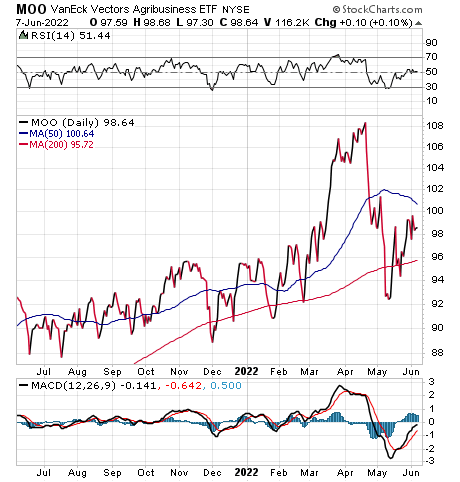

Seven Food Supply Investments to Buy Include MOO

Another food supply investment to buy is ETF VanEck Agribusiness (NYSE ARCA: MOO). I bought shares in the fund years ago to tap the growing need for food from a finite supply of land that increasingly is used for development.

Bob Carlson, a pension fund manager who also leads the Retirement Watch investment newsletter, recommends the fun to track the MVIS Global Agribusiness Index. The index is composed of companies that generate at least 50% of their revenues from agrichemicals, animal health and fertilizers, seeds and traits, farm/irrigation equipment, farm machinery, aquaculture, fishing, livestock and more.

Bob Carlson, who leads Retirement Watch, meets with Paul Dykewicz.

MOO’s largest holdings recently included Deere & Co. (NYSE: DE), Nutrien (NYSE: NTR), Bayer (OTCMKTS: BAYRY), Zoetis (NYSE: ZTS) and Archer-Daniels Midland (NYSE: ADM). The ETF owns more than 50 stocks and has nearly 60% of its holdings in the 10 largest positions.

Chart courtesy of www.stockcharts.com

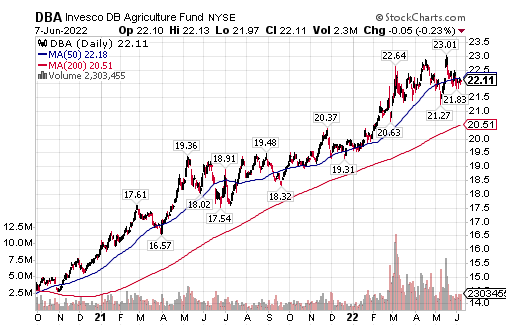

Carlson Chooses DBA to Join Seven Food Supply Investments to Buy

Another ETF that Carlson recommends offers exposure to diversified agriculture commodities through Invesco DB Agriculture (DBA), Carlson said. The fund seeks to track changes in the DBIQ Diversified Agriculture Index Excess Return.

The ETF also earns interest income from cash it invests primarily in Treasury securities, while holding them as collateral for futures contracts. The major holdings in the index are soybeans, wheat, corn, coffee and live cattle. The index is reconstituted each November.

Chart courtesy of www.stockcharts.com

Fertilizer Stocks Are Among Seven Food Supply Investments to Buy

Both funds favored by Carlson also are recommended by Bryan Perry, who heads the Cash Machine investment newsletter, as well as the Premium Income, Quick Income Trader, Hi-Tech Trader and Breakout Options Alert advisory services. Perry also is a fan of fertilizer manufacturers as investments.

Such companies are likely to profit from Russia’s attack against Ukraine, a major agricultural producer, Perry said. “Demand destruction” may occur in energy markets but will not reduce the need for food, he added.

Paul Dykewicz interviews Wall Street veteran Bryan Perry, who heads the Cash Machine newsletter.

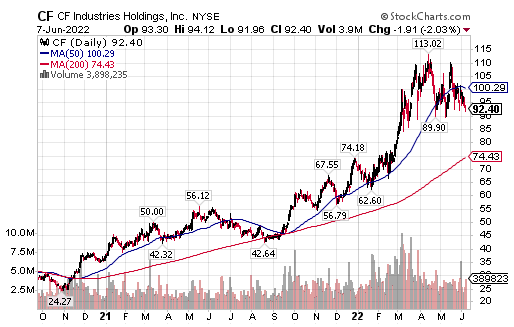

CF Industries Listed Among Seven Food Supply Investments to Buy

Wheat, corn and soybean prices jumped after Russia attacked of Ukraine, Perry continued. One of the big winners from pure demand and sanctions will be CF Industries Holdings, Inc. (NYSE: CF), a manufacturer and distributor of agricultural fertilizers that include ammonia. The company, based in the Chicago suburb of Deerfield, Illinois, is incurring increased distribution costs, particularly for transportation.

In addition, the cost of producing nitrogen fertilizers is highly dependent on the cost of natural gas, a principal raw material and primary fuel source used in ammonia production at the company’s manufacturing facilities. For many producers, more than 70% of the total cost to produce ammonia is due to the cost of natural gas.

The cost of natural gas varies significantly between geographic locations. For example, European customers are seeing their fertilizer prices rise.

Chart courtesy of www.stockcharts.com

Seven Food Supply Investments to Buy Also Include Nutrien

Nutrien Ltd. (NYSE: NTR), a Canadian fertilizer company based in Saskatoon, Saskatchewan, is the largest producer of potash and the third-largest producer of nitrogen fertilizer in the world. The company’s interim chief executive Ken Seitz said Nutrien will boost potash production if supply problems worsen in Russia and Belarus, the world’s second- and third-largest potash-producing countries, respectively, after Canada.

The economic sanctions imposed by the United States, the EU and others against Russia may hurt the warring country’s exports of natural gas, potash and nitrogen. Belarus, a puppet state of Russia, has joined the invasion of Ukraine and must adjust to economic sanctions that have restricted its potash exports.

The decision by Putin to wage war against Ukraine further has raised concerns about wheat, corn and vegetable oil supply problems in the Black Sea region. The result is sharply rising world prices for these agricultural products.

Chart courtesy of www.stockcharts.com

REIT Rates Among Seven Food Supply Investments to Buy

Real estate investment trusts (REITs) that focus on distribution centers benefit from food inflation, said Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management. One of the largest customers of distribution and industrial centers are the food and beverage industries, she added.

The use of multiple distribution centers reduces shipping costs for food and beverage companies. For example, a beverage business that does business on the West Coast and the East Coast benefits from having nearby distribution centers. Shipping from a close distribution center to a retail facility reins in costs.

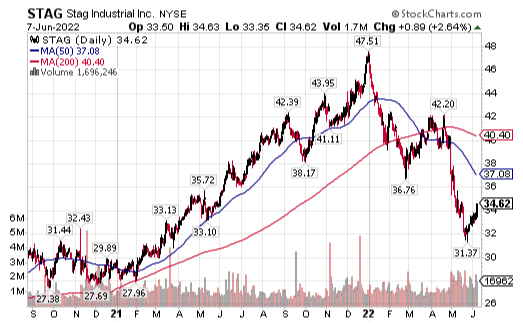

Connell said her top choice for a REIT engaged in storage and warehousing is Boston-based Stag Industrial Inc. (NYSE: STAG). Distribution centers became more imperative during the pandemic due to the switch from bricks and mortar to online shopping, she added.

“The demand for distribution centers is expected to continue to grow,” Connell continued. “While e-commerce sales have grown 167% in the past five years, they are expected to grow another 50% in the next five years.”

Chart courtesy of www.stockcharts.com

U.S. Soon May Gain a Fourth COVID-19 Vaccine Choice

Food and Drug Administration (FDA) advisors agreed Tuesday, June 7, to recommend a more traditional type of shot as a potential fourth vaccine choice. The next step would be for the FDA to decide whether to approve the protein vaccine of Gaithersburg, Maryland-based Novavax (NASDAQ: NVAC).

COVID-19 vaccines from Novavax already are available in Australia, Canada and parts of Europe, as well as other countries. Its vaccines can be used for initial doses or booster shots.

Pfizer (NYSE: PFE), Moderna (NASDAQ: MRNA) and a lesser-used vaccine from Johnson & Johnson (NYSE: JNJ) currently are approved for use of their respective versions in America.

Increased U.S. vaccinations should be good for the American economy, businesses, consumers and workers. The restrictions of the past before vaccines became widely available in the United States led many businesses to close.

Supply Chains Should Recover as China Scales back COVID-19 Curbs

China’s economic center of Shanghai is trying to rebound economically after easing its two-month lockdown to prevent the spread of COVID-19. Supply chains that had been disrupted now are starting to normalize again but further progress is needed. China’s lockdowns have affected an estimated 373 million people, including roughly 40% of the country’s gross domestic product (GDP).

Disrupted supply chains hurt supply of products such as rice, oil and natural gas. Shanghai, home to 25 million residents and the world’s largest port, has strained to unload cargo due to strict regulations that have caused shipping containers to stack up. Some Shanghai residents posted videos online that went viral to complain about a lack of food during the lockdown.

U.S. COVID Deaths Top 1 Million and Keep Climbing

U.S. COVID-19 deaths rose more than 2,300 in the past week to reach 1,009,325, as of May June 7, according to Johns Hopkins University. Cases in the United States jumped about 80,000 in the last week to hit 85,003,945. America retains the dreaded distinction as the country with the highest numbers of COVID-19 deaths and cases.

COVID-19 deaths worldwide totaled 6,302,240 on June 7, according to Johns Hopkins. Cases across the globe have grown in the last week to 533,033,968.

Roughly 78% of the U.S. population, or 258,865,995, have obtained at least one dose of a COVID-19 vaccine, as of June 7, the CDC reported. Fully vaccinated people total 221,559,553, or 66.7%, of America’s population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to 104 million people, up more than 400,000 in the past week, compared to a 500,000 jump the week before.

The seven food supply investments to buy can help investors to profit while alleviating the world’s growing hunger problem. With the highest inflation in 40 years, the Fed’s plan for further interest rate hikes to limit price hikes, rising federal deficits and Russia’s unrelenting deadly attacks on Ukraine, these seven food supply investments to buy offer potential profitability and protection.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

![[tractor mowing wheat]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_48384775.jpg)