Five agricultural investments to buy in response to Russian President Vladimir Putin’s unprovoked attack on Ukraine should benefit from newly announced economic sanctions that countries around the world have placed against the former KGB agent and the invading nation he leads.

The five agricultural investments to buy in response to Russia’s invasion of neighboring nation Ukraine will be helped by the pressure Putin is starting to face to stop military actions that include brutally bombing civilian targets. Putin’s deployment of an estimated 150,000 Russian troops in Ukraine has resulted in a 40-mile convoy that is heading toward the country’s capital of Kiev.

Russia’s attack on Ukraine jeopardizes the agricultural capabilities of the sovereign nation that Putin has invaded from the land, air and sea, while triggering the European Union, the United States, Japan, South Korea, Australia and others to limit the attacking country’s exports and access to financial transactions. The purpose of the sanctions is to restore peace in Ukraine. That country and Russia produce a combined 57% of sunflower seed, safflower and cotton seed oil, 26% of wheat and Meslin, and 24% of barley worldwide.

Five Agricultural Investments to Buy as Putin Accused of Possible ‘War Crimes’

The International Criminal Court’s chief prosecutor announced plans to investigate Putin’s actions “as rapidly as possible” for potential war crimes carried out by troops following the Russian leader’s orders. Ukraine, home to citizens trying to defend their freedom against a much bigger and better equipped military force, is facing “barbaric tactics” that include attacking hospitals, kindergartens, residential areas and other civilian targets, said Boris Johnson, the British prime minister.

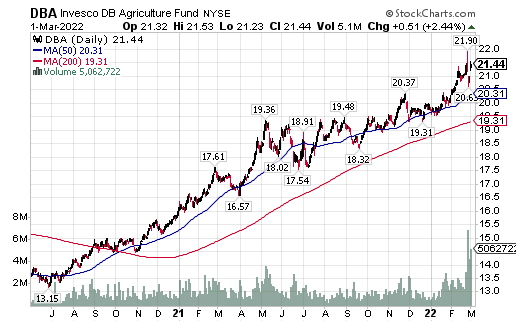

Despite the horrors of war, investors have a chance to profit from the surge in agriculture prices and other commodities through the futures markets. Instead of buying futures directly, investors can invest in a diversified agriculture commodities through Invesco DB Agriculture (DBA), an exchange-traded fund, said Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter.

The fund seeks to track changes in the DBIQ Diversified Agriculture Index Excess Return. The ETF also earns interest income from cash it invests primarily in treasury securities while holding them as collateral for the futures contracts.

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

The major holdings in the index are soybeans, 13.6%; wheat, 12.9%; corn, 12.6%; coffee, 12.1%; and live cattle, 11.6%. The index is reconstituted each November.

The fund is up 2.43% in the last four weeks and 4.76% for the year to date.

Chart courtesy of www.stockcharts.com

Perry Picks Four of Five Agricultural Investments to Buy

Efforts to thwart Putin’s plan to bombard Kiev and other key cities in Ukraine have not been successful, said Bryan Perry, who leads the Cash Machine investment newsletter, as well as the Premium Income, Quick Income Trader, Breakout Options Alert and Hi-Tech Trader services. Despite heavy sanctions, financial chokeholds on its banking system and a crash in the value of the ruble, Putin and the Kremlin seem intent on taking full control of Ukraine, installing a client-state government and maintaining a non-NATO buffer nation between Russia and Europe, he added.

“The global reaction is one of shock and amazement that such nation-on-nation aggression could still take place in this day and age, but Putin’s incursions into Georgia, Crimea and Belarus show a clear pattern of his desire to rebuild Russia back to the pre-1991 split-up of the Soviet Union,” Perry wrote to his Cash Machine subscribers on March 1. “He is a man of tyrannical character and rules though fear and violence. Sadly, the current generation of young Ukrainians and Russians are bewildered this is all happening like something out of the 1979-1985 cold war when Russia invaded Afghanistan under sharp criticism from the West.”

Against this surreal backdrop, the market rebound from late last week is giving way to concerns about how the Ukraine situation plays out, as well as the impact on global supply chains with Russia being such a global powerhouse in commodities.

Paul Dykewicz interviews Bryan Perry, who heads the Cash Machinenewsletter.

Fertilizer Stocks Are Among Five Agricultural Investments to Buy

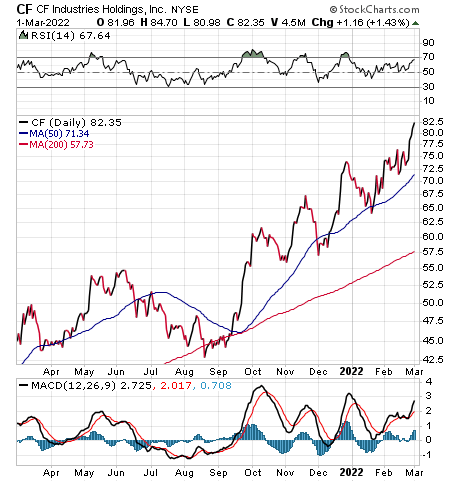

Fertilizer manufacturers appear most likely to profit from Russia’s attack against Ukraine, Perry said. While there may be “demand destruction” in the energy sector, there won’t be in the global food supply and demand curves, he added.

Wheat, corn and soybean prices jumped upon the full revelation of the Russian attack of Ukraine, Perry continued. One of the big winners from pure demand and sanctions will be CF Industries Holdings, Inc. (NYSE: CF), a manufacturer and distributor of agricultural fertilizers, including ammonia. The company, based in Deerfield, Illinois, a suburb of Chicago, is facing increased distribution costs, particularly for transportation.

In addition, the cost of producing nitrogen fertilizers is highly dependent on the cost of natural gas, which is the principal raw material and primary fuel source used in ammonia production at the company’s manufacturing facilities. For many producers globally, more than 70% of the total cost to produce ammonia is from the cost of natural gas.

The cost of natural gas varies significantly between geographic locations. European customers may see their burden grow, since natural gas prices have been surging there.

Chart courtesy of www.stockcharts.com

Five Agricultural Investments to Buy Include Nutrien

Nutrien Ltd. (NYSE: NTR), a Canadian fertilizer company based in Saskatoon, Saskatchewan, is the largest producer of potash and the third largest producer of nitrogen fertilizer in the world. The company’s interim chief executive Ken Seitz said Nutrien will boost potash production if supply problems worsen in Russia and Belarus, the world’s second- and third-largest potash-producing countries after Canada.

The economic sanctions imposed by the United States, the European Union and other countries against Russia may hurt the country’s export of natural gas, potash and nitrogen. Belarus, a puppet state of Russia, has joined the invasion of Ukraine and also must adjust to economic sanctions that have restricted its potash exports.

The decision by Putin to wage war against Ukraine further has raised concerns about wheat, corn and vegetable oil supply problems in the Black Sea region. The result is rising world prices for these agricultural products.

Chart courtesy of www.stockcharts.com

CVR Partners LP Earns Berth Among Five Agricultural Investments to Buy

CVR Partners LP (NYSE: UAN), of Sugar Land, Texas, manufactures and provides nitrogen fertilizer products as a subsidiary of Coffeyville Resources, a unit of CVR Energy Inc. UAN is another recommendation of Perry, who especially likes its 9.1% dividend yield that should interest income seekers.

The company’s nitrogen fertilizer manufacturing facility includes a 1,300-ton-per-day ammonia unit, a 3,000 ton-per-day urea ammonium nitrate (UAN) unit and a dual-train gasifier complex that can produce 89 million standard cubic feet of hydrogen per day. The UAN solution, produced by combining urea, nitric acid and ammonia, is a liquid fertilizer product with a nitrogen content that typically ranges from 28 percent to 32 percent.

UAN can be applied more uniformly than non-liquid forms of fertilizer. The solution also can be mixed with herbicides, pesticides and other nutrients to let farmers cut costs by applying several materials simultaneously rather than making separate applications.

Chart courtesy of www.stockcharts.com

Mosaic Jumps Among Five Agricultural Investments to Buy

Mosaic Company (NYSE: MOS), a Fortune 500 company headquartered in Tampa, Florida, mines phosphate and potash and urea. The largest U.S. producer of potash and phosphate fertilizer, Mosaic operates through segments such as international distribution and Mosaic Fertilizantes.

Russia is a big producer of potash, a key crop nutrient that is used in agricultural production. Mosaic reported solid earnings on Feb. 22 that basically were in line with expectations.

The company’s year-over-year earnings per share (EPS) growth jumped about 242%. That report, along with the price pressure in the industry from constricted supply out of Russia, has resulted in a big surge in the value of MOS call options that recently were recommended by Jim Woods in his High Velocity Options service.

On March 1, Woods recommended that his subscribers take profits after the options soared in value by 150% in just one week. That triple-digit-percentage gain exemplifies how options can be such a big money maker.

Chart courtesy of www.stockcharts.com

White House Expected to Reveal New COVID-19 Strategy

The White House is expected to unveil a new strategy laying out the next phase of its response to COVID-19 on Feb. 2, according to news reports. The Biden administration is supposed to outline a plan that would include fewer disruptions to daily life while preparing for the potential of another coronavirus variant.

The Centers for Disease Control and Prevention (CDC) reported that the variants still are spurring people to obtain COVID-19 boosters. But more than 60 million people in the United States remain eligible to be vaccinated but have not done so, said Dr. Anthony Fauci, the chief White House medical adviser on COVID-19.

As of March 1, 253,629,644 people, or 76.4% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. Those who are fully vaccinated total 215,677,777, or 65% of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of March 2, topped the 5.9 million mark to hit 5,964,704, according to Johns Hopkins University. Worldwide COVID-19 cases have zoomed past 438 million, reaching 438,535,937 on that date.

U.S. COVID-19 cases, as of March 2, soared beyond 79 million, totaling 79,091,360 and causing 952,423 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five agricultural investments to buy are positioned to profit, despite Putin’s invasion of Ukraine. With inflation, the Russia-Ukraine conflict intensifying and economic sanctions against Russia taking hold, agricultural investments should keep climbing in value during the weeks and months ahead.

![[tractor mowing wheat]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_48384775.jpg)