Cisco Systems’ stock price climb and dividend yield offer appeal for investors who want to buy shares in a technology stock that will pay them to stay patient amid any upcoming market pullbacks.

Cisco Systems Inc. (NASDAQ:CSCO), a developer, manufacturer and seller of networking hardware, telecommunications equipment and other high-technology services and products, overcame the challenge of trade tariffs in its previous quarter and may be able to do again. The company’s top leaders mitigated almost the entire effect of 25 percent tariffs by improving its supply chain position and by selectively boosting its prices, Goldman Sachs wrote.

The success allowed Cisco Systems’ management team to raise the guidance for its 2019 fourth fiscal quarter that will close on July 27 and led Goldman Sachs analysts to write that the forecast could be “conservative.” Goldman Sachs affirmed its “buy” rating on Cisco Systems and its 12-month target price on the company of $62, or 13.62 percent above the stock’s closing price of $54.74 on July 1.

Trade Tariff Mitigation Aids Cisco Systems’ Stock Price

For the fiscal 2019 third quarter, Cisco Systems reported revenues 0.5 percent above consensus analysts’ estimates and earnings per share 1 percent above consensus due to better-than expected profit margins. Despite the challenge of navigating through trade tariffs, Cisco Systems’ fiscal year 2019 fourth-quarter revenue guidance of $13.21-$13.46 billion topped consensus expectations by 0.3 percent, Goldman Sachs wrote.

Cisco Systems’ latest fiscal third quarter produced revenue of $13.0 billion, net income on a generally accepted accounting principles basis of $3.0 billion, or $0.69 cents a share, and a non-generally accepted accounting principles (GAAP) net income of $3.5 billion, or 78 cents a share. Its revenue rose 6 percent from fiscal year 2018’s third quarter, after factoring out the sale of Cisco Systems’ Service Provider Software Solutions business in the second quarter of fiscal year 2019. GAAP earnings per share (EPS) jumped 23 percent in fiscal year 2019’s third quarter, compared to the same quarter of fiscal year 2018, while non-GAAP EPS climbed 18 percent in fiscal 2019’s third quarter, compared to the third quarter of fiscal 2018.

Cisco Systems’ GAAP total gross margin of 63.1 percent, product gross margin of 63.7 percent and service gross margin of 66.3 percent in fiscal year 2019’s third quarter improved from 62.3 percent, 61.0 percent and 65..8 percent, respectively, for the same quarter of fiscal 2018. On a non-GAAP basis, the company’s fiscal 2019 third-quarter total gross margin, product gross margin and service gross margin hit 63.1 percent, 62.0 percent and 66.3 percent, respectively, compared with 64.5 percent, 63.7 percent and 67.1 percent in fiscal 2018’s third quarter.

Dividend Payments Help to Protect Cisco Systems’ Stock Price

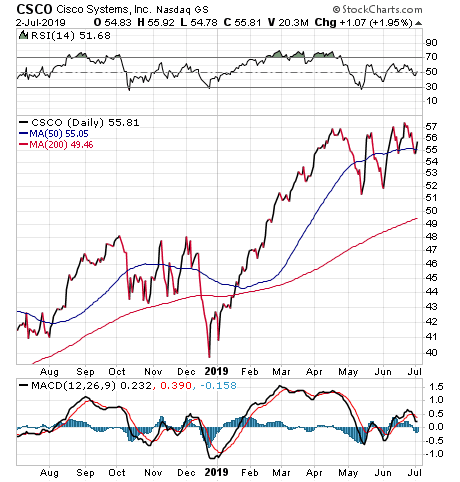

Chart courtesy of stockcharts.com

Mark Skousen, who heads the Forecasts & Strategies investment advisory service, recommends Cisco as one of his Flying Five stocks that feature the five lowest-priced stocks among the 10 highest-yielding of the Dow Jones 30. He has followed the technical method of finding dividend-paying bargain stocks since 1994 and it generally has proven profitable.

However, the Flying Five did not keep up with the high-tech boom of the late 1990s and the strategy further faltered in 2008, when three of the Flying Five stocks stopped paying dividends. Since then, the Flying Five strategy consistently has beaten the market.

Skousen recommended Cisco in July 26, 2016, and has kept it in his Forecasts & Strategies Flying Five portfolio since then to produce a dividend-aided total return of 92.64 percent through the close of trading on Tuesday, July 2. The stock has soared so far in 2019, with a dividend-adjusted total return of 31.37 percent through July 2.

Cisco Systems offers a current dividend yield of 2.56 percent and has initiated a rising dividend policy to boost its payout each year. It also supported its stock price by repurchasing $6 billion worth of shares in the third quarter of fiscal year 2019 and it still is authorized to repurchase an additional $18 billion of its stock.

U.S.-China Trade Truce Fails to Fuel Cisco Systems’ Stock Price

Cisco has been locked in a global competitive struggle against China’s Huawei for years, which means that efforts to level the playing field through trade talks could bring the American company relief, said Hilary Kramer, a Wall Street money manager who leads the Value Authority, GameChangers, Turbo Trader, High Octane Trader and Inner Circle advisory services for individual investors.

“On one side, you’ve got the high-end high-performance technology leader, tackling the business of moving data across networks as a research-intensive enterprise,” Kramer said. “It costs a lot of money to keep packing more ports and more connections into every device every year to keep up with network loads. Cisco passes that research and development (R&D) cost on to customers who need the speed.”

On the other side, there is Huawei, which treats networking as a commodity business where simply throwing enough routers and switches at the problem is the right solution, provided of course that the equipment is built cheaply enough and replaced in large volumes when it breaks, Kramer continued. These aren’t quite disposable devices, but the lowest-cost approach definitely appeals to small, price-sensitive enterprise customers with limited budgets, she added.

“Plug it in, use it until it breaks, throw it away and buy another one,” Kramer said in explaining that purchasing strategy. “Both companies will get you running. Huawei will get you running cheaper. It’s no wonder that Cisco sales have stalled at barely 1 percent annualized growth since 2012, while Huawei has expanded its share of the global Ethernet universe from 2 percent to 8 percent over that period.”

Huawei’s Pricing Slashing Held Back Cisco Systems’ Stock Price

The competition between Cisco and Huawei has left the American company “trapped in an increasingly rarefied premium market position” but also forced it to make concessions on pricing to keep Huawei from taking away big customers, Kramer said.

“Think of Apple without its luxury brand cachet: while Cisco devices perform better, it’s up to the company’s sales team to communicate the long-term value to people whose natural impulse is to go with the cheapest solution,” Kramer said. “Ultimately, Cisco has reacted by cutting R&D programs, giving up the high end of the market to more nimble and niche-oriented startups. It’s a defensive strategy. Sales and margins haven’t eroded, but year by year the company becomes a little less vibrant and a little less relevant to the future of networking.”

Trump’s Concession to China’s Huawei May Pressure Cisco Systems

President Trump’s recent agreement to let American suppliers resume selling to Huawei during a discussion with China’s President Xi at the G20 talks in Osaka, Japan, could start to pressure Cisco’s stock price in the months ahead. However, Kramer said her informal model suggests that Cisco can recover at least $1 billion a year in sales from Western customers that would have once been tempted to go to China or demand price breaks from Cisco Systems in exchange for more advanced technology.

“That’s not huge when you’re dealing with a $50 billion run rate, but it starts nudging growth back in the right direction for the first time in ages,” Kramer said. “Admittedly, it takes time for those purchasing plans to swing from blacklisted vendors and Cisco now needs to make sure it can build solutions for enterprises that could only afford Huawei in the first place. The impact this year will be minimal, maybe an extra percentage point of sales growth.”

Once those devices are in place, Cisco can then market added services to the network operators to squeeze incremental cash out of every sale, Kramer said. In the meantime, that slice of global network capacity is not up for renegotiation until the devices wear out or technology renders them obsolete, she added.

Cisco Systems’ Stock Price May Benefit from Prolonged Trade War

Even if the U.S.-China trade war ends, Huawei remains locked out of those potential sales for at least the current replacement cycle, Kramer said. It may reset the competitive clock two or three years for Cisco, she added.

“What interests me is that instead of a zero-sum future, the company now has those years to use as productively as it can,” Kramer said. “It’s a breathing space — a time out. I’m not buying the stock yet but I definitely would not sell it here either.”

Back in 2016, Cisco was in a “deep funk” and not even producing a 13 times earnings price-to-earnings multiple, while Huawei undercut its pricing, Kramer said.

“Investors are getting excited to see what the once-and-future giant can do with a chance to catch its competitive breath,” Kramer said. “Here at 18 times earnings, a lot of good news is already built into the stock. I’d probably nibble on dips down to $50.”

U.S.-China Trade Truce Fails to Fuel Cisco Systems’ Stock Price

“The trade conflict with China was the only thing holding back Cisco’s stock price the last few months,” said Bob Carlson, who heads the Retirement Watch investment advisory service. “The company’s doing well in a range of key technology sectors, sells at a reasonable valuation and has an attractive dividend yield. If the trade conflicts are on the way to being resolved, only a recession would hold down the stock’s price.”

Cisco Systems remains a technology leader and has impressed Goldman Sachs and others with its improved performance, despite the ongoing trade tariffs. If the company’s management can stay on that course, its shareholders could be rewarded with a double-digit-percentage return during the next year.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.