Five biopharmaceutical stocks to buy to seize upon genetic advances still appear to have room for plenty of appreciation, according to seasoned market trackers who I asked to provide recommendations.

The five biopharmaceutical stocks to buy to tap into genetic research inroads include companies that collectively are seeking to find effective treatments for amyotrophic lateral sclerosis (ALS) and muscular dystrophy, among others. As a former fundraiser for the Muscular Dystrophy Association (MDA) when I attended graduate school, I am among those who are hoping for long-sought treatments for that disease and many others that genetic research holds the promise to deliver.

“Biotechnology stocks have been doing well recently, and that’s likely to continue,” said Bob Carlson, leader of the Retirement Watch investment newsletter. “Companies continue to announce breakthroughs, and a number of biotech companies are going public.”

Pension fund and Retirement Watch leader Bob Carlson takes questions from Paul Dykewicz.

“The field of genomic medicine is one of the most promising new areas in medicine,” said Jim Woods, editor of Intelligence Report and Successful Investing. “Some of my favorites in the space are CRSP, BNGO and NTLA, but those aren’t the only ones.”

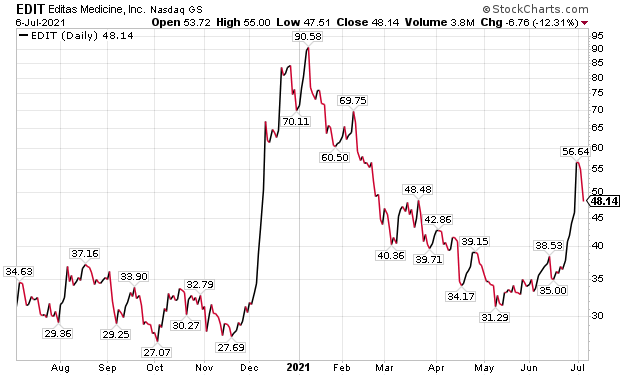

Source: Stock Rover. Click here to sign up for a free two-week trial.

Five Biopharmaceutical Stocks to Buy Include CRISPR Therapeutics

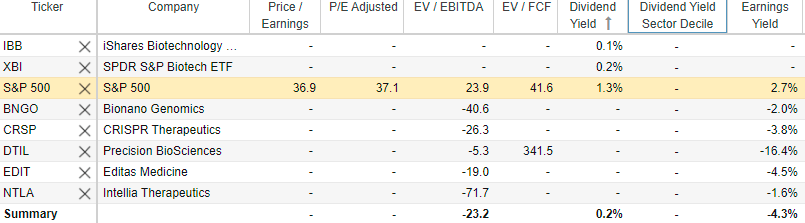

CRISPR Therapeutics (NASDAQ:CRSP), a Swiss-American biotechnology company headquartered in Zug, Switzerland, received an upgrade to “outperform” by Evercore ISI on May 13, along with a price target of $125 that the company has blown past in less than two months. The stock also roared beyond its $134 price target set by Citi when it boosted a rating on the stock to “neutral” from “sell” on June 11.

CRISPR Therapeutics is a biopharmaceutical company focused on developing what its management describes as “transformative, gene-based medicines” for serious diseases. It formed a partnership with Capsida Biotherapeutics Inc, a biotechnology company dedicated to developing breakthrough gene therapies using fully integrated adeno-associated virus (AAV) engineering. The two companies will collaborate to research, develop, manufacture and commercialize in vivo gene editing therapies that are delivered with engineered AAV vectors to treat familial amyotrophic lateral sclerosis (ALS) and Friedreich’s ataxia.

Partnership Propels One of the Five Biopharmaceutical Stocks to Buy

Under the agreement, CRISPR Therapeutics will lead research and development of the Friedreich’s ataxia program and perform gene-editing activities for both programs, while Capsida will spearhead research and development of the ALS program and conduct capsid engineering for both endeavors. Capsida’s high-throughput AAV engineering platform generates capsids designed to target specific tissue types and to limit transduction of tissues and cell types that are not relevant to the target disease in hopes of improving efficacy and safety.

CRISPR Therapeutics and Capsida each have the option to co-develop and co-commercialize the program that the other company leads. The companies would share equally all research, development and commercialization costs and profits of the collaboration.

Chart courtesy of www.StockCharts.com

Woods Chooses Three of the Five Biopharmaceutical Stocks to Buy

Woods wrote in June that CRSIPR announced positive data from clinical trials for CTX001, a potential one-time therapy under development with it and Boston-based Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) for patients suffering from transfusion-dependent beta thalassemia and severe sickle cell disease.

“Blood disease therapies and other debilitating diseases that can be treated and cured by genomic companies are the next phase of this profoundly promising medical technology,” Woods opined.

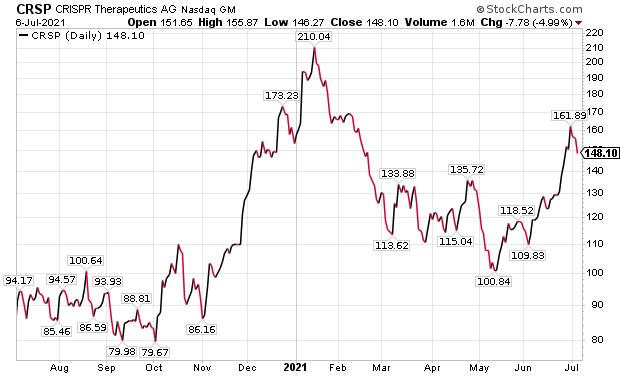

BioNano Genomics Inc. (NASDAQ:BNGO), of San Diego, California, announced on July 6 that it has achieved “significant progress” in China with the adoption of its Saphyr System for optical genome mapping (OGM) by WeHealth Shanghai, a provider of genome analysis services for reproductive health. The adoption was discussed at the Structural Variation Symposium in Shanghai, organized with support from the Shanghai Society of Genetics.

Chart courtesy of www.StockCharts.com

Multiple presentations were delivered on reproductive health at the symposium, with speakers highlighting a significant need and opportunity in China with approximately 16 million births annually. Dr. Xiangdong Kong, based at The First Affiliated Hospital of Zhengzhou University, reported using optical genome mapping for prenatal testing in families with a history of facioscapulohumeral muscular dystrophy (FSHD), a form of muscular dystrophy.

BioNano Genomics received a “buy” recommendation on June 16 from the New York-based BTIG investment firm, along with a $10 price target. That projection would mark a 52.0% increase from the company’s closing price of $6.58 on July 6.

Paul Dykewicz interviews seasoned stock picker and investment newsletter veteran Jim Woods.

Two Stock Pickers Agree on One of the Five Biopharmaceutical Stocks to Buy

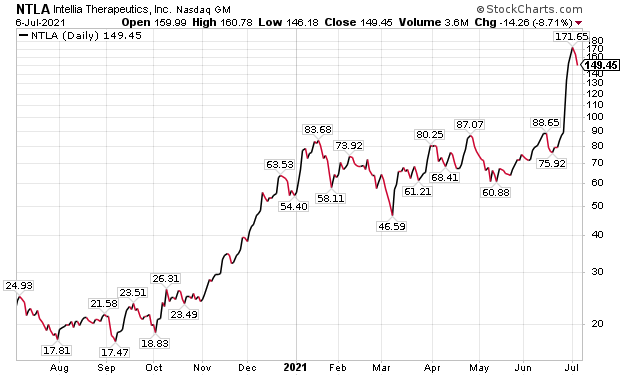

Intellia Therapeutics Inc. (NASDAQ:NTLA), a Cambridge, Massachusetts-based biopharmaceutical company, is another recommendation of Woods but he is not the only one to like the stock. Another is New York-based money manager Hilary Kramer, who also hosts the weekly “Millionaire Maker” radio program.

“A lot of the genetic stocks are close to fully valued after the great news from Intellia Biotherapeutics Inc. (NASDAQ:NTLA) a few weeks ago,” said Kramer, who heads the GameChangers and Value Authority advisory services. “Yes, this technology has now been validated in human patients. We can rewrite the liver and other organs to remove genetic faults and, in theory, program tired tissue to rejuvenate itself. The hard part took years, but it’s over.”

Now, NTLA just needs to develop specific applications, Kramer said. The real risk and returns have already played out in the favor of shareholders with vision and long-term conviction, she added.

Chart courtesy of www.StockCharts.com

Five Biopharmaceutical Stocks to Buy Include One Kramer Recommended Years Ago

“The time to buy Crispr Therapeutics, for example, was three years ago, when I was recommending it at under $60,” Kramer said. “You can still make money buying it here, but the next double might take five to 10 years.”

The same reasoning applies to NTLA, where the good news is now baked into the value of the stock, Kramer said. However, other opportunities for further upside gains remain, she added.

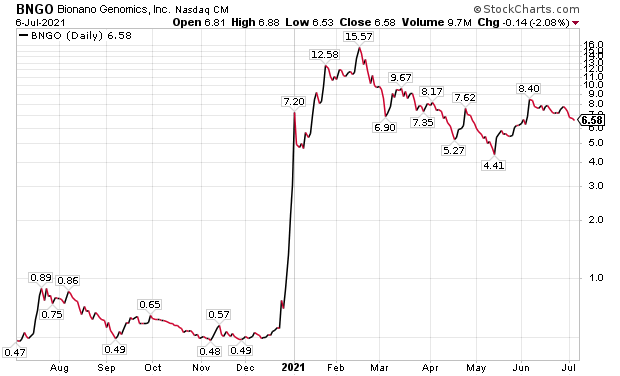

Editas Medicine Is One of Five Biopharmaceutical Stocks to Buy

“Editas Medicine Inc. (NASDAQ:EDIT) has more room to run,” Kramer counseled. “Even if it only recovers its 52-week high, people who come in now can do quite well for themselves. The key is to keep your eyes on the frontier as technologies that felt like a dream years ago move inexorably toward commercialization.”

Chart courtesy of www.StockCharts.com

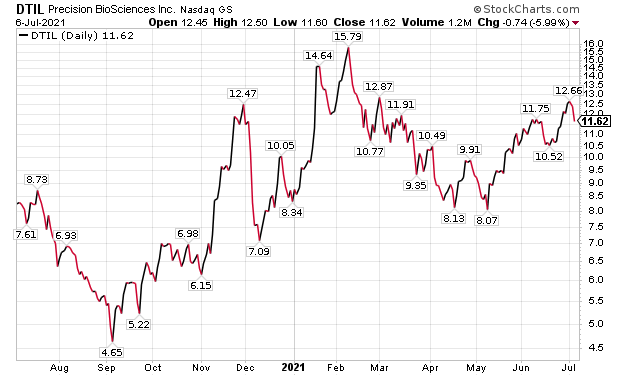

Right now, CRSP, NTLA and Cambridge, Massachusetts-based EDIT are near the horizon as five biopharmaceutical stocks to buy to capture genetic advances. But stocks such as Precision BioSciences Inc. (NASDAQ:DTIL), a Durham, North Carolina-based clinical stage biotechnology company that is developing allogeneic CAR T and in vivo gene correction therapies with its ARCUS genome editing platform, are only now coming in on that far frontier.

“That’s where the long-term gains happen,” Kramer said.

For that reason, Kramer identified Precision BioSciences as her favorite genetic drug stock for the long run.

Chart courtesy of www.StockCharts.com

“That end of the industry provides the kind of experience a lot of investors want from biotech,” Kramer said.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

Five Biopharmaceutical Stocks to Buy as New Variants of COVID-19 Spread

The Delta variant of COVID-19 that has spread to almost every state in America is heightening concerns among health officials about budding spikes in cases. Genetic variants of SARS-CoV-2 have been emerging and circulating worldwide throughout the COVID-19 pandemic, according to the Centers for Disease Control and Prevention (CDC).

A variant has one or more mutations that differentiate it from other varieties in circulation. The Delta variant is expected to become the dominant coronavirus strain in the United States, the CDC director recently said. With only about 47.5%, or 157,636,088 people, in the U.S. population fully vaccinated, public health officials warn a resurgence of Covid-19 cases may occur this fall when many unvaccinated children are expected to go back to school.

Progress in COVID-19 vaccinations raises hope that new cases and deaths will be curtailed. As of July 6, 182,714,064 people, or 55.0% of the U.S. population, have received at least one dose. President Joe Biden is among the elected officials in the United States who are urging people in the country who are eligible for COVID-19 vaccinations to receive them.

The Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine, manufactured by Johnson & Johnson (NYSE:JNJ), and that one only requires one rather than the two doses needed with the first two vaccine providers: Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA).

COVID-19 cases worldwide have hit 184,546,452 and caused 3,991,715 deaths, as of late on July 6, according to Johns Hopkins University. U.S. COVID-19 cases totaled 33,746,452 and have led to 605,905 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five biopharmaceutical stocks to buy in search of genetic advances give investors ways to pursue profits while helping to fund the development of new treatments. Increased COVID-19 vaccine availability, an improving economy and a recent $1.9 trillion federal stimulus package could lift the valuations of the five biopharmaceutical stocks to buy to even healthier levels as the companies achieve genetic research progress.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special Father’s Day gift pricing!