A flicker of hope for theme park stocks was ignited in early April amid news of the COVID-19 pandemic beginning to slow in Europe and Asia, along with reductions in the rate of infection and death in major parts of the United States.

Certain amusement and theme park stocks jumped sharply with the renewed sense of optimism spreading through the states. With governors around the country now possessing White House guidelines for reopening their states as the threat of COVID-19 is reined in, the timing seems good to assess the prospects of five beaten-down amusement park stocks.

Vijay Jayant, a New York-based analyst with Evercore ISI, shared a sentiment of hope for the long-term profitability of amusement park stocks.

“In the near-term, theme parks are an area of concern, but an analysis of past recessions shows these businesses tend to rebound over time,” Jayant said.

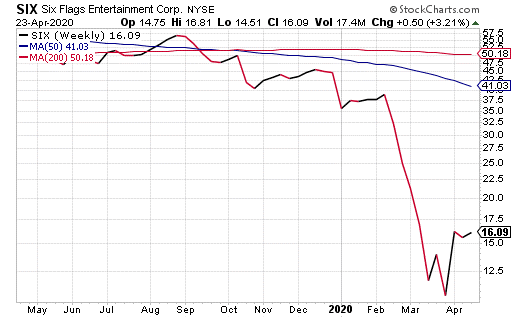

The potential was shown by Six Flags Entertainment Corporation (NYSE: SIX) jumping 4.7% on Friday, April 17, when its share price closed at $15.59. This company pays a quarterly dividend and has a current dividend yield of 6.18%. In 2019, its most recent fiscal year, SIX reported earnings per share (EPS) of $2.24. Six Flags has a modest price-to-earnings ratio of 7.36 and an expected P/E growth of 14.22.

Theme Park Stocks Ride Hopes for Economic Reopening

“Millionaire Maker” radio show host Hilary Kramer, who leads the Value Authority and GameChangers advisory services, predicted SIX probably has the best geographical footprint in an early state-by-state reopening as the COVID-19 infection risk subsides.

“If you’re looking for a real rollercoaster, SIX is probably your ride,” Kramer said.

Courtesy of StockCharts.com

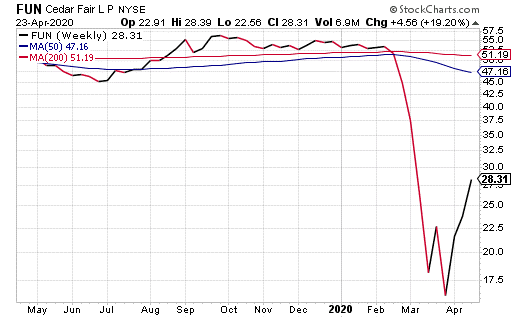

Another example of investment promise came when Cedar Fair, L.P. (NYSE: FUN) catapulted almost 7% on Friday, April 17, and 5.3% on Thursday, April 23, as investors showed renewed interest in the stock. In between those dates, FUN shares traded with heightened volume without a clear upward trend.

While there is a level of volatility, FUN has had nine years of consecutive dividend increases. Its current dividend amount is $0.935, and it has a dividend yield of 14.45%.

Courtesy of StockCharts.com

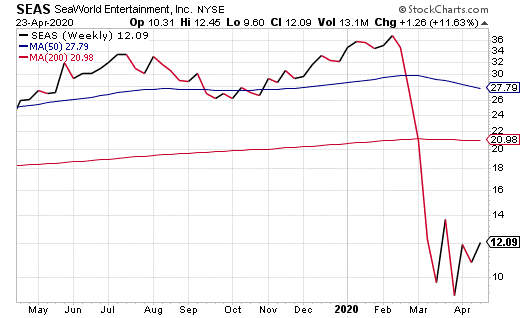

SeaWorld Entertainment Inc. (NYSE: SEAS) produced a one-day share-price gain on April 17 of 17.21% and on April 23 of 9.8, as the stock jumped like one of its performing dolphins. In assessing the current and prospective worth of the stock, analysts have noted that while SEAS is down a great deal from its 52-week high, it’s up roughly 60% from its 52-week low. Kramer said that SEAS is not a buy for her right now, observing significant challenges for it to overcome.

‘Perfect Storm’ Buffets One of the Theme Park Stocks

“SEAS has the perfect storm of a largely coastal operation and turmoil within top management with the CEO quitting after only five months,” Kramer said.

Courtesy of StockCharts.com

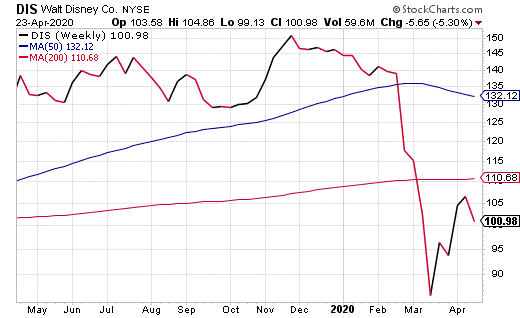

The Walt Disney Company (NYSE: DIS) shares were downgraded by UBS analyst John Hodulik on April 20 after news broke that the world’s biggest entertainment company will stop paying more than 100,000 employees this week as COVID-19 continues to choke off cash flow. Currently, half of the company’s employees are on furlough to cut costs without revenue needed to support them.

Disney has incurred a large cut in market cap since the tail-end of 2019. Its current intraday market cap is $182.3 billion, which is down greatly from $257.6 billion on Dec. 31, 2019. The stock’s 52-week range shows the current share price is closer to its low of $79.07, as opposed to its high of $153.41.

DIS is relatively diversified with varied sources of revenue, but the current shutdown of its theme parks in American and elsewhere will have a financial impact, Kramer said,

“Here, closing the theme parks is truly a drag,” Kramer said. “If you want a streaming video play unburdened by the tourist shutdown, just buy NFLX or ROKU.”

Courtesy of StockCharts.com

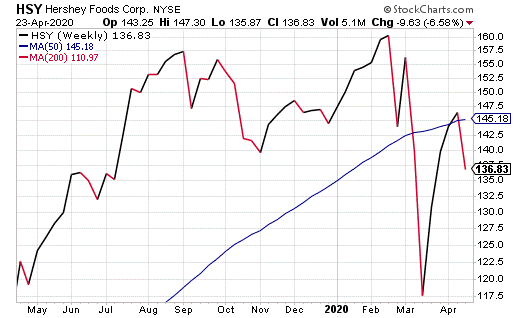

The Hershey Company (NYSE: HSY) is best known as a chocolate bar and candy manufacturer, but it also boasts a theme park located in Hershey, Pennsylvania. Though this tourist destination may be a relatively small portion of the company’s revenue, Kramer said it nonetheless has a currently closed theme park that cannot produce revenue.

Chocolate is a low-cost “comfort indulgence” tailored for a recession, so it’s no wonder Hershey is up so far this year, despite the coronavirus crisis, Kramer said. She also suggested HSY as a bond replacement because it pays a dividend of 2.12%, which is currently far outpacing the returns from Treasury debt.

HSY released its first-quarter 2020 report on April 23, before market’s opened, showing earnings per share (EPS) of $1.63, which is up 2.5% from Q1 last year. The company also reported a 2.1% increase in North America net sales, compared to the same period last year. Investors did not appear to be impressed since the stock closed down 4.45% the same day.

Courtesy of StockCharts.com

Amusement and theme parks are taking a huge hit from the COVID-19 pandemic. Not only are these parks going to continue to suffer due to the current closures, but their outlook is also uncertain without a vaccine available to protect against COVID-19.

Potential visitors may fear going to theme and amusement parks even when they do reopen. The need for many tourists to travel long distances on airlines also may deter those people from making the attempt.

Amid these legitimate concerns for the patrons of theme and amusement parks, there seems to be no rush to buy shares in any of the stocks now. Only speculators who can afford to be patient enough to await a return to economic normalcy may find the reduced prices for these stocks compelling enough to buy and hold for a recovery.

Emily Mirabelli is an editorial staffer at Eagle Financial Publications and writes for www.StockInvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)