Since the terrible maritime accident that caused the near-instant collapse of the Francis Scott Key bridge in Baltimore early Tuesday morning, I’ve fielded multiple questions about this from readers concerned about the potential economic aftereffects of this tragedy.

Because of these questions, as well as a slew of recent questions on Bitcoin, this week, I decided to do another edition of “Ask Me Anything.” First, let’s start with the Baltimore bridge collapse.

Here is the essence of the inquiries posed to me by multiple readers on this subject: “Jim, do you think the Baltimore bridge collapse and subsequent shipping disruptions it will cause will have a big impact on supply chains, and could this lead to a bounce back in inflation?”

As we wrote this morning in my Eagle Eye Opener regarding this situation, there is unlikely to be a big impact on global supply chains that leads to inflation, and that’s due to two main reasons.

First, as of 2021, Baltimore was the 17th-largest port in the U.S. based on total tonnage, according to Bureau of Transportation Statistics. However, the port does rank near the top in terms of volume of automobiles and light trucks it handles and for vessels that carry wheeled cargo, including farm and construction machinery. Because the port is somewhat specialized, it’s not large enough to cause a material supply chain disruption that leads to broader inflation. Additionally, many of the port’s major imports are specialized automobiles, and that disruption will be partially absorbed by ports in Charleston, Savannah and New York/New Jersey.

Second, there aren’t major energy imports into the port that could lead to an inflationary spike in energy prices. Coal is a major export from the port and that will cause short-term disruptions, and that’s why we saw the coal names down sharply Tuesday, such as CONSOL Energy Inc. (CEIX) and rail operator CSX Corporation (CSX), which slid 6.8% and 1.9%, respectively. Yet, in early Wednesday trading, CEIX was up nearly 3% while CSX was up some 1%, so each have recaptured about half of yesterday’s declines.

But while it will take a long time to rebuild the bridge, this isn’t a material negative for either company. However, if we do see declines in these and related stocks, that will likely be a long-term buying opportunity.

So, while the bridge collapse is both a human tragedy and a short-term negative for specific companies (Northeastern coal and rails, autos due to delayed imports) it’s unlikely to alter the outlook for inflation or growth and it’s not enough to disrupt the bullish mantra I’ve written about in detail in my newsletters of 1) Stable growth, 2) Falling inflation, 3) Looming Fed rate cuts and 4) AI enthusiasm.

Michael C. writes: “Jim, can you explain what’s going on with Bitcoin, and specifically the Bitcoin halving?”

Subscribers to my Successful Investing and Intelligence Report newsletters were treated to a full explanation of the reason for Bitcoin’s latest move, and it has a lot to do with the upcoming “halving.” So, Michael, if you were a subscriber, you would already know the answer. But since you are a reader of The Deep Woods that values my advice on these matters, I will gladly give you the essential answer right now.

One reason for the big move higher in Bitcoin is that the recent approval of the spot Bitcoin exchange-traded funds (ETFs) has helped the cryptocurrency vault firmly in the minds of even casual observers of markets. The other big reason is “the halving.”

You see, Bitcoin’s “anonymous” creator, Satoshi Nakamoto, wanted Bitcoin to stand out from all paper currencies (i.e., dollar, euro, franc, etc.). Satoshi wanted Bitcoin to hold its value (or gain in value) over time, so he built an “anti-inflationary mechanism” into its code.

Per its code, the “block subsidy is cut in half every 210,000 blocks, which will occur every four years.” Therefore, every four years, there’s a 50% reduction in the number of new Bitcoins that come to market. This continuous four-year cycle — built into Bitcoin’s code — is fixed and can’t be altered. This is what’s known as “the halving.”

The 2024 halving will reduce the number of new Bitcoins mined (the “block reward”) from 6.25 to 3.125 per block — or from 900 Bitcoins produced each day to 450 Bitcoins produced daily. Eventually, the number of Bitcoins will hit its maximum supply of 21 million coins — expected to be by the year 2140. There are roughly 19.6 million Bitcoins in existence today.

Now, Bitcoin has gone through three of these cycles so far. The first was in November 2012. The second was in July 2016. The third was in May 2020. And every time, Bitcoin’s price has rallied substantially.

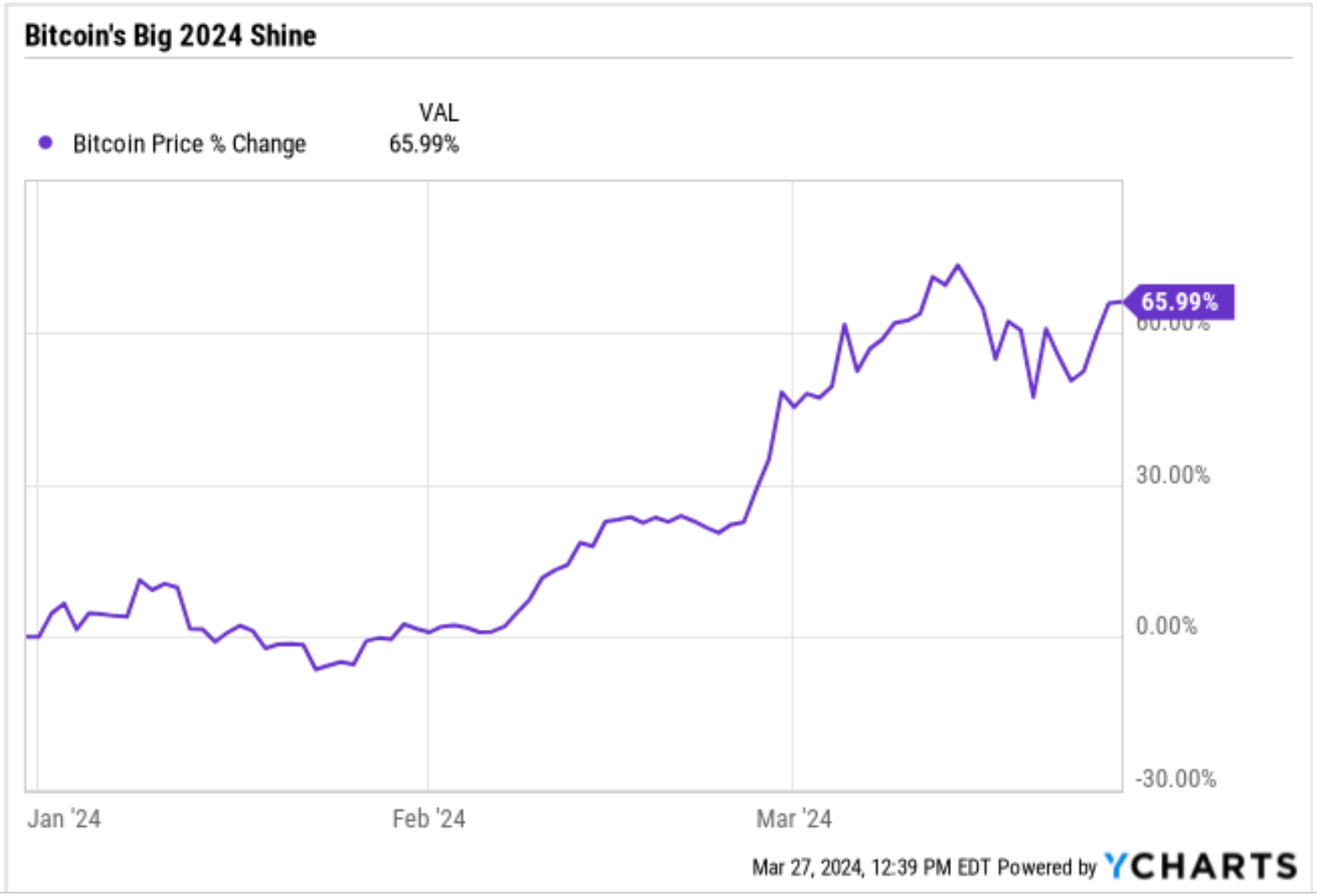

Although nowhere near the gains after the halving occurs, there’s also typically a considerable bump in price leading up to the halving like we’ve seen this year, with Bitcoin breaking $73,000 and surging nearly 66% since the year began.

So, why does this predictable event result in these outsized gains? It’s pretty much Economics 101: As supply decreases and demand remains constant (or increases), the only thing left to move is price.

The next halving is projected to take place around April 19-20, 2024. So, if past is prologue, some of these gains have been driven by halving anticipation, but I suspect there is more to come.

Would you like to find out my thoughts on topics such as the economy, markets, investing, social issues, pop culture issues, literature, music, fitness or anything else I’m into?

If so, just email me. I welcome all inquiries, but I ask that you keep it all respectful, and in the name of the very best within you.

*****************************************************************

The Boys Are Back

That jukebox in the corner blasting out my favorite song

The nights are getting warmer, it won’t be long

Won’t be long till summer comes

Now that the boys are here again

–Thin Lizzy, “The Boys Are Back in Town”

As any child of the 1970s is likely to recall, the rock anthem “The Boys Are Back in Town” by the great Irish band Thin Lizzy was an instant classic blaring through all of our big speakers and wearing out our scratchy vinyl records. And though we have just entered spring, the lyrics here about it not being long until summer comes takes me back to a more carefree time when I rode my bike all day, practiced piano, hit home runs in little league and watched sitcoms with my parents at night.

Of course, the boy that I was is no longer, but those feelings of liberation at a life unbound remain — and I am reminded of those feelings by the sense memory of great songs such as “The Boys Are Back in Town.” If you long for a little unbound memory, go back and listen to some of the music you loved in your teen years. I can guarantee it will conjure up smile-inducing recollections.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)